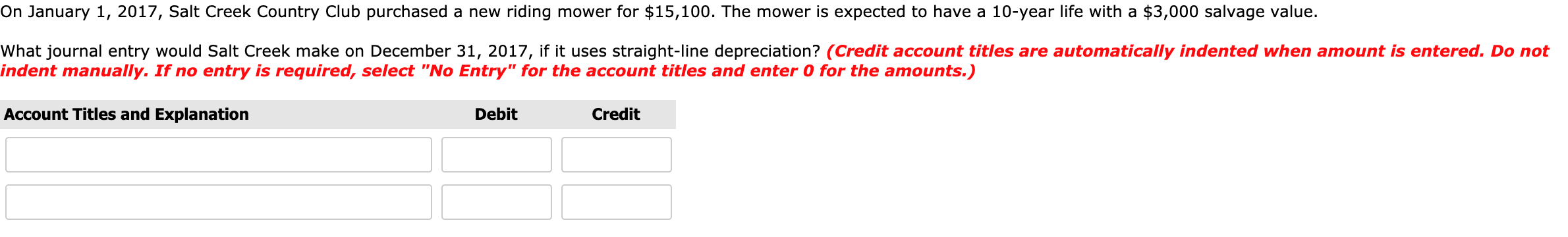

On January 1, 2017, Salt Creek Country Club purchased a new riding mower for $15,100. The mower is expected to have a 10-year life with a $3,000 salvage value. What journal entry would Salt Creek make on December 31, 2017, if it uses straight-line depreciation? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit

On January 1, 2017, Salt Creek Country Club purchased a new riding mower for $15,100. The mower is expected to have a 10-year life with a $3,000 salvage value. What journal entry would Salt Creek make on December 31, 2017, if it uses straight-line depreciation? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Transcribed Image Text:On January 1, 2017, Salt Creek Country Club purchased a new riding mower for $15,100. The mower is expected to have a 10-year life with a $3,000 salvage value.

What journal entry would Salt Creek make on December 31, 2017, if it uses straight-line depreciation? (Credit account titles are automatically indented when amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning