On January 1, 2018, ABC Company purchased 40,000 shares of RST at P100 per share. The investment in measurement at fair value through other comprehensive income. Brokerage fees measured to P120,000. A P5 dividend per share of RST had been declared on December 15, 2017 to be paid on March 31, 2018 to shareholders of record on January 31, 2018. No other transactions occurred in 2018 affecting the investment in RST shares.

On January 1, 2018, ABC Company purchased 40,000 shares of RST at P100 per share. The investment in measurement at fair value through other comprehensive income. Brokerage fees measured to P120,000. A P5 dividend per share of RST had been declared on December 15, 2017 to be paid on March 31, 2018 to shareholders of record on January 31, 2018. No other transactions occurred in 2018 affecting the investment in RST shares.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15E

Related questions

Question

100%

Transcribed Image Text:EQUITY INVESTMENTS

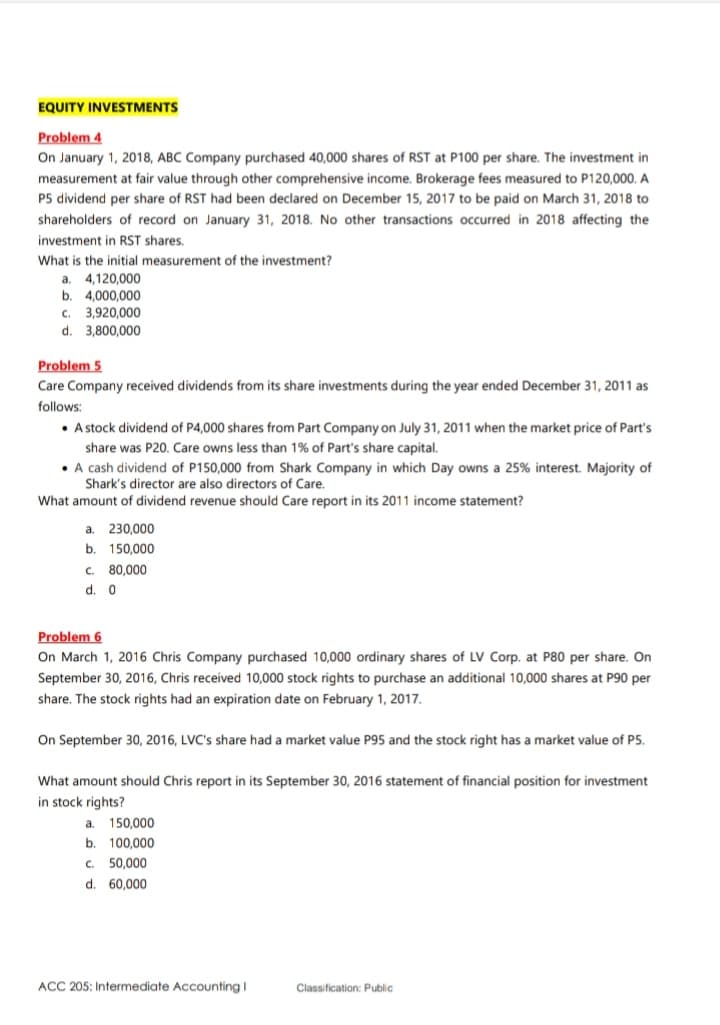

Problem 4

On January 1, 2018, ABC Company purchased 40,000 shares of RST at P100 per share. The investment in

measurement at fair value through other comprehensive income. Brokerage fees measured to P120,000. A

P5 dividend per share of RST had been declared on December 15, 2017 to be paid on March 31, 2018 to

shareholders of record on January 31, 2018. No other transactions occurred in 2018 affecting the

investment in RST shares.

What is the initial measurement of the investment?

4,120,000

a.

b. 4,000,000

c. 3,920,000

d.

3,800,000

Problem 5

Care Company received dividends from its share investments during the year ended December 31, 2011 as

follows:

• A stock dividend of P4,000 shares from Part Company on July 31, 2011 when the market price of Part's

share was P20. Care owns less than 1% of Part's share capital.

• A cash dividend of P150,000 from Shark Company in which Day owns a 25% interest. Majority of

Shark's director are also directors of Care.

What amount of dividend revenue should Care report in its 2011 income statement?

a.

230,000

b.

150,000

C.

80,000

d. 0

Problem 6

On March 1, 2016 Chris Company purchased 10,000 ordinary shares of LV Corp. at P80 per share. On

September 30, 2016, Chris received 10,000 stock rights to purchase an additional 10,000 shares at P90 per

share. The stock rights had an expiration date on February 1, 2017.

On September 30, 2016, LVC's share had a market value P95 and the stock right has a market value of P5.

What amount should Chris report in its September 30, 2016 statement of financial position for investment

in stock rights?

a.

150,000

b.

100,000

C.

50,000

d.

60,000

ACC 205: Intermediate AccountingI

Classification: Public

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning