On January 1, 2019, Field Company acquired 40% of North Company by purchasing 10,000 shares for $180,000 and obtained significant influence. On the date of acquisition, Field calculated that its share of the excess of the fair value over the book value of North’s depreciable assets was $15,000 and that the purchased goodwill was $12,000. At the end of 2019, North reported net income of $45,000 and paid dividends of $0.60 per share. Field depreciates its depreciable assets over a 12-year remaining life. Required: 1. Prepare all the journal entries of Field to record the preceding information for 2019. 2. Next Level What is the conceptual justification for the use of the equity method? {Chart of Accounts} {General Journal} The conceptual justification for the use of the equity method is: a. It recognizes that fair value is not an appropriate valuation method for the investment because the investor could influence the amount of income it recognizes. b. It recognizes that a material relationship exists between the investor and the investee. c. It closely fits the requirements of accrual accounting by reporting the investor's share in investee income in the period in which it is earned rather than as cash is received. d. All of the choices are correct.

On January 1, 2019, Field Company acquired 40% of North Company by purchasing 10,000 shares for $180,000 and obtained significant influence. On the date of acquisition, Field calculated that its share of the excess of the fair value over the book value of North’s depreciable assets was $15,000 and that the purchased goodwill was $12,000. At the end of 2019, North reported net income of $45,000 and paid dividends of $0.60 per share. Field depreciates its depreciable assets over a 12-year remaining life. Required: 1. Prepare all the journal entries of Field to record the preceding information for 2019. 2. Next Level What is the conceptual justification for the use of the equity method? {Chart of Accounts} {General Journal} The conceptual justification for the use of the equity method is: a. It recognizes that fair value is not an appropriate valuation method for the investment because the investor could influence the amount of income it recognizes. b. It recognizes that a material relationship exists between the investor and the investee. c. It closely fits the requirements of accrual accounting by reporting the investor's share in investee income in the period in which it is earned rather than as cash is received. d. All of the choices are correct.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter6: Receivables And Inventories

Section: Chapter Questions

Problem 6.7.6MBA

Related questions

Question

100%

On January 1, 2019, Field Company acquired 40% of North Company by purchasing 10,000 shares for $180,000 and obtained significant influence. On the date of acquisition, Field calculated that its share of the excess of the fair value over the book value of North’s depreciable assets was $15,000 and that the purchased goodwill was $12,000. At the end of 2019, North reported net income of $45,000 and paid dividends of $0.60 per share. Field depreciates its depreciable assets over a 12-year remaining life.

Required:

| 1. | Prepare all the |

| 2. | Next Level What is the conceptual justification for the use of the equity method? |

{Chart of Accounts}

{General Journal}

The conceptual justification for the use of the equity method is:

a. It recognizes that fair value is not an appropriate valuation method for the investment because the investor could influence the amount of income it recognizes.

b. It recognizes that a material relationship exists between the investor and the investee.

c. It closely fits the requirements of accrual accounting by reporting the investor's share in investee income in the period in which it is earned rather than as cash is received.

d. All of the choices are correct.

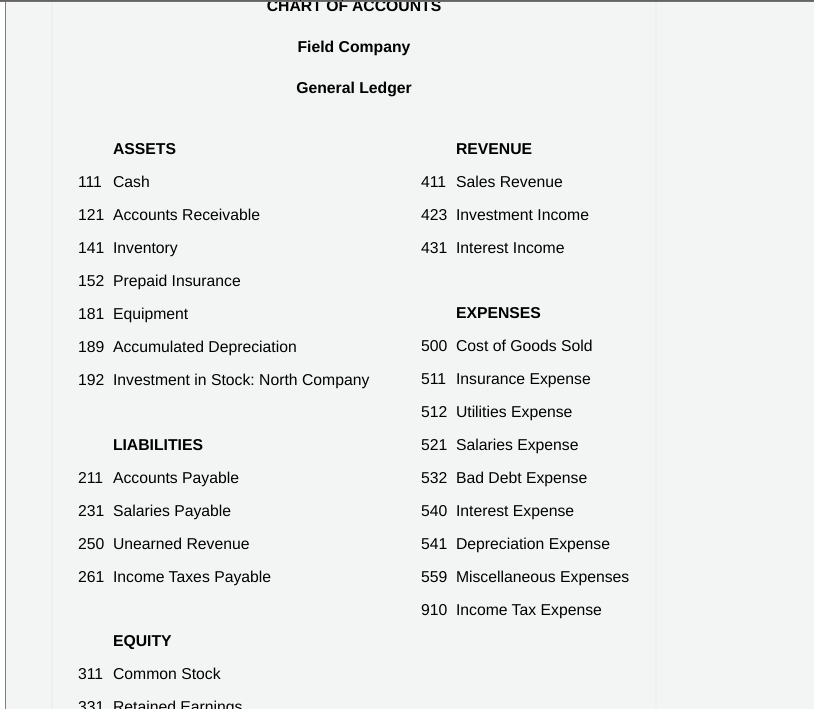

Transcribed Image Text:CHART OF ACCOUNTS

Field Company

General Ledger

ASSETS

REVENUE

111 Cash

411 Sales Revenue

121 Accounts Receivable

423 Investment Income

141 Inventory

431 Interest Income

152 Prepaid Insurance

181 Equipment

EXPENSES

189 Accumulated Depreciation

500 Cost of Goods Sold

192 Investment in Stock: North Company

511 Insurance Expense

512 Utilities Expense

LIABILITIES

521 Salaries Expense

211 Accounts Payable

532 Bad Debt Expense

231 Salaries Payable

540 Interest Expense

250 Unearned Revenue

541 Depreciation Expense

261 Income Taxes Payable

559 Miscellaneous Expenses

910 Income Tax Expense

EQUITY

311 Common Stock

331 Retained Farnings

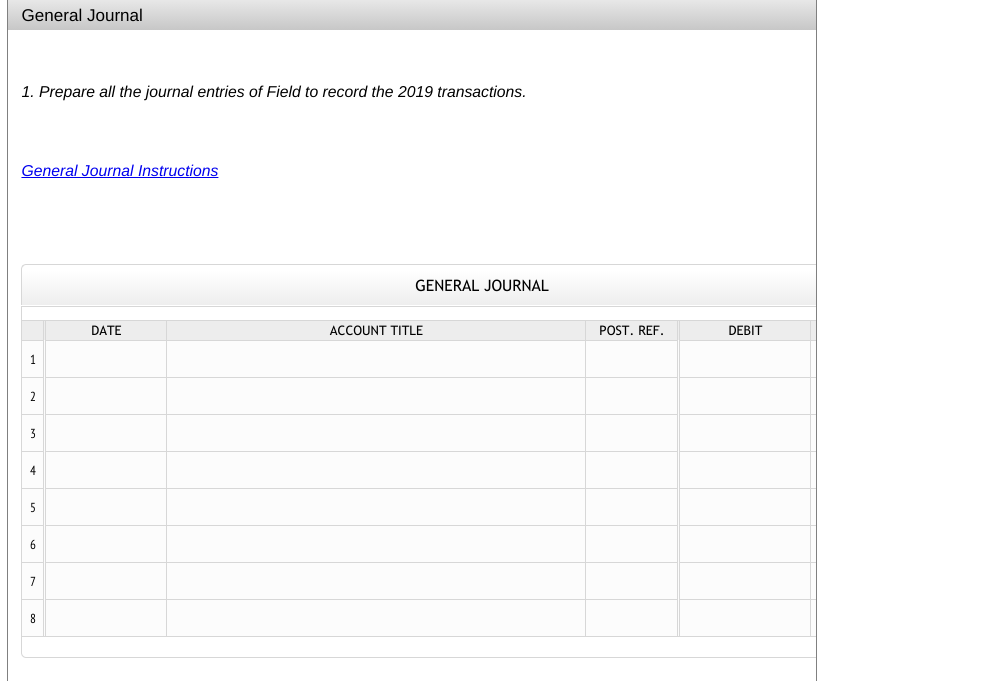

Transcribed Image Text:General Journal

1. Prepare all the journal entries of Field to record the 2019 transactions.

General Journal Instructions

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

1

2

3

4

5

6

8

Expert Solution

Step 1

Equity method is an accounting technique of recording the financial transactions related to company’s investment in another company in which it holds a significant influence. Therefore, it can exert the significant influence over the operations and dividend policy of the other company in which it is invested.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning