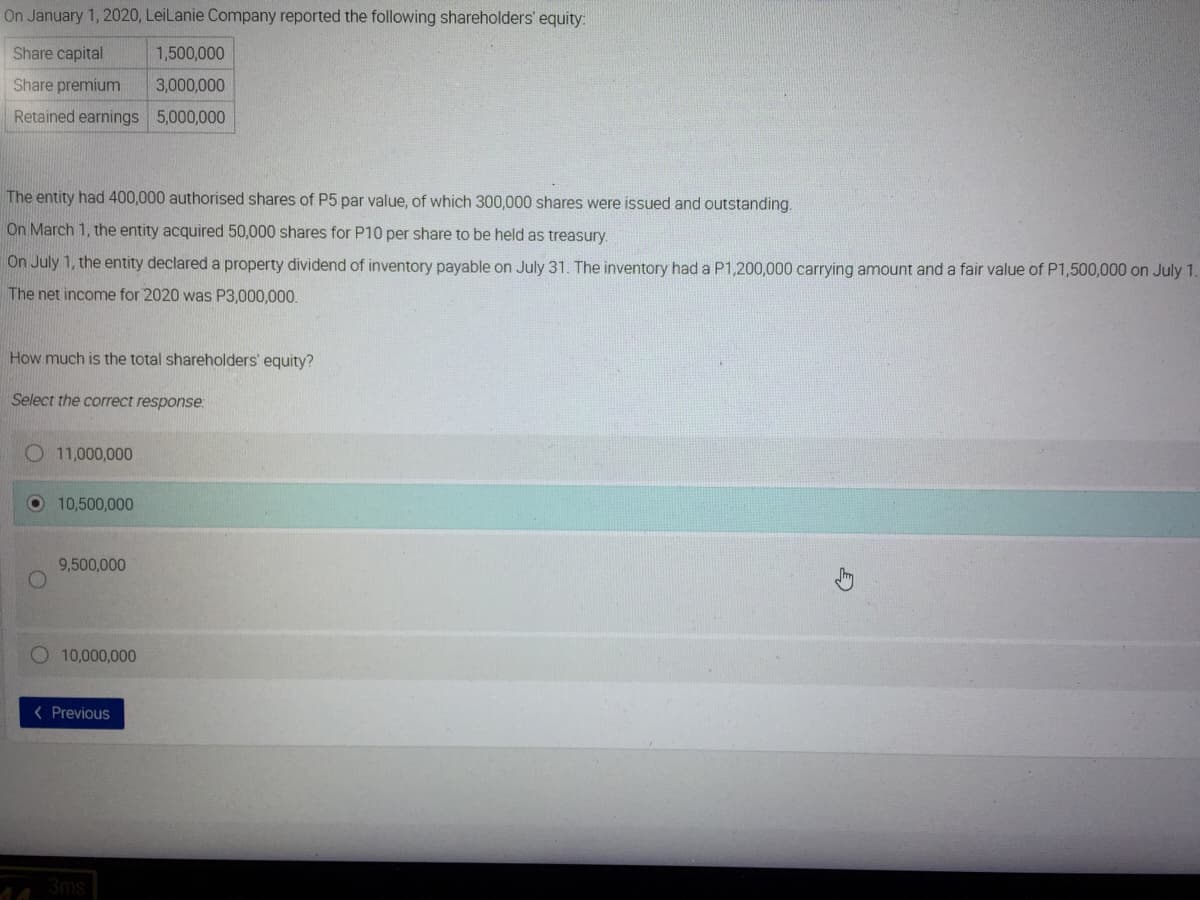

On January 1, 2020, LeiLanie Company reported the following shareholders' equity: Share capital 1,500,000 Share premium 3,000,000 Retained earnings 5,000,000 The entity had 400,000 authorised shares of P5 par value, of which 300,000 shares were issued and outstanding. On March 1, the entity acquired 50,000 shares for P10 per share to be held as treasury. On July 1, the entity declared a property dividend of inventory payable on July 31. The inventory had a P1,200,000 carrying amount and a fair value of P1,500,000 on July The net income for 2020 was P3,000,000.

On January 1, 2020, LeiLanie Company reported the following shareholders' equity: Share capital 1,500,000 Share premium 3,000,000 Retained earnings 5,000,000 The entity had 400,000 authorised shares of P5 par value, of which 300,000 shares were issued and outstanding. On March 1, the entity acquired 50,000 shares for P10 per share to be held as treasury. On July 1, the entity declared a property dividend of inventory payable on July 31. The inventory had a P1,200,000 carrying amount and a fair value of P1,500,000 on July The net income for 2020 was P3,000,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Transcribed Image Text:On January 1, 2020, LeiLanie Company reported the following shareholders' equity:

Share capital

1,500,000

Share premium

3,000,000

Retained earnings 5,000,000

The entity had 400,000 authorised shares of P5 par value, of which 300,000 shares were issued and outstanding.

On March 1, the entity acquired 50,000 shares for P10 per share to be held as treasury.

On July 1, the entity declared a property dividend of inventory payable on July 31. The inventory had a P1,200,000 carrying amount and a fair value of P1,500,000 on July 1.

The net income for 2020 was P3,000,000.

How much is the total shareholders' equity?

Select the correct response:

O 11,000,000

10,500,000

9,500,000

O 10,000,000

< Previous

3ms

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College