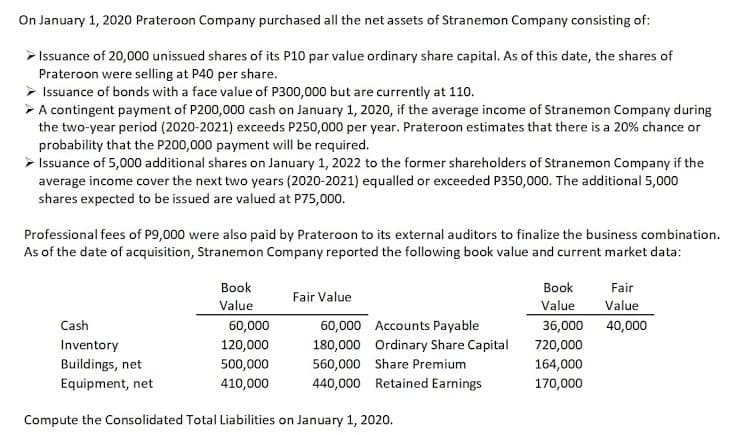

On January 1, 2020 Prateroon Company purchased all the net assets of Stranemon Company consisting of: Issuance of 20,000 unissued shares of its P10 par value ordinary share capital. As of this date, the shares of Prateroon were selling at P40 per share. > Issuance of bonds with a face value of P300,000 but are currently at 110. > A contingent payment of P200,000 cash on January 1, 2020, if the average income of Stranemon Company during the two-year period (2020-2021) exceeds P250,000 per year. Prateroon estimates that there is a 20% chance or probability that the P200,000 payment will be required. > Issuance of 5,000 additional shares on January 1, 2022 to the former shareholders of Stranemon Company if the average income cover the next two years (2020-2021) equalled or exceeded P350,000. The additional 5,000 shares expected to be issued are valued at P75,000. Professional fees of P9,000 were also paid by Prateroon to its external auditors to finalize the business combination. As of the date of acquisition, Stranemon Company reported the following book value and current market data:

On January 1, 2020 Prateroon Company purchased all the net assets of Stranemon Company consisting of: Issuance of 20,000 unissued shares of its P10 par value ordinary share capital. As of this date, the shares of Prateroon were selling at P40 per share. > Issuance of bonds with a face value of P300,000 but are currently at 110. > A contingent payment of P200,000 cash on January 1, 2020, if the average income of Stranemon Company during the two-year period (2020-2021) exceeds P250,000 per year. Prateroon estimates that there is a 20% chance or probability that the P200,000 payment will be required. > Issuance of 5,000 additional shares on January 1, 2022 to the former shareholders of Stranemon Company if the average income cover the next two years (2020-2021) equalled or exceeded P350,000. The additional 5,000 shares expected to be issued are valued at P75,000. Professional fees of P9,000 were also paid by Prateroon to its external auditors to finalize the business combination. As of the date of acquisition, Stranemon Company reported the following book value and current market data:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 9P

Related questions

Question

please answer it with a solution.

REQUIRED: COMPUTE THE CONSOLIDATED TOTAL LIABILITIES ON JANUARY 1, 2020.

Transcribed Image Text:On January 1, 2020 Prateroon Company purchased all the net assets of Stranemon Company consisting of:

> Issuance of 20,000 unissued shares of its P10 par value ordinary share capital. As of this date, the shares of

Prateroon were selling at P40 per share.

> Issuance of bonds with a face value of P300,000 but are currently at 110.

> A contingent payment of P200,000 cash on January 1, 2020, if the average income of Stranemon Company during

the two-year period (2020-2021) exceeds P250,000 per year. Prateroon estimates that there is a 20% chance or

probability that the P200,000 payment will be required.

> Issuance of 5,000 additional shares on January 1, 2022 to the former shareholders of Stranemon Company if the

average income cover the next two years (2020-2021) equalled or exceeded P350,000. The additional 5,000

shares expected to be issued are valued at P75,000.

Professional fees of P9,000 were also paid by Prateroon to its external auditors to finalize the business combination.

As of the date of acquisition, Stranemon Company reported the following book value and current market data:

Вook

Book

Fair

Fair Value

Value

Value

Value

Cash

60,000

60,000 Accounts Payable

36,000 40,000

Inventory

120,000

180,000 Ordinary Share Capital

720,000

Buildings, net

500,000

560,000 Share Premium

164,000

Equipment, net

410,000

440,000 Retained Earnings

170,000

Compute the Consolidated Total Liabilities on January 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning