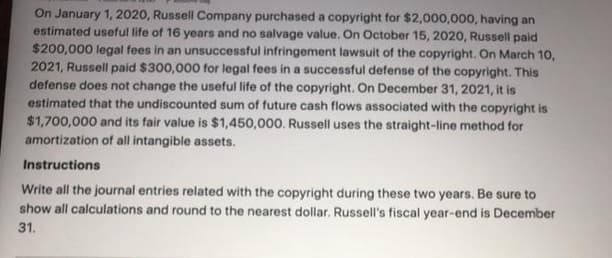

On January 1, 2020, Russell Company purchased a copyright for $2,000,000, having an estimated useful life of 16 years and no salvage value. On October 15, 2020, Russell paid $200,000 legal fees in an unsuccessful infringement lawsuit of the copyright. On March 10, 2021, Russell paid $300,000 for legal fees in a successful defense of the copyright. This defense does not change the useful life of the copyright. On December 31, 2021, it is estimated that the undiscounted sum of future cash flows associated with the copyright is $1,700,000 and its fair value is $1,450,000. Russell uses the straight-line method for amortization of all intangible assets. Instructions Write all the journal entries related with the copyright during these two years. Be sure to show all calculations and round to the nearest dollar. Russell's fiscal year-end is December 31.

On January 1, 2020, Russell Company purchased a copyright for $2,000,000, having an estimated useful life of 16 years and no salvage value. On October 15, 2020, Russell paid $200,000 legal fees in an unsuccessful infringement lawsuit of the copyright. On March 10, 2021, Russell paid $300,000 for legal fees in a successful defense of the copyright. This defense does not change the useful life of the copyright. On December 31, 2021, it is estimated that the undiscounted sum of future cash flows associated with the copyright is $1,700,000 and its fair value is $1,450,000. Russell uses the straight-line method for amortization of all intangible assets. Instructions Write all the journal entries related with the copyright during these two years. Be sure to show all calculations and round to the nearest dollar. Russell's fiscal year-end is December 31.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6RE

Related questions

Question

Transcribed Image Text:On January 1, 2020, Russell Company purchased a copyright for $2,000,000, having an

estimated useful life of 16 years and no salvage value. On October 15, 2020, Russell paid

$200,000 legal fees in an unsuccessful infringement lawsuit of the copyright. On March 1o,

2021, Russell paid $300,000 for legal fees in a successful defense of the copyright. This

defense does not change the useful life of the copyright. On December 31, 2021, it is

estimated that the undiscounted sum of future cash flows associated with the copyright is

$1,700,000 and its fair value is $1,450,000. Russell uses the straight-line method for

amortization of all intangible assets.

Instructions

Write all the journal entries related with the copyright during these two years. Be sure to

show all calculations and round to the nearest dollar. Russell's fiscal year-end is December

31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT