On January 1, 2020, Vaughn Manufacturing borrows $ 3150000 from National Bank at 12% annual interest. In addition, Vaughn is required to keep a compensatory balance of $315000 on deposit at National Bank which will earn interest at 6%. The effective interest that Vaughn pays on its $ 3150000 loan is O 12.5%. O 12.7%. O 12.0%. O 12.0%. Save for Later Attempts: 0 of 1 used Submit Answer

On January 1, 2020, Vaughn Manufacturing borrows $ 3150000 from National Bank at 12% annual interest. In addition, Vaughn is required to keep a compensatory balance of $315000 on deposit at National Bank which will earn interest at 6%. The effective interest that Vaughn pays on its $ 3150000 loan is O 12.5%. O 12.7%. O 12.0%. O 12.0%. Save for Later Attempts: 0 of 1 used Submit Answer

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 5E: Investment Discount Amortization Schedule On January 1, 2019, Rodgers Company purchased 200,000 face...

Related questions

Question

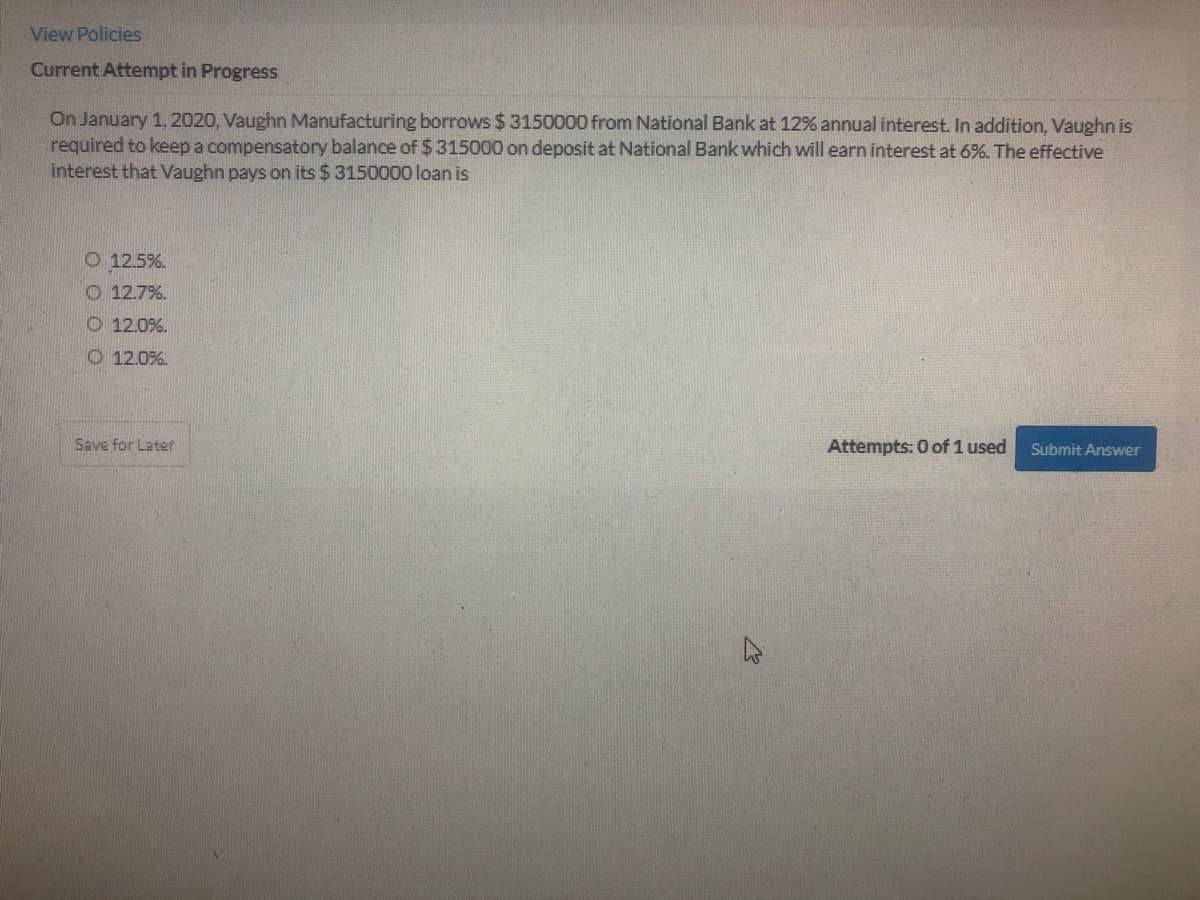

Transcribed Image Text:View Policies

Current Attempt in Progress

On January 1, 2020, Vaughn Manufacturing borrows $ 3150000 from National Bank at 12% annual interest. In addition, Vaughn is

required to keep a compensatory balance of $ 315000 on deposit at National Bank which will earn interest at 6%. The effective

interest that Vaughn pays on its $ 3150000 loan is

O 12.5%.

O 12.7%.

O 12.0%.

O 12.0%.

Save for Later

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning