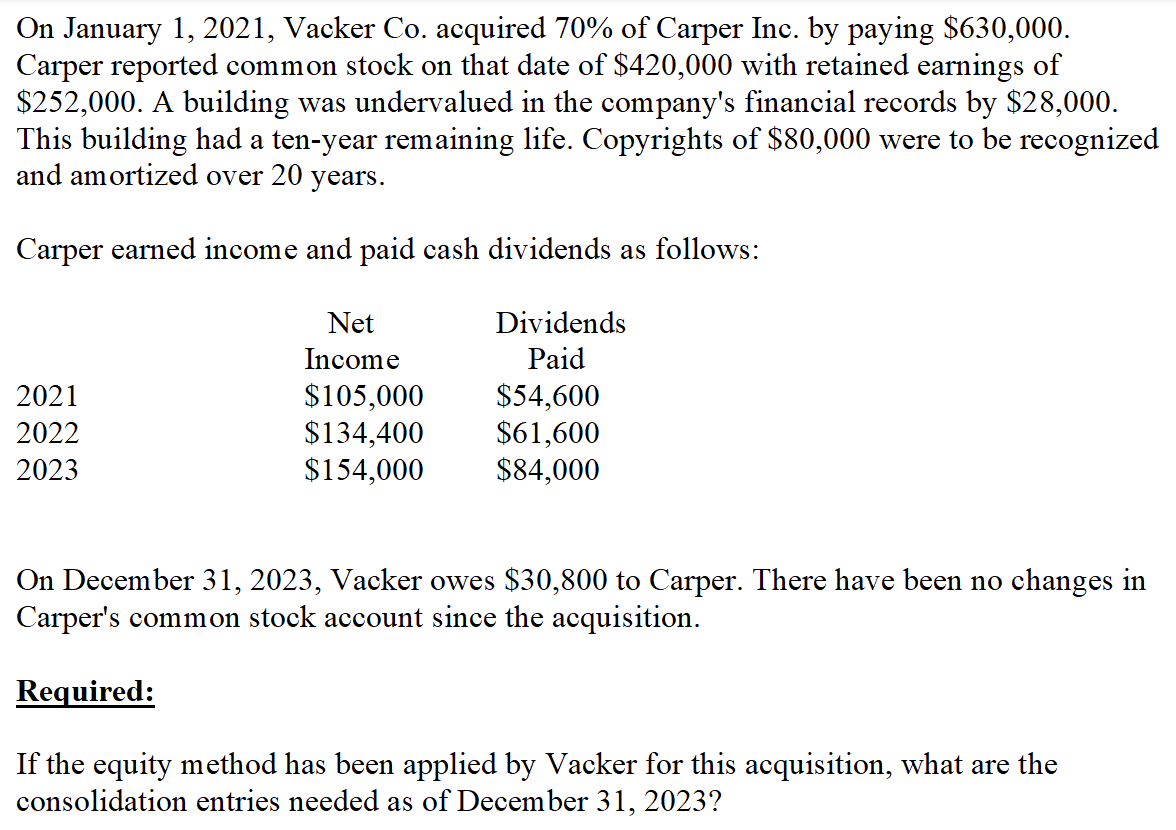

On January 1, 2021, Vacker Co. acquired 70% of Carper Inc. by paying $630,000. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years. Carper earned income and paid cash dividends as follows: 2021 2022 2023 Net Income $105,000 $134,400 $154,000 Dividends Paid $54,600 $61,600 $84,000 On December 31, 2023, Vacker owes $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition. Required: If the equity method has been applied by Vacker for this acquisition, what are the consolidation entries needed as of December 31, 2023?

On January 1, 2021, Vacker Co. acquired 70% of Carper Inc. by paying $630,000. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years. Carper earned income and paid cash dividends as follows: 2021 2022 2023 Net Income $105,000 $134,400 $154,000 Dividends Paid $54,600 $61,600 $84,000 On December 31, 2023, Vacker owes $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition. Required: If the equity method has been applied by Vacker for this acquisition, what are the consolidation entries needed as of December 31, 2023?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

im.2

Transcribed Image Text:On January 1, 2021, Vacker Co. acquired 70% of Carper Inc. by paying $630,000.

Carper reported common stock on that date of $420,000 with retained earnings of

$252,000. A building was undervalued in the company's financial records by $28,000.

This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized

and amortized over 20 years.

Carper earned income and paid cash dividends as follows:

2021

2022

2023

Net

Income

$105,000

$134,400

$154,000

Dividends

Paid

$54,600

$61,600

$84,000

On December 31, 2023, Vacker owes $30,800 to Carper. There have been no changes in

Carper's common stock account since the acquisition.

Required:

If the equity method has been applied by Vacker for this acquisition, what are the

consolidation entries needed as of December 31, 2023?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning