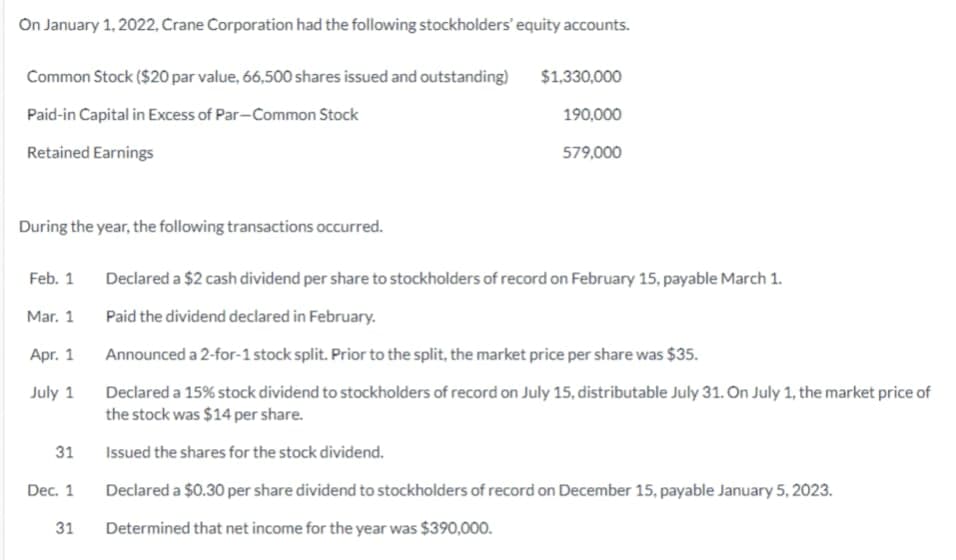

On January 1, 2022, Crane Corporation had the following stockholders' equity accounts. Common Stock ($20 par value, 66,500 shares issued and outstanding) Paid-in Capital in Excess of Par-Common Stock Retained Earnings During the year, the following transactions occurred. Feb. 1 Mar. 1 Apr. 1 July 1 31 Dec. 1 31 $1,330,000 190,000 579,000 Declared a $2 cash dividend per share to stockholders of record on February 15, payable March 1. Paid the dividend declared in February. Announced a 2-for-1 stock split. Prior to the split, the market price per share was $35. Declared a 15% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $14 per share. Issued the shares for the stock dividend. Declared a $0.30 per share dividend to stockholders of record on December 15, payable January 5, 2023. Determined that net income for the year was $390,000.

Q: Calculatedecimal. Please present answer to nearest half a month. the payback period for both…

A: Payback period is one of the capital budgeting technique. Under this, time period is calculated to…

Q: Landen Corporation uses a job-order costing system. At the beginning of the year, the company made…

A: The plantwide overhead rate is the single overhead rate on the basis of which overhead is applied to…

Q: Pastina Company sells various types of pasta to grocery chains as private label brands. The…

A: T-Accounts - T-Accounts are the Ledgers that are prepared using journal entries, adjusting and…

Q: ssume that The AM Bakery is preparing a budget for the month ending November 30. Management prepares…

A: The AM Bakery Bakery Sales Actual…

Q: Investors are more willing to put money into limited liability companies than partnerships because:…

A: A partnership is formed when two or more individuals or businesses come together to do business for…

Q: Amazon.com, Inc., headquartered in Seattle, WA, started its electronic commerce business in 1995 and…

A: Accounting equation is also called balance sheet equation. It is a relationship between assets…

Q: Discuss the circumstances that require a contingent liability to be disclosed in the notes to the…

A: A contingent liability is a liability that may (or may not) occur in future. The occurrence of…

Q: Solar Solutions began operations on January 1, 2015, and is now in its sixth year of operations. It…

A: Income Statement - An income statement, also known as a profit and loss account, is one of a…

Q: Question 5 CBDC Company is a wholesaler which uses a perpetual inventory system. The following show…

A: The income statement is prepared to record the revenues and expenses of the current period. The…

Q: (b) An annuity immediate has quarterly payments of P 5,000 for 6 years at a rate of 4% convertible…

A: Annuity immediate which starts at the beginning of period. Present value is the equivalent value…

Q: Question 1 – Case Study Alpha Homes is a private limited company involved in specialist home…

A: Product cost and Period cost All the costs which are directly related to the product manufacturing…

Q: Apex Corporation estimates that its production for the coming year will be 10,000 units with the…

A: PREDETERMINED OVERHEAD RATE Predetermined rate means an indirect cost rate. predetermined overhead…

Q: An annuity immediate has quarterly payments of P 5,000 for 6 years at a rate of 4% convertible…

A: Note that the rate of interest per payment period (semi annual) is 4%/2 = 2%, and there are 4 × 6 =…

Q: Selected data for the CJ Manufacturing Company for the year 2021 follow: Budgeted for Year Direct…

A: Under absorption costing manufacturing overhead is charged (applied) to the product based on the…

Q: Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Indicate which of the following answers to the statement below represents the best choice, then…

A: Activity Based Costing Activity based costing is one of the techniques that distributes the costs on…

Q: Martinez Ltd. issued a $890,000, 10-year bond at par on January 1, 2023. The bond paid 10% interest…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: purposes. ransactions costs am year end the value of the sh was R25 000. The financial asset…

A: Current assets are those assets which can be sold at any time in the market and can be converted…

Q: December 20-1, TJ’s Specialty Shop engaged in the following transactions: Dec. 16 Received payment…

A: Income Statement - An income statement offers useful information about a company's operations,…

Q: Q.2 duced in a single continuous process and Amsterdam uses the weighted average process costing…

A:

Q: in February 10, 2019, Grettle purchases 10 calls on Green Corporation for $220 per cal. Each call…

A: Comment - Multiple Questions Asked Options - A contract known as an option gives its owner, the…

Q: On January 31, 2024, B Corp. issued $650,000 face value, 12% bonds for $650,000 cash. The bonds are…

A: BOND Bond is a Financial Securities which is Generally Issued by the Corporation's, Government…

Q: Tri-State Bank and Trust is considering giving Swifty Company a loan. Before doing so, management…

A: Lets understand the basics. Physical inventory count is generally done at frequent time period in…

Q: The following is the Trial Balance of Khalid Butt on 31st December 2005: Capital Land and Building…

A: Financial Statement - The Financial Statement of the company includes a profit and loss account, a…

Q: IV. Following is the Receipt and Payment Account of Bangkok Sports Club; prepare the Income…

A: Bangkok Sports Club Income and expenditure account For the year ending December 31, 2021…

Q: se the adjusted trial balance for Stockton Company to answer the question that follow Stockton…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: In the equation Y = 200 + 0.8X, Y represents Question 54 options: a) Variable cost per unit of…

A: The total cost of production is calculated as sum of variable and fixed cost. The variable cost…

Q: Required information [The following information applies to the questions displayed below] Clem is…

A: Adjusted gross income (AGI) is your gross income minus certain adjustments. The IRS uses the AGI to…

Q: Instructions Journalize the entries to record the summarized operations.

A: Cost of goods sold is the total direct cost that is consumed by a product at the time of producing.…

Q: Discount Amortization On the first day of the fiscal year, a company issues a $1,100,000, 7%, 7-year…

A: To record financial accounting transaction system, ledger book entries are moved from the diaries…

Q: Ted and Alice were divorced in January 2018. The provisions of the divorce decree and Alices's…

A: Mortgage - Mortgages are a sort of loan that can be used to buy or keep up a house, land, or another…

Q: Old Antique Store prepared the following budget information for the month of May: Sales are budgeted…

A: Formula is :- Budgeted cost of inventory purchases = Budgeted cost of goods sold +…

Q: A company manufactures three products using the same production process. The costs incurred up to…

A:

Q: Mystic Masters, Inc., provides fortune-telling services over the Internet. In recent years the…

A: Income statement Statement of Retained earnings Company's balance sheet Year-end Closing entries…

Q: Indicate whether the following statements about the conceptual framework are true or false. If…

A: There are accounting rules and regulations and these rules and regulation must be followed and these…

Q: Landen Corporation uses à job-order costing Direct labor-hours required to support estimated…

A: The plantwide predetermined overhead rate is the traditional method of applying the overhead costs…

Q: Lee and Chen Distributors uses the direct write-off method in accounting for uncollectible accounts.…

A: Direct Write-off Method - Under the Direct Write-off method of accounting accounts that remain…

Q: If the cost of materials were not reduced, then what increase in sales does the firm need to…

A: To solve this question the concept of costing will be applied. Direct materials and direct labor are…

Q: Thornton Manufacturing Company was started on January 1, year 1, when it acquired $89,000 cash by…

A: Working note: Calculation of depreciation on manufacturing equipment: Depreciation = (cost - salvage…

Q: On January 4, 2021, Runyan Bakery paid $356 million for 10 million shares of Lavery Labeling Company…

A: Significant Influence A situation where a company exercises minimal control over the company is…

Q: Cox Electric makes electronic components and has estimated the following for a new design of one of…

A: This is a case or a question in which concepts of break-even analysis and cost volume profit…

Q: Swanson & Hiller, Inc., purchased a new machine on September 1 of the current year at a cost of…

A: Depreciation is a strategy used in accounting to calculate that reduction over time. For each year…

Q: PREPARE THE BANK RECONCILIATION

A: Bank reconciliation is a way to reconcile the difference in the balance of bank book and cash book.…

Q: For each of the above transactions, complete the tabulation, indicating the amount of each…

A: A) cash Dr. 15000 To game fee revenue. 15000 Impacts Asset as increase in asset,…

Q: A loan amortization schedule A chart showing the percentage of the payment applied to the principal…

A: It has been given that the monthly payment towards the mortgage loan is $2,684.11 and the loan…

Q: Angelo Ltd produces a range of tools used in the construction industry. The costing system indicates…

A: Formulas for Material Variance 1) Material Price Variance (MPV) MPV = (SP - AP) x AQ. Where, SP =…

Q: Scala Oil has the following information available regarding its three divisions: production,…

A: The company may contain several departments and it is also possible that one department sells its…

Q: Convert the accompanying database to an Excel table to find: a.The total cost of all orders.…

A: Ordering cost The cost of placing an order is termed as ordering cost, this cost is a relevant cost…

Q: Bonita Corporation issues $470,000 of 9% bonds, due in 9 years, with interest payable semiannually.…

A:

Q: Consult the relevant proclamations and regulations to discuss elaborately how the following types of…

A: Schedule D tax rates is a residuary in which income taxable under them Income Tax Proclamation but…

A: Journalize the transactions and the closing entries for net income and dividends

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73