On January 1, 2023, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing. Incorporated, for a total of $880,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $730,000, retained earnings of $280,000, and a noncontrolling Interest fair value of $220,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its Investment in Smashing. During the next two years, Smashing reported the following: Items 2823 2824 Net Incone $188,000 168,000 Dividends Declared $ 38,000 48,000 Inventory Purchases from Corgan $130,000 150,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2023 and 2024, 50 percent of the current year purchases remain in Smashing's inventory.

On January 1, 2023, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing. Incorporated, for a total of $880,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $730,000, retained earnings of $280,000, and a noncontrolling Interest fair value of $220,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its Investment in Smashing. During the next two years, Smashing reported the following: Items 2823 2824 Net Incone $188,000 168,000 Dividends Declared $ 38,000 48,000 Inventory Purchases from Corgan $130,000 150,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2023 and 2024, 50 percent of the current year purchases remain in Smashing's inventory.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:On January 1, 2023, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing, Incorporated, for a total of

$880,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $730,000, retained earnings of

$280,000, and a noncontrolling Interest fair value of $220,000. Corgan attributed the excess of fair value over Smashing's book value

to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing.

During the next two years, Smashing reported the following:

Itens

2823

2824

Net Incone

$188,008

168,000

Dividends

Declared

$ 38,000

48,000

Inventory Purchases

from Corgan

$130,000

150,000

Corgan sells Inventory to Smashing using a 60 percent markup on cost. At the end of 2023 and 2024, 50 percent of the current year

purchases remain in Smashing's inventory.

Required:

a. Compute the equity method balance in Corgan's Investment in Smashing, Incorporated, account as of December 31, 2024.

b. Prepare the worksheet adjustments for the December 31, 2024, consolidation of Corgan and Smashing

Complete this question by entering your answers in the tabs below.

Required A

Required B

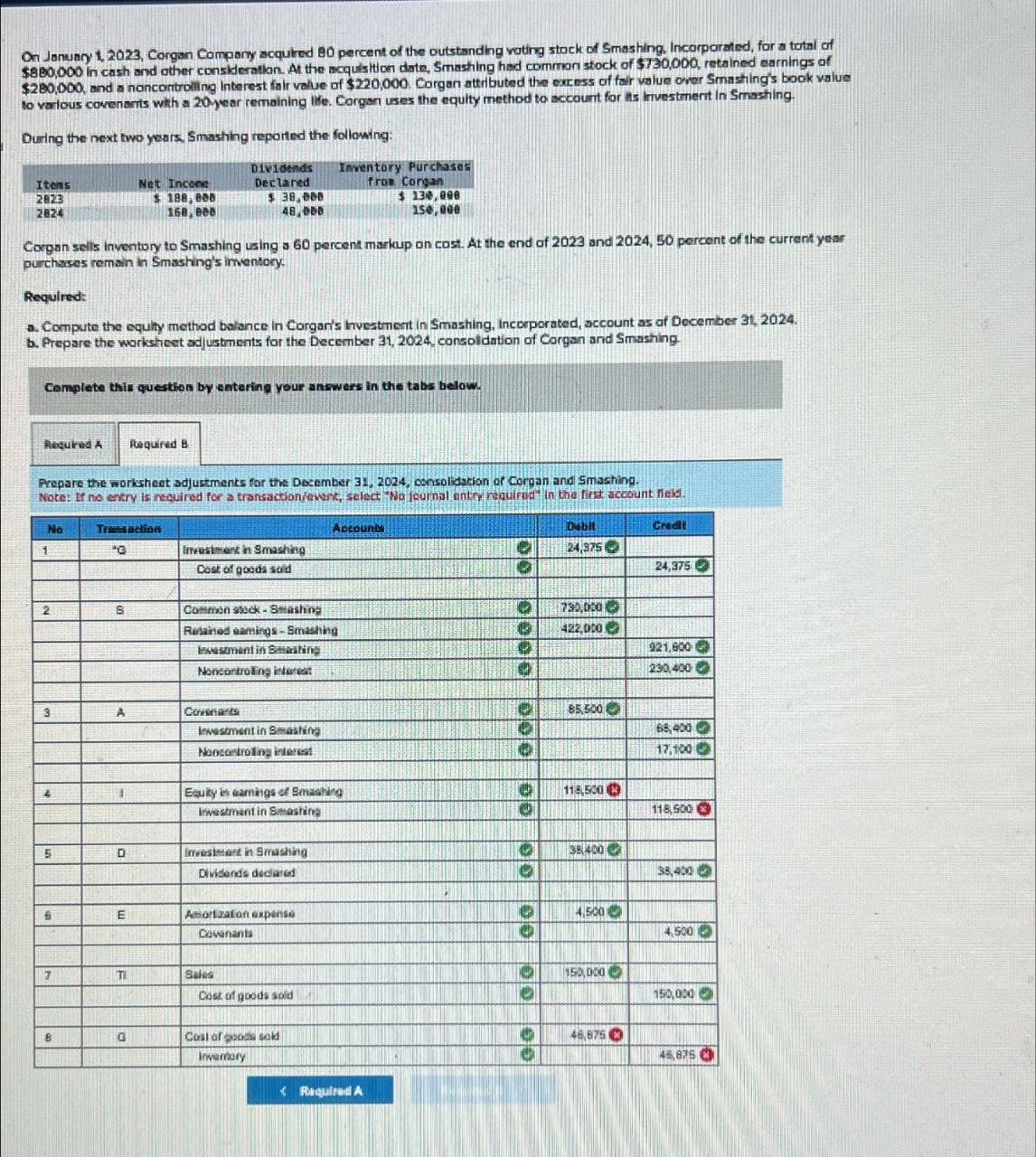

Prepare the worksheet adjustments for the December 31, 2024, consolidation of Corgan and Smashing.

Note: If no entry is required for a transaction/event, select "No journal entry required in the first account field.

No

Transaction

Accounts

1

G

Investment in Smashing

Cost of goods sold

2

S

Common stock - Smashing

3

A

4

5

D

B

E

7

T

B

G

Retained eamings-Smashing

Investment in Smashing

Noncontrolling interest

Covenants

Investment in Smashing

Noncontroling interest

Equity in earnings of Smashing

Investment in Smashing

Investment in Smashing

Dividends declared

Amortization expense

Covenants

Sales

Cost of goods sold

Cost of goods sold

Inventory

<Required A

0000 000

00

00

00

Dabit

24,375

Credit

24,375

730,000

422,000

921,600

230,400

00

00

85,500

68,400

17,100

118,500

118,500

38.400 C

38,400

4,500

4,500

150,000

150,000

46,675

45,875 C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning