On January 1, 2023, Larkspur Corporation purchased a newly issued $1,500,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Larkspur's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, eg. 52.75.) the price paid for the bond is $ 1,421,367.95

On January 1, 2023, Larkspur Corporation purchased a newly issued $1,500,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Larkspur's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, eg. 52.75.) the price paid for the bond is $ 1,421,367.95

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

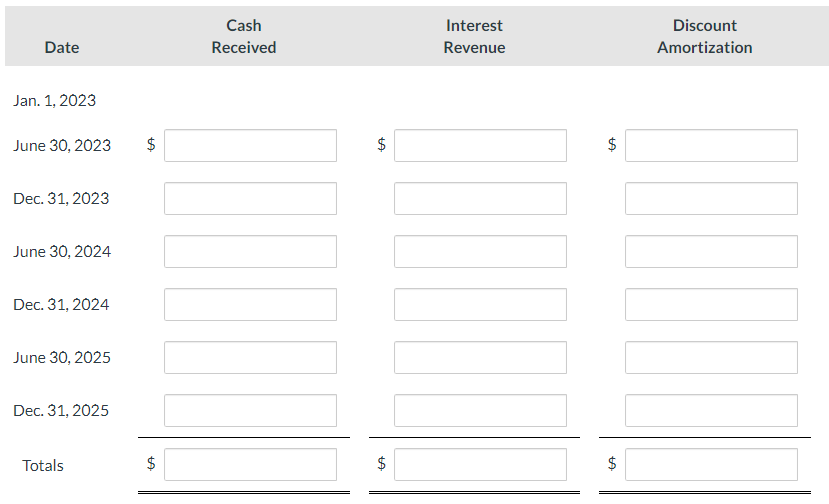

On January 1, 2023, Larkspur Corporation purchased a newly issued $1,500,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Larkspur's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model.

Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, eg. 52.75.)

the price paid for the bond is $ 1,421,367.95

Transcribed Image Text:Date

Jan. 1, 2023

June 30, 2023

Dec. 31, 2023

June 30, 2024

Dec. 31, 2024

June 30, 2025

Dec. 31, 2025

Totals

$

$

LA

Cash

Received

LA

$

LA

Interest

Revenue

LA

CA

Discount

Amortization

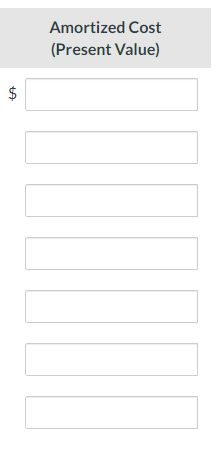

Transcribed Image Text:LA

Amortized Cost

(Present Value)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you