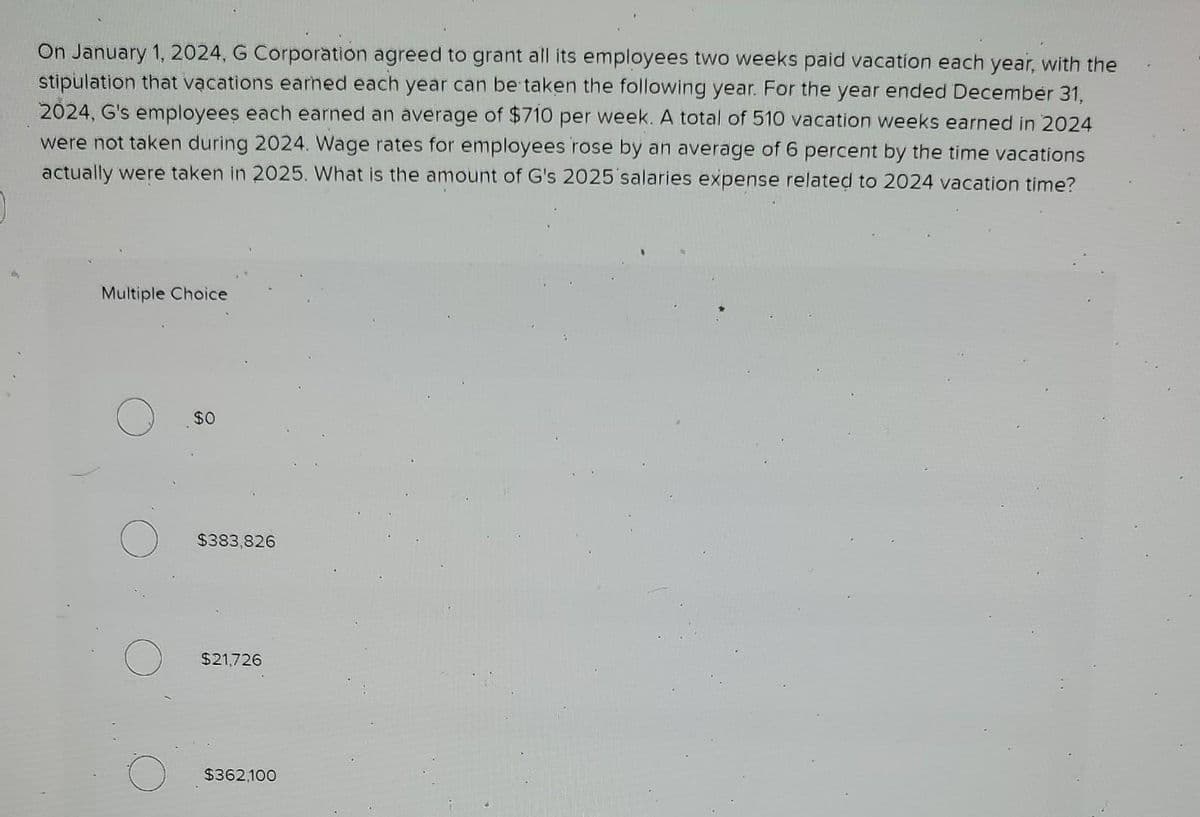

On January 1, 2024, G Corporation agreed to grant all its employees two weeks paid vacation each year, with the stipulation that vacations earned each year can be taken the following year. For the year ended December 31, 2024, G's employees each earned an average of $710 per week. A total of 510 vacation weeks earned in 2024 were not taken during 2024. Wage rates for employees rose by an average of 6 percent by the time vacations actually were taken in 2025. What is the amount of G's 2025 salaries expense related to 2024 vacation time? Multiple Choice $0 $383,826 $21,726 $362,100

On January 1, 2024, G Corporation agreed to grant all its employees two weeks paid vacation each year, with the stipulation that vacations earned each year can be taken the following year. For the year ended December 31, 2024, G's employees each earned an average of $710 per week. A total of 510 vacation weeks earned in 2024 were not taken during 2024. Wage rates for employees rose by an average of 6 percent by the time vacations actually were taken in 2025. What is the amount of G's 2025 salaries expense related to 2024 vacation time? Multiple Choice $0 $383,826 $21,726 $362,100

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 6MC

Related questions

Question

2

Transcribed Image Text:On January 1, 2024, G Corporation agreed to grant all its employees two weeks paid vacation each year, with the

stipulation that vacations earned each year can be taken the following year. For the year ended December 31,

2024, G's employees each earned an average of $710 per week. A total of 510 vacation weeks earned in 2024

were not taken during 2024. Wage rates for employees rose by an average of 6 percent by the time vacations

actually were taken in 2025. What is the amount of G's 2025 salaries expense related to 2024 vacation time?

Multiple Choice

$0

$383,826

$21,726

$362,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT