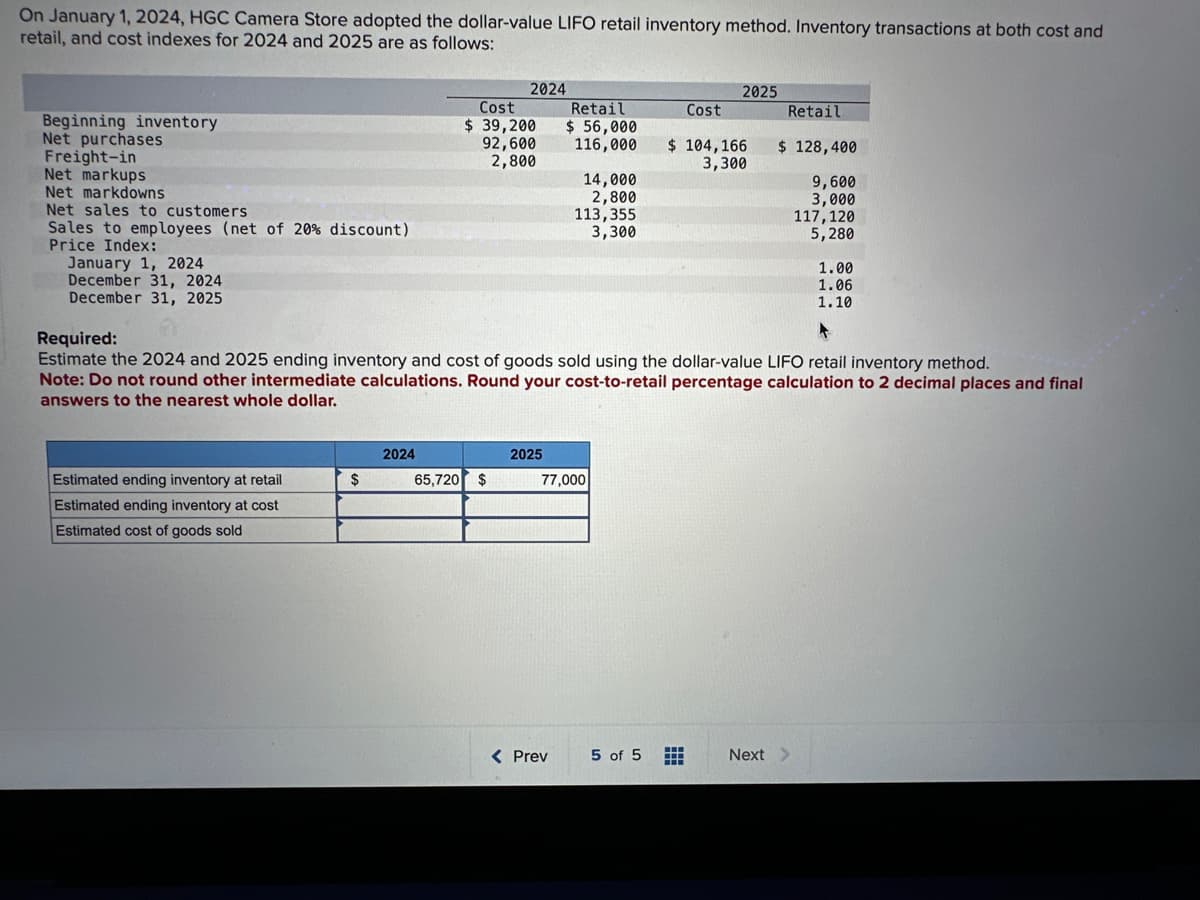

On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ 2024 2024 Cost $ 39,200 92,600 2,800 65,720 $ Retail $ 56,000 116,000 2025 14,000 2,800 113,355 3,300 1.00 1.06 1.10 4 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Cost 77,000 2025 $ 104,166 3,300 Retail $ 128,400 9,600 3,000 117,120 5,280

On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ 2024 2024 Cost $ 39,200 92,600 2,800 65,720 $ Retail $ 56,000 116,000 2025 14,000 2,800 113,355 3,300 1.00 1.06 1.10 4 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Cost 77,000 2025 $ 104,166 3,300 Retail $ 128,400 9,600 3,000 117,120 5,280

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 13P: Webster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X,...

Related questions

Topic Video

Question

complete chart

Transcribed Image Text:On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and

retail, and cost indexes for 2024 and 2025 are as follows:

Beginning inventory

Net purchases

Freight-in

Net markups

Net markdowns

Net sales to customers

Sales to employees (net of 20% discount)

Price Index:

January 1, 2024

December 31, 2024

December 31, 2025

Estimated ending inventory at retail

Estimated ending inventory at cost

Estimated cost of goods sold

$

2024

2024

Cost

$ 39,200

92,600

2,800

65,720 $

2025

Retail

$ 56,000

116,000

1.00

1.06

1.10

A

Required:

Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method.

Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final

answers to the nearest whole dollar.

14,000

2,800

113,355

3,300

< Prev

77,000

5 of 5

Cost

2025

$ 104,166

3,300

H

Retail

$ 128,400

9,600

3,000

117,120

5,280

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,