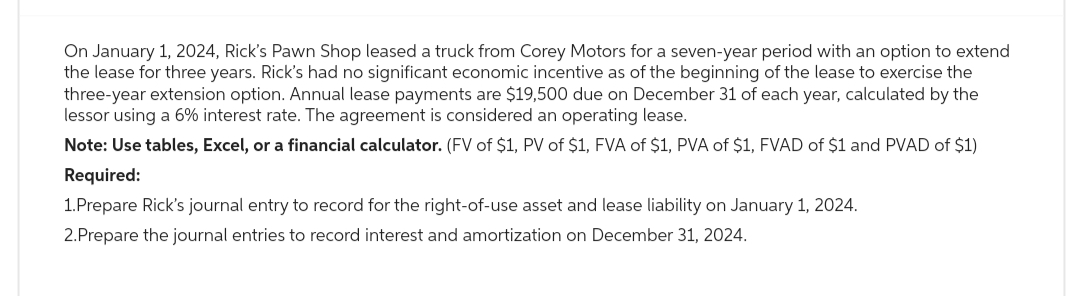

On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a seven-year period with an option to extend the lease for three years. Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $19,500 due on December 31 of each year, calculated by the lessor using a 6% interest rate. The agreement is considered an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1.Prepare Rick's journal entry to record for the right-of-use asset and lease liability on January 1, 2024. 2.Prepare the journal entries to record interest and amortization on December 31, 2024.

On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a seven-year period with an option to extend the lease for three years. Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $19,500 due on December 31 of each year, calculated by the lessor using a 6% interest rate. The agreement is considered an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1.Prepare Rick's journal entry to record for the right-of-use asset and lease liability on January 1, 2024. 2.Prepare the journal entries to record interest and amortization on December 31, 2024.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a seven-year period with an option to extend

the lease for three years. Rick's had no significant economic incentive as of the beginning of the lease to exercise the

three-year extension option. Annual lease payments are $19,500 due on December 31 of each year, calculated by the

lessor using a 6% interest rate. The agreement is considered an operating lease.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1.Prepare Rick's journal entry to record for the right-of-use asset and lease liability on January 1, 2024.

2.Prepare the journal entries to record interest and amortization on December 31, 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT