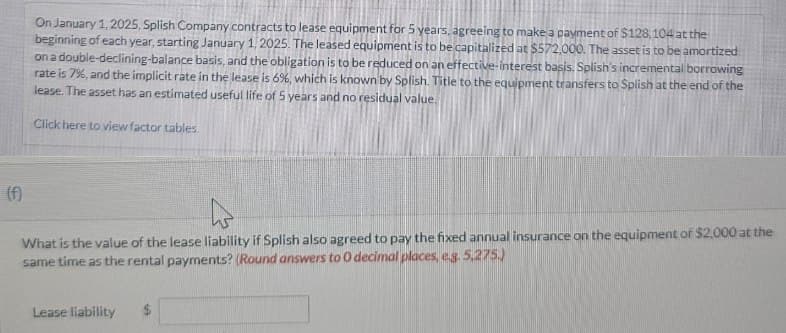

On January 1, 2025, Splish Company contracts to lease equipment for 5 years, agreeing to make a payment of $128,104 at the beginning of each year, starting January 1, 2025. The leased equipment is to be capitalized at $572,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Splish's incremental borrowing rate is 7%, and the implicit rate in the lease is 6%, which is known by Splish. Title to the equipment transfers to Splish at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Click here to view factor tables. (f) What is the value of the lease liability if Splish also agreed to pay the fixed annual insurance on the equipment of $2,000 at the same time as the rental payments? (Round answers to O decimal places, eg. 5,275.) Lease liability $

On January 1, 2025, Splish Company contracts to lease equipment for 5 years, agreeing to make a payment of $128,104 at the beginning of each year, starting January 1, 2025. The leased equipment is to be capitalized at $572,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Splish's incremental borrowing rate is 7%, and the implicit rate in the lease is 6%, which is known by Splish. Title to the equipment transfers to Splish at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Click here to view factor tables. (f) What is the value of the lease liability if Splish also agreed to pay the fixed annual insurance on the equipment of $2,000 at the same time as the rental payments? (Round answers to O decimal places, eg. 5,275.) Lease liability $

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 24E: Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January...

Related questions

Question

None

Transcribed Image Text:On January 1, 2025, Splish Company contracts to lease equipment for 5 years, agreeing to make a payment of $128,104 at the

beginning of each year, starting January 1, 2025. The leased equipment is to be capitalized at $572,000. The asset is to be amortized

on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Splish's incremental borrowing

rate is 7%, and the implicit rate in the lease is 6%, which is known by Splish. Title to the equipment transfers to Splish at the end of the

lease. The asset has an estimated useful life of 5 years and no residual value.

Click here to view factor tables.

(f)

What is the value of the lease liability if Splish also agreed to pay the fixed annual insurance on the equipment of $2,000 at the

same time as the rental payments? (Round answers to O decimal places, eg. 5,275.)

Lease liability $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning