On January 1, 20x1, Kageyama Corporation i 2x10. Legal and other costs of P24,000 were bonds is payableannually each December 31. amortized on a straight-line basisover the 10 also being amortized on a straight-line basis The bonds are callable at 10, and on Januany bondsand retired them. Unamortized discount on January 2,=

On January 1, 20x1, Kageyama Corporation i 2x10. Legal and other costs of P24,000 were bonds is payableannually each December 31. amortized on a straight-line basisover the 10 also being amortized on a straight-line basis The bonds are callable at 10, and on Januany bondsand retired them. Unamortized discount on January 2,=

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

100%

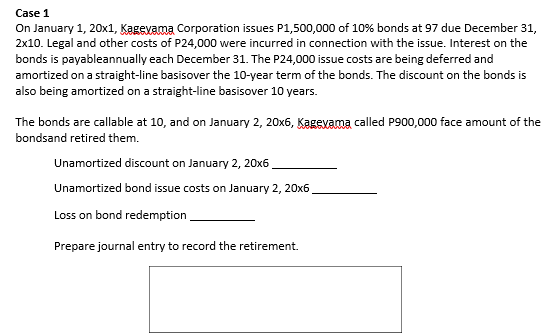

Transcribed Image Text:Case 1

On January 1, 20x1, Kagevama Corporation issues P1,500,000 of 10% bonds at 97 due December 31,

2x10. Legal and other costs of P24,000 were incurred in connection with the issue. Interest on the

bonds is payableannually each December 31. The P24,000 issue costs are being deferred and

amortized on a straight-line basisover the 10-year term of the bonds. The discount on the bonds is

also being amortized on a straight-line basisover 10 years.

The bonds are callable at 10, and on January 2, 20x6, Kagevama called P900,000 face amount of the

bondsand retired them.

Unamortized discount on January 2, 20x6

Unamortized bond issue costs on January 2, 20x6

Loss on bond redemption,

Prepare journal entry to record the retirement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College