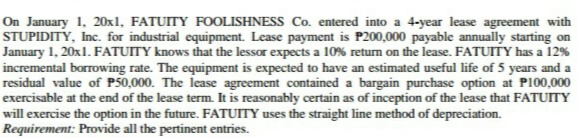

On January 1, 20xl, FATUITY FOOLISHNESS Co. entered into a 4-year lease agreement with STUPIDITY, Inc. for industrial equipment. Lease payment is P200,000 payable annually starting on January 1, 20x1. FATUITY knows that the lessor expects a 10% return on the lease. FATUITY has a 12% incremental borrowing rate. The equipment is expected to have an estimated useful life of 5 years and a residual value of P50,000. The lease agreement contained a bargain purchase option at PI00,000 exercisable at the end of the lease term. It is reasonably certain as of inception of the lease that FATUITY will exercise the option in the future. FATUITY uses the straight line method of depreciation. Requirement: Provide all the pertinent entries.

On January 1, 20xl, FATUITY FOOLISHNESS Co. entered into a 4-year lease agreement with STUPIDITY, Inc. for industrial equipment. Lease payment is P200,000 payable annually starting on January 1, 20x1. FATUITY knows that the lessor expects a 10% return on the lease. FATUITY has a 12% incremental borrowing rate. The equipment is expected to have an estimated useful life of 5 years and a residual value of P50,000. The lease agreement contained a bargain purchase option at PI00,000 exercisable at the end of the lease term. It is reasonably certain as of inception of the lease that FATUITY will exercise the option in the future. FATUITY uses the straight line method of depreciation. Requirement: Provide all the pertinent entries.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6P: Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a...

Related questions

Question

Please show the solution.

Transcribed Image Text:On January 1, 20xl, FATUITY FOOLISHNESS Co. entered into a 4-year lease agreement with

STUPIDITY, Inc. for industrial equipment. Lease payment is P200,000 payable annually starting on

January 1, 20x1. FATUITY knows that the lessor expects a 10% return on the lease. FATUITY has a 12%

incremental borrowing rate. The equipment is expected to have an estimated useful life of 5 years and a

residual value of P50,000. The lease agreement contained a bargain purchase option at P100,000

exercisable at the end of the lease term. It is reasonably certain as of inception of the lease that FATUITY

will exercise the option in the future. FATUITY uses the straight line method of depreciation.

Requirement: Provide all the pertinent entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning