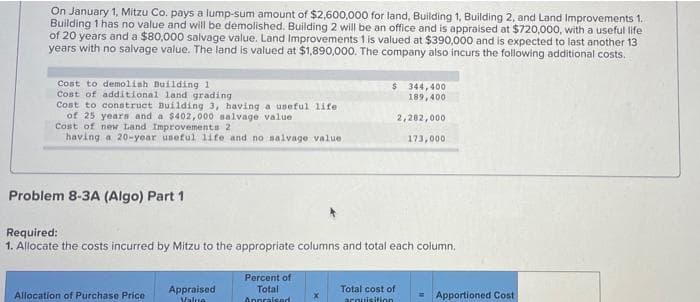

On January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $720,000, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $390,000 and is expected to last another 13 years with no salvage value. The land is valued at $1,890,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cont of additional land grading Cost to construct Building 3, having a useful 1ite of 25 yearn and a $402,000 salvage value Cont of new Land Improvements 2 having a 20-year useful 1ife and no nalvage value $ 344,400 189, 400 2,202,000 173,000 Problem 8-3A (Algo) Part 1 Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Percent of Total Total cost of auuisition Appraised Allocation of Purchase Price Apportioned Cost Malua

On January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $720,000, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $390,000 and is expected to last another 13 years with no salvage value. The land is valued at $1,890,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cont of additional land grading Cost to construct Building 3, having a useful 1ite of 25 yearn and a $402,000 salvage value Cont of new Land Improvements 2 having a 20-year useful 1ife and no nalvage value $ 344,400 189, 400 2,202,000 173,000 Problem 8-3A (Algo) Part 1 Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Percent of Total Total cost of auuisition Appraised Allocation of Purchase Price Apportioned Cost Malua

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

please help me to solve this problem

Thank you

Transcribed Image Text:On January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1.

Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $720,000, with a useful life

of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $390,000 and is expected to last another 13

years with no salvage value. The land is valued at $1,890,000. The company also incurs the following additional costs.

Cost to demolish Building 1

Cost of additional land grading

Cost to construct Building 3, having a useful life

of 25 years and a $402,000 salvage value

Cost of new Land Improvements 2

having a 20-year useful life and no salvage value

$ 344, 400

189, 400

2,282,000

173,000

Problem 8-3A (Algo) Part 1

Required:

1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column.

Percent of

Total

Appraised

Total cost of

Allocation of Purchase Price

Apportioned Cost

Value

Annraised

acouisition

Transcribed Image Text:Sivd

Help

Save & Evit

Submi

Check my work

Required information

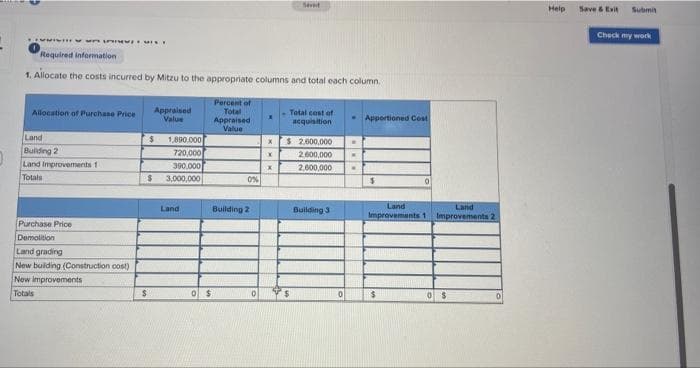

1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column,

Percent of

Total

Appraised

Value

- Total cest of

acquisition

Allocation of Purchase Price

Apportioned Cost

Appraised

Value

Land

Building 2

1,890.000

720,000

300,000

3,000,000

$ 200,000

2600,000

Land Improvements 1

Totals

2.000,000

24

Land

Building 2

Building 3

Land

Land

Improvements 1 Improvements 2

Purchase Price

Demolition

Land grading

New bulding (Construction cost)

Now improvements

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT