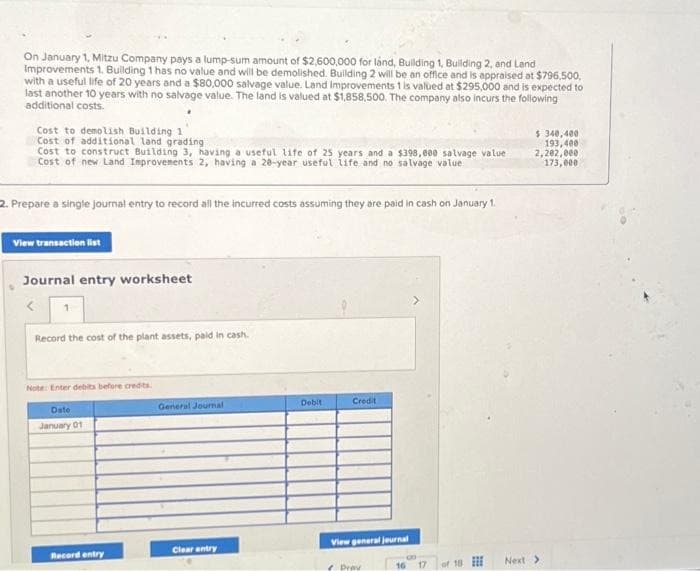

On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for lånd, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $796,500, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $295,000 and is expected to last another 10 years with no salvage value. The land is valued at $1,858,500. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value repare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1. $ 340,400 193,400 2,282,000 173,000

On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for lånd, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $796,500, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $295,000 and is expected to last another 10 years with no salvage value. The land is valued at $1,858,500. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value repare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1. $ 340,400 193,400 2,282,000 173,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

Transcribed Image Text:On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for lånd, Building 1, Building 2, and Land

Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $796,500,

with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $295,000 and is expected to

last another 10 years with no salvage value. The land is valued at $1,858,500. The company also incurs the following

additional costs.

Cost to demolish Building 1

Cost of additional land grading i

Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value

Cost of new Land Improvements 2, having a 20-year useful life and no salvage value

2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1.

View transaction list

Journal entry worksheet

1

Record the cost of the plant assets, paid in cash.

Note: Enter debits before credits.

Date

January 01

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Prav

16 17

of 18

$ 340,400

193,400

2,202,000

173,000

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,