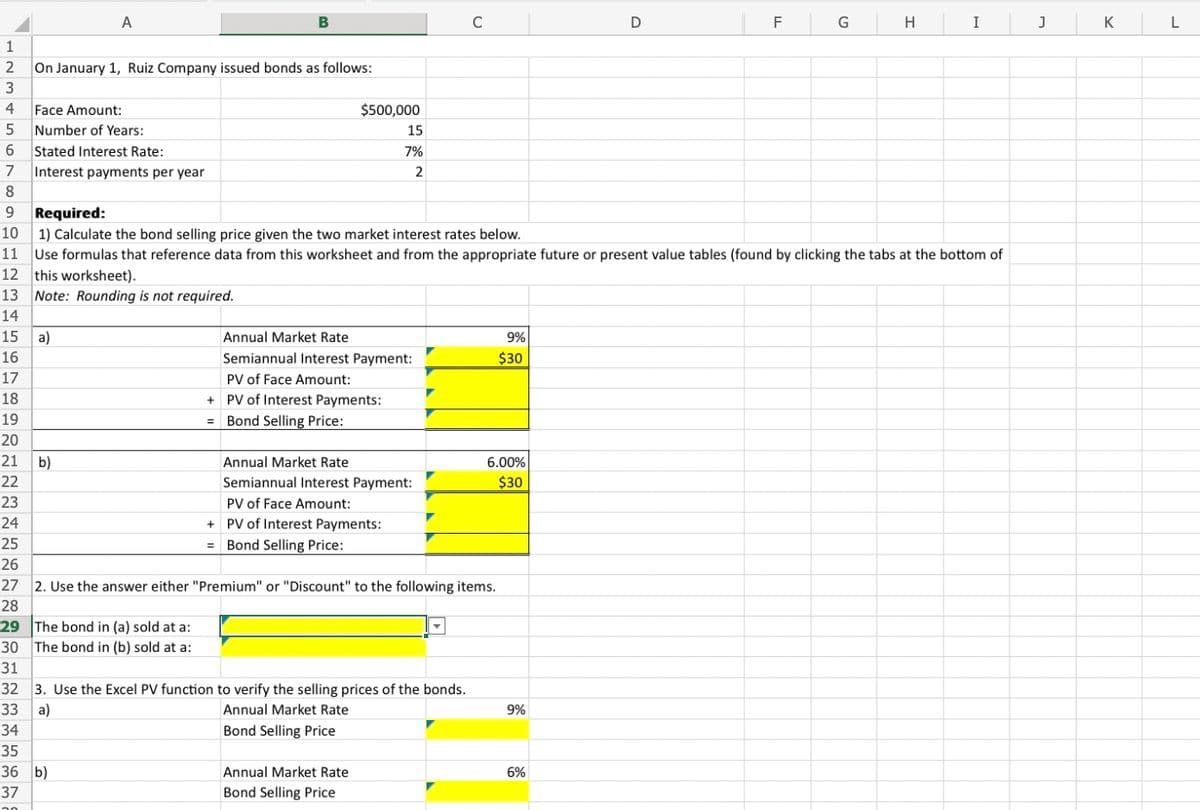

On January 1, Ruiz Company issued bonds as follows: Face Amount: Number of Years: Stated Interest Rate: Interest payments per year a) $500,000 Required: 1) Calculate the bond selling price given the two market interest rates below. Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the bottom of this worksheet). Note: Rounding is not required. b) 15 7% 2 Annual Market Rate Semiannual Interest Payment: PV of Face Amount: +PV of Interest Payments: = Bond Selling Price: Annual Market Rate Semiannual Interest Payment: PV of Face Amount: + PV of Interest Payments: = Bond Selling Price: 9% $30 6.00% $30 2. Use the answer either "Premium" or "Discount" to the following items. The bond in (a) sold at a: The bond in (b) sold at a:

On January 1, Ruiz Company issued bonds as follows: Face Amount: Number of Years: Stated Interest Rate: Interest payments per year a) $500,000 Required: 1) Calculate the bond selling price given the two market interest rates below. Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the bottom of this worksheet). Note: Rounding is not required. b) 15 7% 2 Annual Market Rate Semiannual Interest Payment: PV of Face Amount: +PV of Interest Payments: = Bond Selling Price: Annual Market Rate Semiannual Interest Payment: PV of Face Amount: + PV of Interest Payments: = Bond Selling Price: 9% $30 6.00% $30 2. Use the answer either "Premium" or "Discount" to the following items. The bond in (a) sold at a: The bond in (b) sold at a:

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.3E: Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8%...

Related questions

Question

Transcribed Image Text:A

Interest payments per year

13

14

15 a)

16

17

18

19

20

21

22

23

24

25

26

b)

B

Annual Market Rate

Semiannual Interest Payment:

PV of Face Amount:

PV of Interest Payments:

+

= Bond Selling Price:

$500,000

15

7%

2

1

2

On January 1, Ruiz Company issued bonds as follows:

3

4 Face Amount:

5 Number of Years:

6 Stated Interest Rate:

7

8

9

Required:

10 1) Calculate the bond selling price given the two market interest rates below.

11 Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the bottom of

12 this worksheet).

Note: Rounding is not required.

Annual Market Rate

Semiannual Interest Payment:

PV of Face Amount:

+ PV of Interest Payments:

= Bond Selling Price:

C

29 The bond in (a) sold at a:

30 The bond in (b) sold at a:

31

32 3. Use the Excel PV function to verify the selling prices of the bonds.

33 a)

Annual Market Rate

34

Bond Selling Price

35

36 b)

37

Annual Market Rate

Bond Selling Price

27

2. Use the answer either "Premium" or "Discount" to the following items.

28

9%

$30

6.00%

$30

9%

D

6%

LL

F

G

H

I

J

K

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning