On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1. Required: a. How much of his share of the loss can Carrot deduct on his Year 1 return? b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Complete this question by entering your answers in the tabs below. Required A Required B Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Root Stock Adjusted basis Root Note On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1. Required: a. How much of his share of the loss can Carrot deduct on his Year 1 return? b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Complete this question by entering your answers in the tabs below. Required A Required B How much of his share of the loss can Carrot deduct on his Year 1 return? Deduction

On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1. Required: a. How much of his share of the loss can Carrot deduct on his Year 1 return? b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Complete this question by entering your answers in the tabs below. Required A Required B Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Root Stock Adjusted basis Root Note On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1. Required: a. How much of his share of the loss can Carrot deduct on his Year 1 return? b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1. Complete this question by entering your answers in the tabs below. Required A Required B How much of his share of the loss can Carrot deduct on his Year 1 return? Deduction

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter15: S Corporations

Section: Chapter Questions

Problem 8BCRQ

Related questions

Question

ssssss

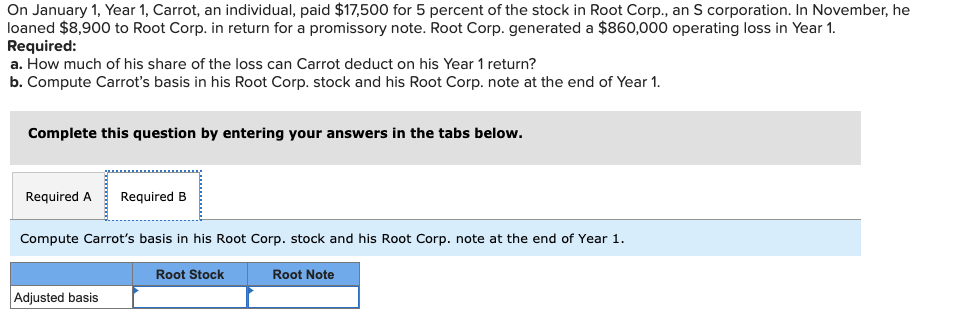

Transcribed Image Text:On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he

loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1.

Required:

a. How much of his share of the loss can Carrot deduct on his Year 1 return?

b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Root Stock

Adjusted basis

Root Note

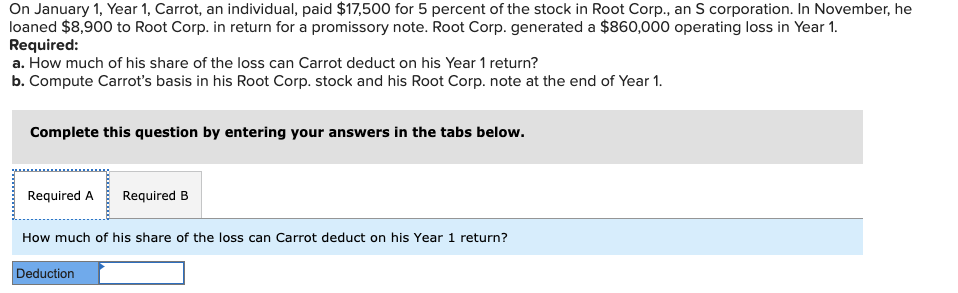

Transcribed Image Text:On January 1, Year 1, Carrot, an individual, paid $17,500 for 5 percent of the stock in Root Corp., an S corporation. In November, he

loaned $8,900 to Root Corp. in return for a promissory note. Root Corp. generated a $860,000 operating loss in Year 1.

Required:

a. How much of his share of the loss can Carrot deduct on his Year 1 return?

b. Compute Carrot's basis in his Root Corp. stock and his Root Corp. note at the end of Year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B

How much of his share of the loss can Carrot deduct on his Year 1 return?

Deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you