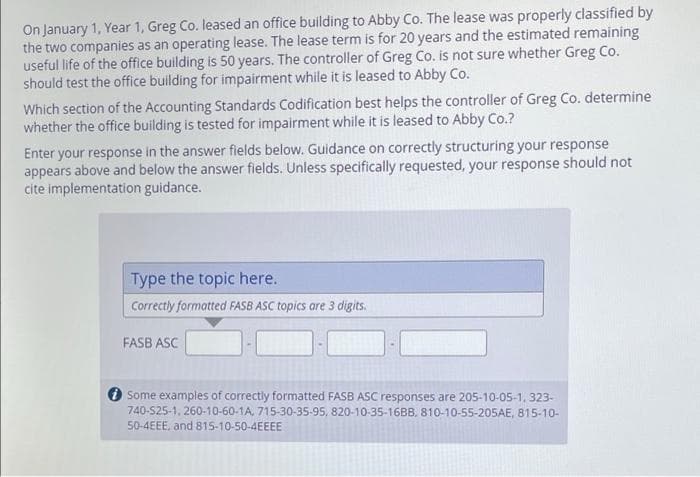

On January 1, Year 1, Greg Co. leased an office building to Abby Co. The lease was properly classified by the two companies as an operating lease. The lease term is for 20 years and the estimated remaining useful life of the office building is 50 years. The controller of Greg Co. is not sure whether Greg Co. should test the office building for impairment while it is leased to Abby Co. Which section of the Accounting Standards Codification best helps the controller of Greg Co. determine whether the office building is tested for impairment while it is leased to Abby Co.? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Unless specifically requested, your response should not cite implementation guidance. Type the topic here. Correctly formatted FASB ASC topics are 3 digits. FASB ASC Some examples of correctly formatted FASB ASC responses are 205-10-05-1.323- 740-525-1, 260-10-60-1A, 715-30-35-95, 820-10-35-16BB. 810-10-55-205AE, 815-10- 50-4EEE, and 815-10-50-4EEEE

On January 1, Year 1, Greg Co. leased an office building to Abby Co. The lease was properly classified by the two companies as an operating lease. The lease term is for 20 years and the estimated remaining useful life of the office building is 50 years. The controller of Greg Co. is not sure whether Greg Co. should test the office building for impairment while it is leased to Abby Co. Which section of the Accounting Standards Codification best helps the controller of Greg Co. determine whether the office building is tested for impairment while it is leased to Abby Co.? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Unless specifically requested, your response should not cite implementation guidance. Type the topic here. Correctly formatted FASB ASC topics are 3 digits. FASB ASC Some examples of correctly formatted FASB ASC responses are 205-10-05-1.323- 740-525-1, 260-10-60-1A, 715-30-35-95, 820-10-35-16BB. 810-10-55-205AE, 815-10- 50-4EEE, and 815-10-50-4EEEE

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 26CE

Related questions

Question

Transcribed Image Text:On January 1, Year 1, Greg Co. leased an office building to Abby Co. The lease was properly classified by

the two companies as an operating lease. The lease term is for 20 years and the estimated remaining

useful life of the office building is 50 years. The controller of Greg Co. is not sure whether Greg Co.

should test the office building for impairment while it is leased to Abby Co.

Which section of the Accounting Standards Codification best helps the controller of Greg Co. determine

whether the office building is tested for impairment while it is leased to Abby Co.?

Enter your response in the answer fields below. Guidance on correctly structuring your response

appears above and below the answer fields. Unless specifically requested, your response should not

cite implementation guidance.

Type the topic here.

Correctly formatted FASB ASC topics are 3 digits.

FASB ASC

Some examples of correctly formatted FASB ASC responses are 205-10-05-1,323-

740-525-1, 260-10-60-1A, 715-30-35-95, 820-10-35-16BB. 810-10-55-205AE, 815-10-

50-4EEE, and 815-10-50-4EEEE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning