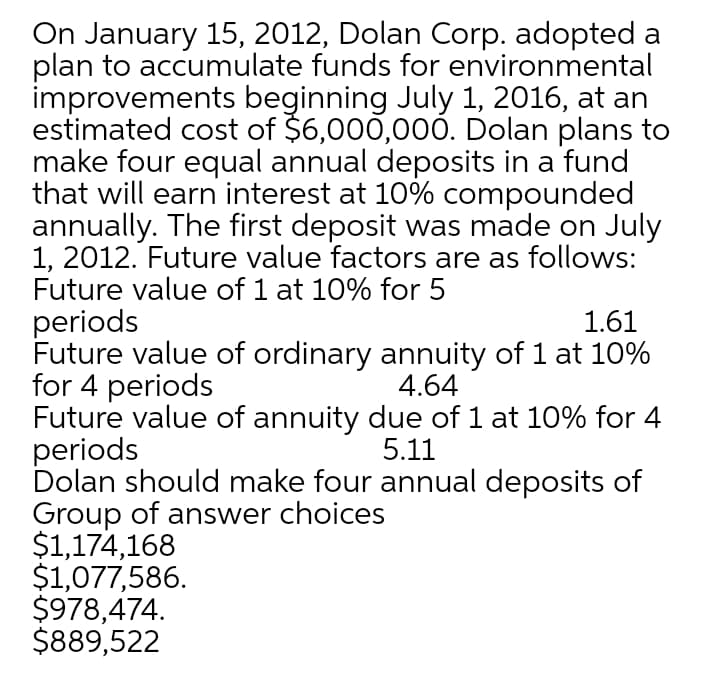

On January 15, 2012, Dolan Corp. adopted a plan to accumulate funds for environmental improvements beginning July 1, 2016, at an estimated cost of $6,000,000. Dolan plans to make four equal annual deposits in a fund that will earn interest at 10% compounded annually. The first deposit was made on July 1, 2012. Future value factors are as follows: Future value of 1 at 10% for 5 periods Future value of ordinary annuity of 1 at 10% for 4 periods Future value of annuity due of 1 at 10% for 4 periods Dolan should make four annual deposits of Group of answer choices $1,174,168 $1,077,586. $978,474. $889,522 1.61 4.64 5.11

On January 15, 2012, Dolan Corp. adopted a plan to accumulate funds for environmental improvements beginning July 1, 2016, at an estimated cost of $6,000,000. Dolan plans to make four equal annual deposits in a fund that will earn interest at 10% compounded annually. The first deposit was made on July 1, 2012. Future value factors are as follows: Future value of 1 at 10% for 5 periods Future value of ordinary annuity of 1 at 10% for 4 periods Future value of annuity due of 1 at 10% for 4 periods Dolan should make four annual deposits of Group of answer choices $1,174,168 $1,077,586. $978,474. $889,522 1.61 4.64 5.11

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:On January 15, 2012, Dolan Corp. adopted a

plan to accumulate funds for environmental

improvements beginning July 1, 2016, at an

estimated cost of $6,000,00Ó. Dolan plans to

make four equal annual deposits in a fund

that will earn interest at 10% compounded

annually. The first deposit was made on July

1, 2012. Future value factors are as follows:

Future value of 1 at 10% for 5

periods

Future value of ordinary annuity of 1 at 10%

for 4 periods

Future value of annuity due of 1 at 10% for 4

periods

Dolan should make four annual deposits of

Group of answer choices

$1,174,168

$1,077,586.

$978,474.

$889,522

1.61

4.64

5.11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning