a. Prepare a journal entry to record depreciation expense on the equipment for 2016. Round your answer to the nearest dollar.

a. Prepare a journal entry to record depreciation expense on the equipment for 2016. Round your answer to the nearest dollar.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 53E: Revision of Depreciation On January 1, 2017, Blizzards-R-Us purchased a snow-blowing machine for...

Related questions

Question

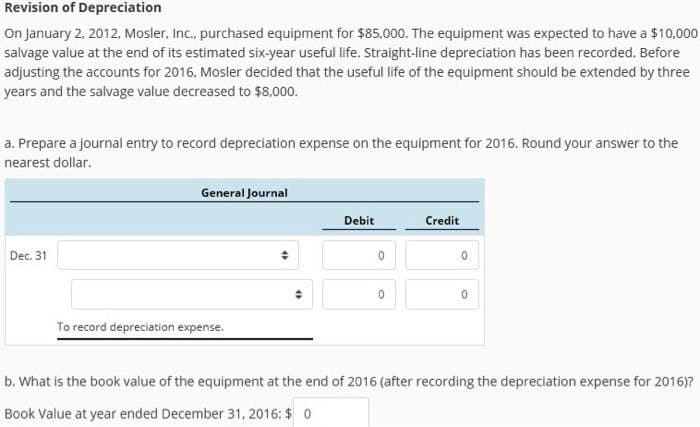

Transcribed Image Text:Revision of Depreciation

On January 2, 2012, Mosler, Inc., purchased equipment for $85,000. The equipment was expected to have a $10,000

salvage value at the end of its estimated six-year useful life. Straight-line depreciation has been recorded. Before

adjusting the accounts for 2016, Mosler decided that the useful life of the equipment should be extended by three

years and the salvage value decreased to $8,000.

a. Prepare a journal entry to record depreciation expense on the equipment for 2016. Round your answer to the

nearest dollar.

Dec. 31

General Journal

Debit

To record depreciation expense.

0

Credit

0

0

0

b. What is the book value of the equipment at the end of 2016 (after recording the depreciation expense for 2016)?

Book Value at year ended December 31, 2016: $ 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,