On January 2, 2015, Moser, Inc., purchased equipment for $100,000. The equipment was expected to have a $10,000 salvage value at the end of its estimated six-year useful life. Straight-line depreciation has been recorded. Before adjusting the accounts for 2019, Moser decided that the useful life of the equipment should be extended by three years and the salvage value decreased to $8,0000. a. Prepare a journal entry to record depreciation expense on the equipment for 2019. Round your answer to the nearest dollar. General Journal Debit Credit Dec. 31 To record depreciation expense. b. What is the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019)? Book Value at year ended December 31, 2019: $

On January 2, 2015, Moser, Inc., purchased equipment for $100,000. The equipment was expected to have a $10,000 salvage value at the end of its estimated six-year useful life. Straight-line depreciation has been recorded. Before adjusting the accounts for 2019, Moser decided that the useful life of the equipment should be extended by three years and the salvage value decreased to $8,0000. a. Prepare a journal entry to record depreciation expense on the equipment for 2019. Round your answer to the nearest dollar. General Journal Debit Credit Dec. 31 To record depreciation expense. b. What is the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019)? Book Value at year ended December 31, 2019: $

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

please help with this question

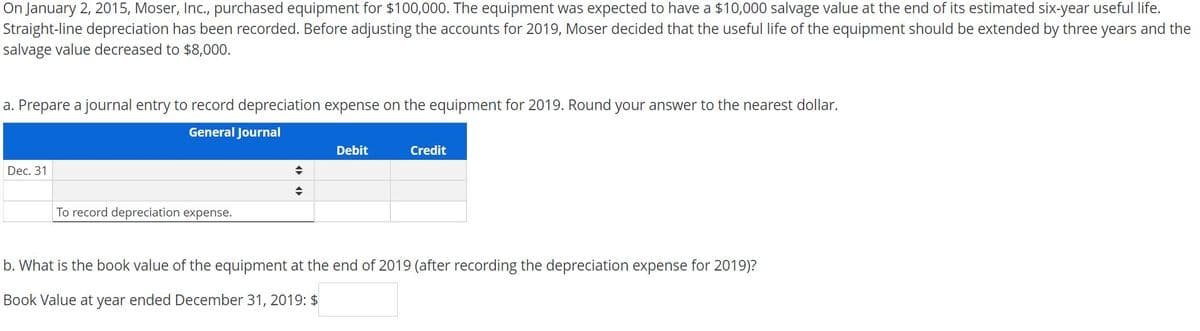

Transcribed Image Text:On January 2, 2015, Moser, Inc., purchased equipment for $100,000. The equipment was expected to have a $10,000 salvage value at the end of its estimated six-year useful life.

Straight-line depreciation has been recorded. Before adjusting the accounts for 2019, Moser decided that the useful life of the equipment should be extended by three years and the

salvage value decreased to $8,000.

a. Prepare a journal entry to record depreciation expense on the equipment for 2019. Round your answer to the nearest dollar.

General Journal

Debit

Credit

Dec. 31

To record depreciation expense.

b. What is the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019)?

Book Value at year ended December 31, 2019: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning