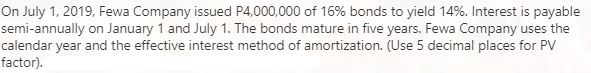

On July 1, 2019, Fewa Company issued P4,000,000 of 16% bonds to yield 14%. Interest is payable semi-annually on January 1 and July 1. The bonds mature in five years. Fewa Company uses the calendar year and the effective interest method of amortization. (Use 5 decimal places for PV factor).

On July 1, 2019, Fewa Company issued P4,000,000 of 16% bonds to yield 14%. Interest is payable semi-annually on January 1 and July 1. The bonds mature in five years. Fewa Company uses the calendar year and the effective interest method of amortization. (Use 5 decimal places for PV factor).

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 4EA: On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated...

Related questions

Question

p17

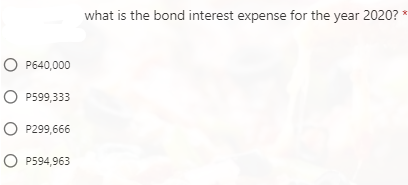

Transcribed Image Text:what is the bond interest expense for the year 2020?

P640,000

P599,333

P299,666

P594,963

Transcribed Image Text:On July 1, 2019, Fewa Company issued P4,000,000 of 16% bonds to yield 14%. Interest is payable

semi-annually on January 1 and July 1. The bonds mature in five years. Fewa Company uses the

calendar year and the effective interest method of amortization. (Use 5 decimal places for PV

factor).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning