On June 1, 2021, Sandalwood Corporation purchases a passenger automobile for 100 percent use in its business. The automobile is in the 5 year cost recovery class and has a basis for depreciation of $60,000o. Assuming that the corporation elects the accelerated method of cost recovery for the asset and takes bonus depreciation, what is the total tax depreciation deduction for the 2021 calendar tax year (Year 1)? Oa. $18.200 Ob. $10,100 Oc. $12.000 Od. $11.160 Oe. None of these choices are correct.

On June 1, 2021, Sandalwood Corporation purchases a passenger automobile for 100 percent use in its business. The automobile is in the 5 year cost recovery class and has a basis for depreciation of $60,000o. Assuming that the corporation elects the accelerated method of cost recovery for the asset and takes bonus depreciation, what is the total tax depreciation deduction for the 2021 calendar tax year (Year 1)? Oa. $18.200 Ob. $10,100 Oc. $12.000 Od. $11.160 Oe. None of these choices are correct.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 26P

Related questions

Question

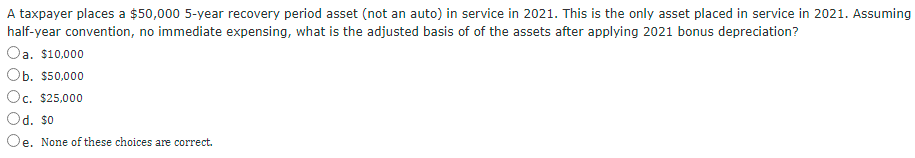

Transcribed Image Text:A taxpayer places a $50,000 5-year recovery period asset (not an auto) in service in 2021. This is the only asset placed in service in 2021. Assuming

half-year convention, no immediate expensing, what is the adjusted basis of of the assets after applying 2021 bonus depreciation?

Oa. $10,000

Ob. $50,000

Oc. $25,000

Od. so

Oe. None of these choices are correct.

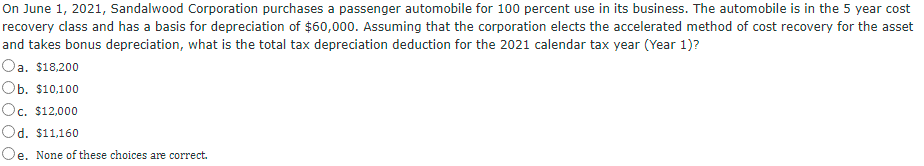

Transcribed Image Text:On June 1, 2021, Sandalwood Corporation purchases a passenger automobile for 100 percent use in its business. The automobile is in the 5 year cost

recovery class and has a basis for depreciation of $60,000. Assuming that the corporation elects the accelerated method of cost recovery for the asset

and takes bonus depreciation, what is the total tax depreciation deduction for the 2021 calendar tax year (Year 1)?

Oa. $18,200

Ob. $10,100

Oc. $12,000

Od. $11,160

Oe. None of these choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT