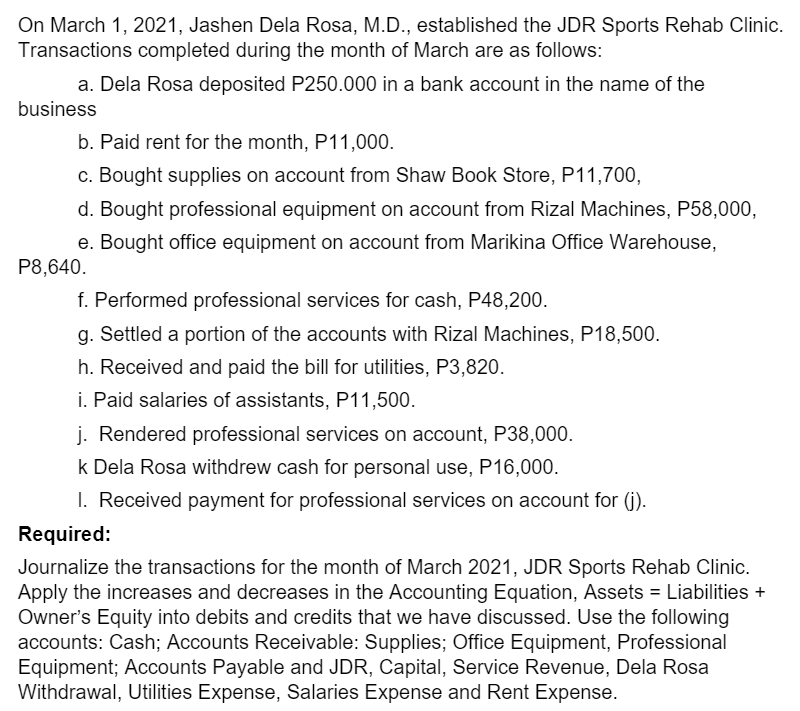

On March 1, 2021, Jashen Dela Rosa, M.D., established the JDR Sports Rehab Clinic. Transactions completed during the month of March are as follows: a. Dela Rosa deposited P250.000 in a bank account in the name of the business b. Paid rent for the month, P11,000. c. Bought supplies on account from Shaw Book Store, P11,700, d. Bought professional equipment on account from Rizal Machines, P58,000, e. Bought office equipment on account from Marikina Office Warehouse, P8,640. f. Performed professional services for cash, P48,200. g. Settled a portion of the accounts with Rizal Machines, P18,500. h. Received and paid the bill for utilities, P3,820. i. Paid salaries of assistants, P11,500. j. Rendered professional services on account, P38,000. k Dela Rosa withdrew cash for personal use, P16,000. I. Received payment for professional services on account for (j). Required: Journalize the transactions for the month of March 2021, JDR Sports Rehab Clinic. Apply the increases and decreases in the Accounting Equation, Assets = Liabilities + Owner's Equity into debits and credits that we have discussed. Use the following accounts: Cash; Accounts Receivable: Supplies; Office Equipment, Professional Equipment; Accounts Payable and JDR, Capital, Service Revenue, Dela Rosa Withdrawal, Utilities Expense, Salaries Expense and Rent Expense.

On March 1, 2021, Jashen Dela Rosa, M.D., established the JDR Sports Rehab Clinic. Transactions completed during the month of March are as follows: a. Dela Rosa deposited P250.000 in a bank account in the name of the business b. Paid rent for the month, P11,000. c. Bought supplies on account from Shaw Book Store, P11,700, d. Bought professional equipment on account from Rizal Machines, P58,000, e. Bought office equipment on account from Marikina Office Warehouse, P8,640. f. Performed professional services for cash, P48,200. g. Settled a portion of the accounts with Rizal Machines, P18,500. h. Received and paid the bill for utilities, P3,820. i. Paid salaries of assistants, P11,500. j. Rendered professional services on account, P38,000. k Dela Rosa withdrew cash for personal use, P16,000. I. Received payment for professional services on account for (j). Required: Journalize the transactions for the month of March 2021, JDR Sports Rehab Clinic. Apply the increases and decreases in the Accounting Equation, Assets = Liabilities + Owner's Equity into debits and credits that we have discussed. Use the following accounts: Cash; Accounts Receivable: Supplies; Office Equipment, Professional Equipment; Accounts Payable and JDR, Capital, Service Revenue, Dela Rosa Withdrawal, Utilities Expense, Salaries Expense and Rent Expense.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 2PB: In March, K. Haas, M.D., established the Haas Sports Injury Clinic. The clinics account headings are...

Related questions

Question

1.

Transcribed Image Text:On March 1, 2021, Jashen Dela Rosa, M.D., established the JDR Sports Rehab Clinic.

Transactions completed during the month of March are as follows:

a. Dela Rosa deposited P250.000 in a bank account in the name of the

business

b. Paid rent for the month, P11,000.

c. Bought supplies on account from Shaw Book Store, P11,700,

d. Bought professional equipment on account from Rizal Machines, P58,000,

e. Bought office equipment on account from Marikina Office Warehouse,

P8,640.

f. Performed professional services for cash, P48,200.

g. Settled a portion of the accounts with Rizal Machines, P18,500.

h. Received and paid the bill for utilities, P3,820.

i. Paid salaries of assistants, P11,500.

j. Rendered professional services on account, P38,000.

k Dela Rosa withdrew cash for personal use, P16,000.

I. Received payment for professional services on account for (j).

Required:

Journalize the transactions for the month of March 2021, JDR Sports Rehab Clinic.

Apply the increases and decreases in the Accounting Equation, Assets = Liabilities +

Owner's Equity into debits and credits that we have discussed. Use the following

accounts: Cash; Accounts Receivable: Supplies; Office Equipment, Professional

Equipment; Accounts Payable and JDR, Capital, Service Revenue, Dela Rosa

Withdrawal, Utilities Expense, Salaries Expense and Rent Expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,