On March 1, 2023, Spoelstra, Inc. borrows $1.120,000 on a three year, 8% loan to finance construction of a new building. Spoelstra also has $2,000,000 of 5% debt outstanding for all of 2023. During 2023, the following events occur: 6/1/23-Spoelstra makes a $332.000 payment to the construction contractor, and work begins on the project. 8/1/23-Spoelstra makes a $387,000 progress payment to the construction contractor. 11/1/23-Spoelstra makes a final payment of $299,000 to the contractor upon completion of construction. How much interest cost should be capitalized into the cost of the building?

On March 1, 2023, Spoelstra, Inc. borrows $1.120,000 on a three year, 8% loan to finance construction of a new building. Spoelstra also has $2,000,000 of 5% debt outstanding for all of 2023. During 2023, the following events occur: 6/1/23-Spoelstra makes a $332.000 payment to the construction contractor, and work begins on the project. 8/1/23-Spoelstra makes a $387,000 progress payment to the construction contractor. 11/1/23-Spoelstra makes a final payment of $299,000 to the contractor upon completion of construction. How much interest cost should be capitalized into the cost of the building?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6MC: Ashton Company exchanged a nonmonetary asset with a cost of 30,000 and accumulated depreciation of...

Related questions

Question

3.

Subject :- Accounting

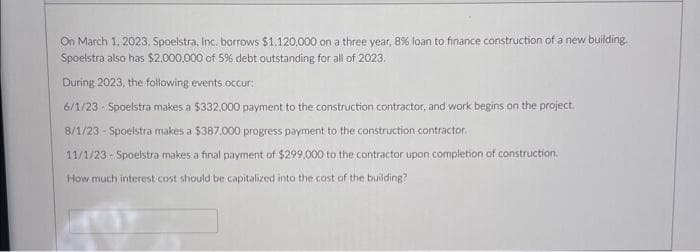

Transcribed Image Text:On March 1, 2023, Spoelstra, Inc. borrows $1.120,000 on a three year, 8% loan to finance construction of a new building.

Spoelstra also has $2,000,000 of 5% debt outstanding for all of 2023.

During 2023, the following events occur:

6/1/23 - Spoelstra makes a $332,000 payment to the construction contractor, and work begins on the project.

8/1/23 - Spoelstra makes a $387,000 progress payment to the construction contractor.

11/1/23-Spoelstra makes a final payment of $299,000 to the contractor upon completion of construction.

How much interest cost should be capitalized into the cost of the building?

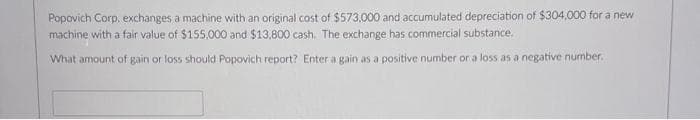

Transcribed Image Text:Popovich Corp, exchanges a machine with an original cost of $573,000 and accumulated depreciation of $304,000 for a new

machine with a fair value of $155,000 and $13,800 cash. The exchange has commercial substance.

What amount of gain or loss should Popovich report? Enter a gain as a positive number or a loss as a negative number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College