On May 1, 2020, Christina Fashions borrowed $106,000 at a bank by signing a four-year, 6% loan. The terms of the loan require equal principal payments of $26,500 and accrued interest at 6% due annually on April 30. The loan agreement requires the company to maintain a minimum current ratio of 2.0. The December 31, 2020, year-end statement of financial position, immediately prior to the reclassification of long-term debt, follows: Current assets $137,800 Current liabilities $53,000 Non-current assets 163,200 Loan payable 106,000 Common shares 72,000 Retained earnings 70,000 Total liabilities and Total assets $301,000 shareholders' equity $301,000 Your answer is partially correct. Does Christina Fashions comply with the bank's current ratio requirement prior to recording the accrued interest and reclassification of the current portion of the long-term loan? (Round answer to 1 decimal place, e.g. 1.2.) Current ratio 2.6

On May 1, 2020, Christina Fashions borrowed $106,000 at a bank by signing a four-year, 6% loan. The terms of the loan require equal principal payments of $26,500 and accrued interest at 6% due annually on April 30. The loan agreement requires the company to maintain a minimum current ratio of 2.0. The December 31, 2020, year-end statement of financial position, immediately prior to the reclassification of long-term debt, follows: Current assets $137,800 Current liabilities $53,000 Non-current assets 163,200 Loan payable 106,000 Common shares 72,000 Retained earnings 70,000 Total liabilities and Total assets $301,000 shareholders' equity $301,000 Your answer is partially correct. Does Christina Fashions comply with the bank's current ratio requirement prior to recording the accrued interest and reclassification of the current portion of the long-term loan? (Round answer to 1 decimal place, e.g. 1.2.) Current ratio 2.6

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.6P

Related questions

Question

Transcribed Image Text:Show Attempt History

Current Attempt in Progress

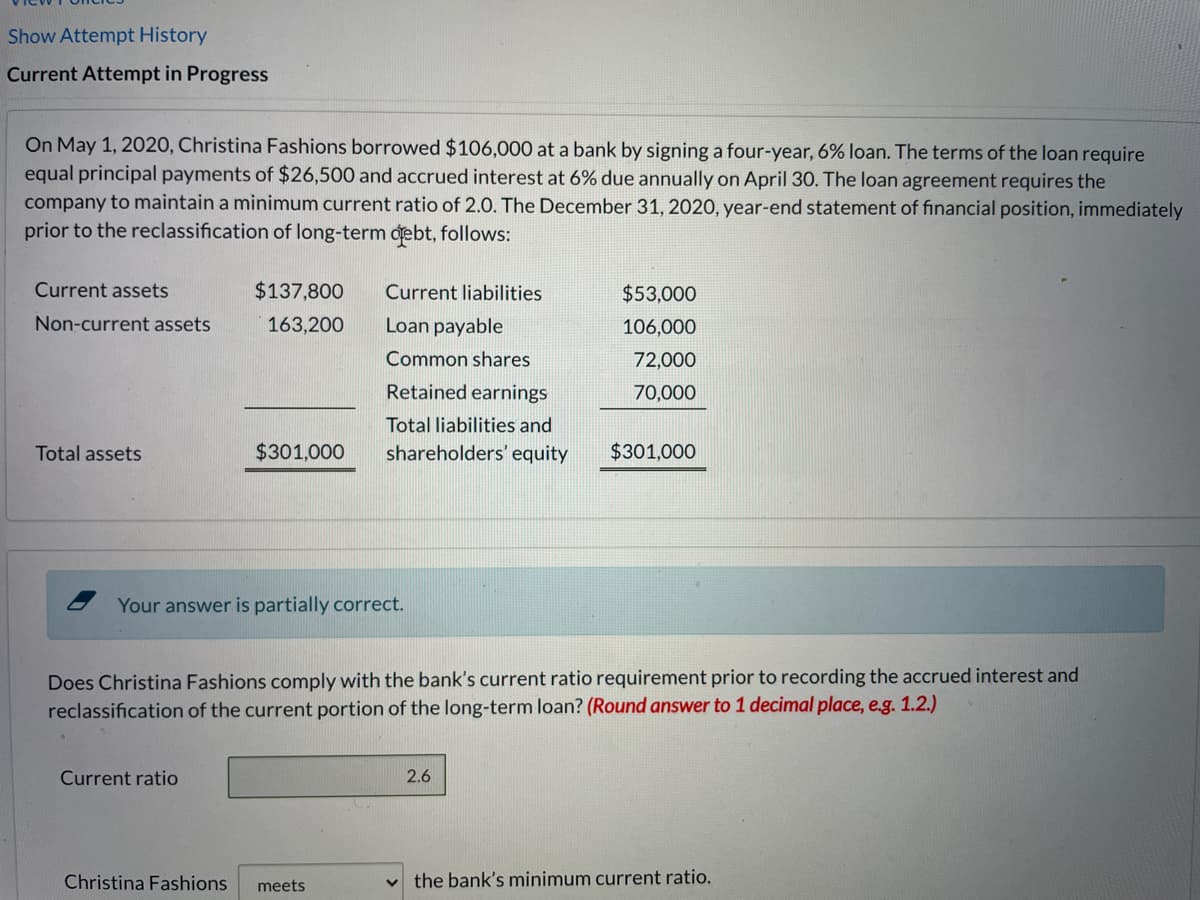

On May 1, 2020, Christina Fashions borrowed $106,000 at a bank by signing a four-year, 6% loan. The terms of the loan require

equal principal payments of $26,500 and accrued interest at 6% due annually on April 30. The loan agreement requires the

company to maintain a minimum current ratio of 2.0. The December 31, 2020, year-end statement of financial position, immediately

prior to the reclassification of long-term debt, follows:

Current assets

$137,800

Current liabilities

$53,000

Non-current assets

163,200

Loan payable

106,000

Common shares

72,000

Retained earnings

70,000

Total liabilities and

Total assets

$301,000

shareholders' equity

$301,000

Your answer is partially correct.

Does Christina Fashions comply with the bank's current ratio requirement prior to recording the accrued interest and

reclassification of the current portion of the long-term loan? (Round answer to 1 decimal place, e.g. 1.2.)

Current ratio

2.6

Christina Fashions

the bank's minimum current ratio.

meets

Transcribed Image Text:List of Accounts

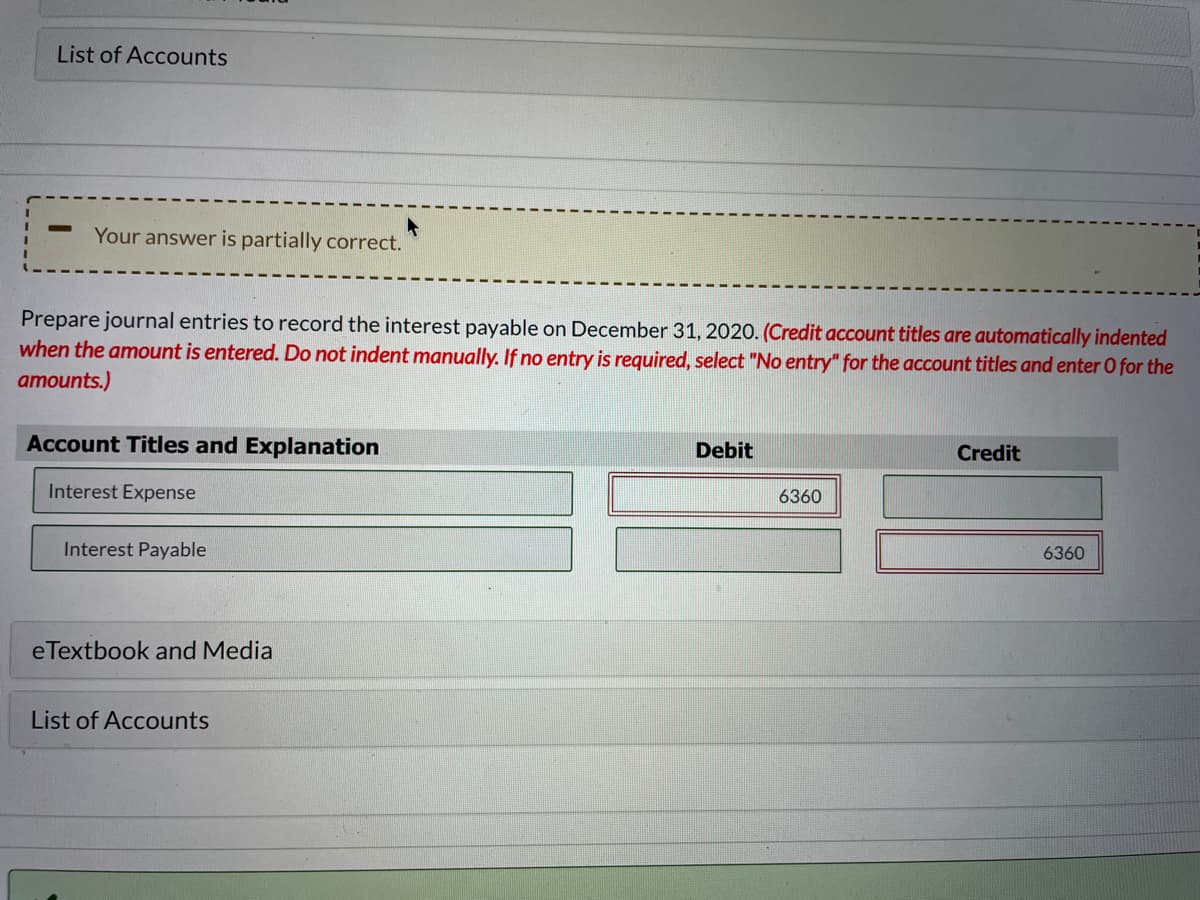

Your answer is partially correct.

Prepare journal entries to record the interest payable on December 31, 2020. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the

amounts.)

Account Titles and Explanation

Debit

Credit

Interest Expense

6360

Interest Payable

6360

eTextbook and Media

List of Accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College