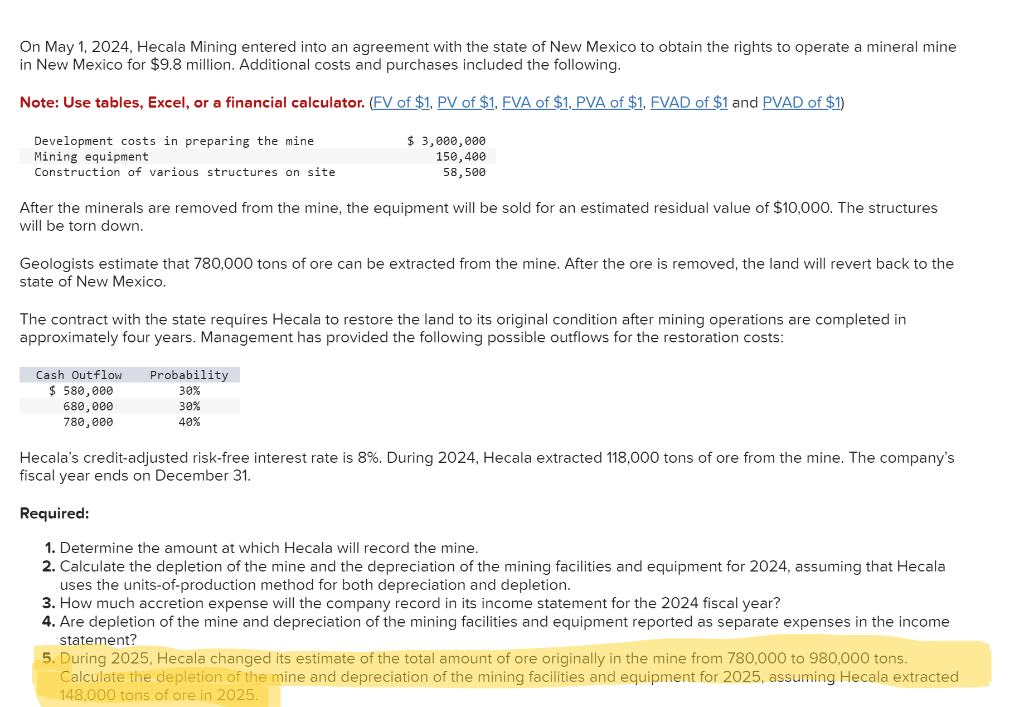

On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a mineral mine in New Mexico for $9.8 million. Additional costs and purchases included the following. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Development costs in preparing the mine Mining equipment Construction of various structures on site After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $10,000. The structures will be torn down. Geologists estimate that 780,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. $3,000,000 150,400 58,500 The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow $ 580,000 680,000 780,000 Probability 30% 30% 40% Hecala's credit-adjusted risk-free interest rate is 8%. During 2024, Hecala extracted 118,000 tons of ore from the mine. The company's fiscal year ends on December 31. Required: 1. Determine the amount at which Hecala will record the mine. 2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Hecala uses the units-of-production method for both depreciation and depletion. 3. How much accretion expense will the company record in its income statement for the 2024 fiscal year? 4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the income statement? 5. During 2025, Hecala changed its estimate of the total amount of ore originally in the mine from 780,000 to 980,000 tons. Calculate the depletion of the mine and depreciation of the mining facilities and equipment for 2025, assuming Hecala extracted 148,000 tons of ore in 2025.

On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a mineral mine in New Mexico for $9.8 million. Additional costs and purchases included the following. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Development costs in preparing the mine Mining equipment Construction of various structures on site After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $10,000. The structures will be torn down. Geologists estimate that 780,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. $3,000,000 150,400 58,500 The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow $ 580,000 680,000 780,000 Probability 30% 30% 40% Hecala's credit-adjusted risk-free interest rate is 8%. During 2024, Hecala extracted 118,000 tons of ore from the mine. The company's fiscal year ends on December 31. Required: 1. Determine the amount at which Hecala will record the mine. 2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Hecala uses the units-of-production method for both depreciation and depletion. 3. How much accretion expense will the company record in its income statement for the 2024 fiscal year? 4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the income statement? 5. During 2025, Hecala changed its estimate of the total amount of ore originally in the mine from 780,000 to 980,000 tons. Calculate the depletion of the mine and depreciation of the mining facilities and equipment for 2025, assuming Hecala extracted 148,000 tons of ore in 2025.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 47P

Related questions

Question

Please do only required 5

Transcribed Image Text:On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a mineral mine

in New Mexico for $9.8 million. Additional costs and purchases included the following.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Development costs in preparing the mine

Mining equipment

Construction of various structures on site

After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $10,000. The structures

will be torn down.

Geologists estimate that 780,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the

state of New Mexico.

$3,000,000

150,400

58,500

The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in

approximately four years. Management has provided the following possible outflows for the restoration costs:

Cash Outflow

$ 580,000

680,000

780,000

Probability

30%

30%

40%

Hecala's credit-adjusted risk-free interest rate is 8%. During 2024, Hecala extracted 118,000 tons of ore from the mine. The company's

fiscal year ends on December 31.

Required:

1. Determine the amount at which Hecala will record the mine.

2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Hecala

uses the units-of-production method for both depreciation and depletion.

3. How much accretion expense will the company record in its income statement for the 2024 fiscal year?

4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the income

statement?

5. During 2025, Hecala changed its estimate of the total amount of ore originally in the mine from 780,000 to 980,000 tons.

Calculate the depletion of the mine and depreciation of the mining facilities and equipment for 2025, assuming Hecala extracted

148,000 tons of ore in 2025.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT