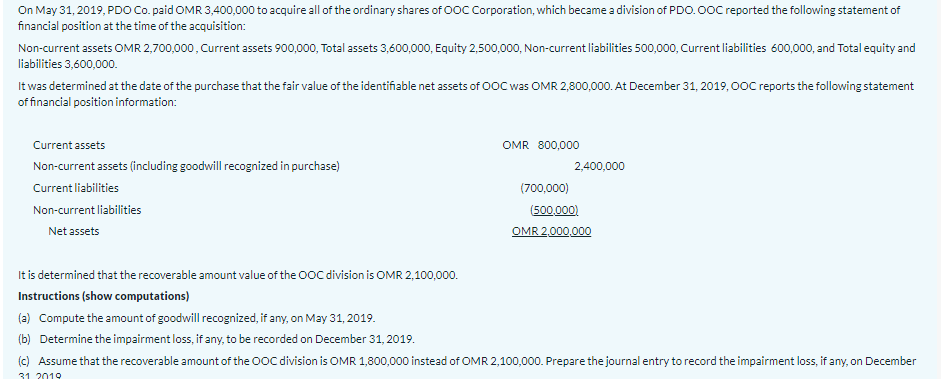

On May 31, 2019, PDO Co. paid OMR 3,400,000 to acquire all of the ordinary shares of 0OC Corporation, which became a division of PDO. 0OC reported the following statement of financial position at the time of the acquisition: Non-current assets OMR 2,700,000, Current assets 900,000, Total assets 3,600,000, Equity 2,500,000, Non-current liabilities 500,000, Current liabilities 600,000, and Total equity and liabilities 3,600,000. It was determined at the date of the purchase that the fair value of the identifiable net assets of 0OC was OMR 2,800,000. At December 31, 2019, 00C reports the following statement of financial position information: Current assets OMR 800,000 Non-current assets (including goodwill recognized in purchase) 2,400,000 Curent liabilities (700,000) Non-current liabilities (500,000) OMR 2,000,000 Net assets It is determined that the recoverable amount value of the 0OC division is OMR 2,100,000. Instructions (show computations) (a) Compute the amount of goodwill recognized, if any, on May 31, 2019. (b) Determine the impairment loss, if any, to be recorded on December 31, 2019. (c) Assume that the recoverable amount of the 0OC division is OMR 1,800,000 instead of OMR 2,100,000. Prepare the journal entry to record the impairment loss, if any, on December

On May 31, 2019, PDO Co. paid OMR 3,400,000 to acquire all of the ordinary shares of 0OC Corporation, which became a division of PDO. 0OC reported the following statement of financial position at the time of the acquisition: Non-current assets OMR 2,700,000, Current assets 900,000, Total assets 3,600,000, Equity 2,500,000, Non-current liabilities 500,000, Current liabilities 600,000, and Total equity and liabilities 3,600,000. It was determined at the date of the purchase that the fair value of the identifiable net assets of 0OC was OMR 2,800,000. At December 31, 2019, 00C reports the following statement of financial position information: Current assets OMR 800,000 Non-current assets (including goodwill recognized in purchase) 2,400,000 Curent liabilities (700,000) Non-current liabilities (500,000) OMR 2,000,000 Net assets It is determined that the recoverable amount value of the 0OC division is OMR 2,100,000. Instructions (show computations) (a) Compute the amount of goodwill recognized, if any, on May 31, 2019. (b) Determine the impairment loss, if any, to be recorded on December 31, 2019. (c) Assume that the recoverable amount of the 0OC division is OMR 1,800,000 instead of OMR 2,100,000. Prepare the journal entry to record the impairment loss, if any, on December

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 26E

Related questions

Question

answer step by step

Transcribed Image Text:On May 31, 2019, PDO Co. paid OMR 3,400,000 to acquire all of the ordinary shares of 0OC Corporation, which became a division of PDO. 0OC reported the following statement of

financial position at the time of the acquisition:

Non-current assets OMR 2,700,000, Current assets 900,000, Total assets 3,600,000, Equity 2,500,000, Non-current liabilities 500,000, Current liabilities 600,000, and Total equity and

liabilities 3,600,000.

It was determined at the date of the purchase that the fair value of the identifiable net assets of 0OC was OMR 2,800,000. At December 31, 2019,00C reports the following statement

of financial position information:

Current assets

OMR 800,000

Non-current assets (including goodwill recognized in purchase)

2,400,000

Current liabilities

(700,000)

Non-current liabilities

(500,000)

OMR 2,000,000

Net assets

It is determined that the recoverable amount value of the OOC division is OMR 2,100,000.

Instructions (show computations)

(2) Compute the amount of goodwill recognized, if any, on May 31, 2019.

(b) Determine the impairment loss, if any, to be recorded on December 31, 2019.

(c) Assume that the recoverable amount of the 0OC division is OMR 1,800,000 instead of OMR 2,100,000. Prepare the journal entry to record the impairment loss, if any, on December

31 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning