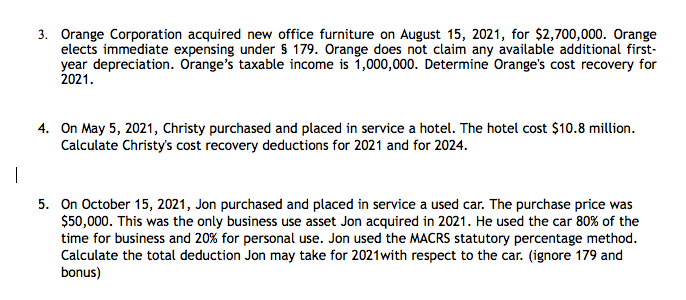

3. Orange Corporation acquired new office furniture on August 15, 2021, for $2,700,000. Orange elects immediate expensing under $ 179. Orange does not claim any available additional first- year depreciation. Orange's taxable income is 1,000,000. Determine Orange's cost recovery for 2021. 4. On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million. Calculate Christy's cost recovery deductions for 2021 and for 2024. 5. On October 15, 2021, Jon purchased and placed in service a used car. The purchase price was $50,000. This was the only business use asset Jon acquired in 2021. He used the car 80% of the time for business and 20% for personal use. Jon used the MACRS statutory percentage method. Calculate the total deduction Jon may take for 2021with respect to the car. (ignore 179 and bonus)

3. Orange Corporation acquired new office furniture on August 15, 2021, for $2,700,000. Orange elects immediate expensing under $ 179. Orange does not claim any available additional first- year depreciation. Orange's taxable income is 1,000,000. Determine Orange's cost recovery for 2021. 4. On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million. Calculate Christy's cost recovery deductions for 2021 and for 2024. 5. On October 15, 2021, Jon purchased and placed in service a used car. The purchase price was $50,000. This was the only business use asset Jon acquired in 2021. He used the car 80% of the time for business and 20% for personal use. Jon used the MACRS statutory percentage method. Calculate the total deduction Jon may take for 2021with respect to the car. (ignore 179 and bonus)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:3. Orange Corporation acquired new office furniture on August 15, 2021, for $2,700,000. Orange

elects immediate expensing under $ 179. Orange does not claim any available additional first-

year depreciation. Orange's taxable income is 1,000,000. Determine Orange's cost recovery for

2021.

4. On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million.

Calculate Christy's cost recovery deductions for 2021 and for 2024.

|

5. On October 15, 2021, Jon purchased and placed in service a used car. The purchase price was

$50,000. This was the only business use asset Jon acquired in 2021. He used the car 80% of the

time for business and 20% for personal use. Jon used the MACRS statutory percentage method.

Calculate the total deduction Jon may take for 2021with respect to the car. (ignore 179 and

bonus)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million. Calculate Christy's cost recovery deductions for 2021 and for 2024.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT