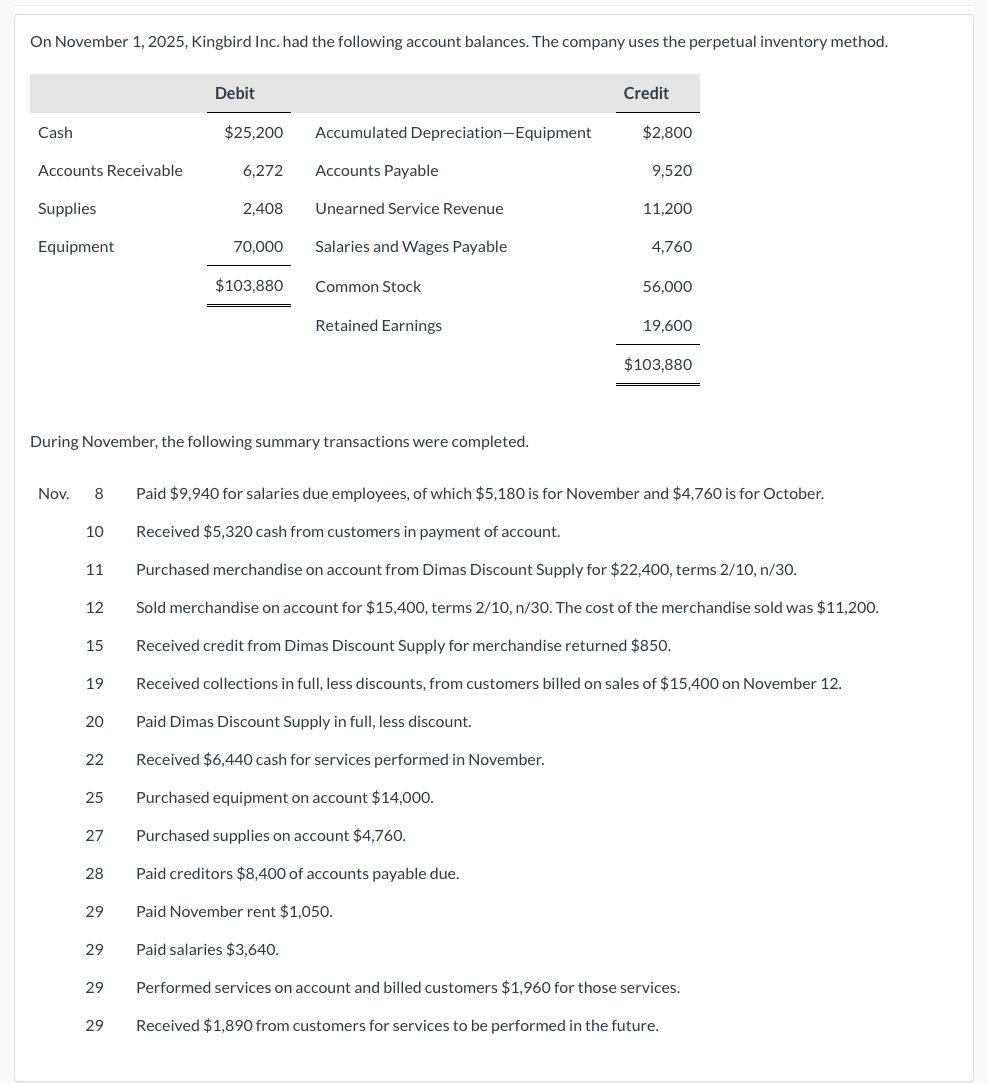

On November 1, 2025, Kingbird Inc. had the following account balances. The company uses the perpetual inventory method. Cash Accounts Receivable Supplies Equipment 10 11 12 15 19 20 22 During November, the following summary transactions were completed. 25 27 28 29 29 Debit 29 $25,200 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue 29 6,272 2,408 70,000 Nov. 8 Paid $9,940 for salaries due employees, of which $5,180 is for November and $4,760 is for October. Received $5,320 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $22,400, terms 2/10, n/30. Sold merchandise on account for $15,400, terms 2/10, n/30. The cost of the merchandise sold was $11,200. Received credit from Dimas Discount Supply for merchandise returned $850. Received collections in full, less discounts, from customers billed on sales of $15,400 on November 12. Paid Dimas Discount Supply in full, less discount. Received $6,440 cash for services performed in November. Purchased equipment on account $14,000. Purchased supplies on account $4,760. Paid creditors $8,4 of Paid November rent $1,050. Paid salaries $3,640. $103,880 Salaries and Wages Payable Common Stock Retained Earnings Credit payable due. $2,800 9,520 11,200 4,760 56,000 19,600 $103,880 Performed services on account and billed customers $1,960 for those services. Received $1,890 from customers for services to be performed in the future.

On November 1, 2025, Kingbird Inc. had the following account balances. The company uses the perpetual inventory method. Cash Accounts Receivable Supplies Equipment 10 11 12 15 19 20 22 During November, the following summary transactions were completed. 25 27 28 29 29 Debit 29 $25,200 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue 29 6,272 2,408 70,000 Nov. 8 Paid $9,940 for salaries due employees, of which $5,180 is for November and $4,760 is for October. Received $5,320 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $22,400, terms 2/10, n/30. Sold merchandise on account for $15,400, terms 2/10, n/30. The cost of the merchandise sold was $11,200. Received credit from Dimas Discount Supply for merchandise returned $850. Received collections in full, less discounts, from customers billed on sales of $15,400 on November 12. Paid Dimas Discount Supply in full, less discount. Received $6,440 cash for services performed in November. Purchased equipment on account $14,000. Purchased supplies on account $4,760. Paid creditors $8,4 of Paid November rent $1,050. Paid salaries $3,640. $103,880 Salaries and Wages Payable Common Stock Retained Earnings Credit payable due. $2,800 9,520 11,200 4,760 56,000 19,600 $103,880 Performed services on account and billed customers $1,960 for those services. Received $1,890 from customers for services to be performed in the future.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Topic Video

Question

Aditstment data:

Supplies on hand are valued at $4.480.

Accrued salaries payable are $1.400.

$1,820 of services related to the unearned service revenue has not been performed by month-end.

Transcribed Image Text:On November 1, 2025, Kingbird Inc. had the following account balances. The company uses the perpetual inventory method.

Cash

Accounts Receivable

Supplies

Equipment

10

11

12

15

19

20

22

During November, the following summary transactions were completed.

25

27

28

29

29

Debit

29

$25,200 Accumulated Depreciation-Equipment

Accounts Payable

Unearned Service Revenue

29

6,272

2,408

70,000

Nov. 8 Paid $9,940 for salaries due employees, of which $5,180 is for November and $4,760 is for October.

Received $5,320 cash from customers in payment of account.

Purchased merchandise on account from Dimas Discount Supply for $22,400, terms 2/10, n/30.

Sold merchandise on account for $15,400, terms 2/10, n/30. The cost of the merchandise sold was $11,200.

Received credit from Dimas Discount Supply for merchandise returned $850.

Received collections in full, less discounts, from customers billed on sales of $15,400 on November 12.

Paid Dimas Discount Supply in full, less discount.

Received $6,440 cash for services performed in November.

Purchased equipment on account $14,000.

Purchased supplies on account $4,760.

Paid creditors $8,4 of

Paid November rent $1,050.

Paid salaries $3,640.

$103,880

Salaries and Wages Payable

Common Stock

Retained Earnings

Credit

payable due.

$2,800

9,520

11,200

4,760

56,000

19,600

$103,880

Performed services on account and billed customers $1,960 for those services.

Received $1,890 from customers for services to be performed in the future.

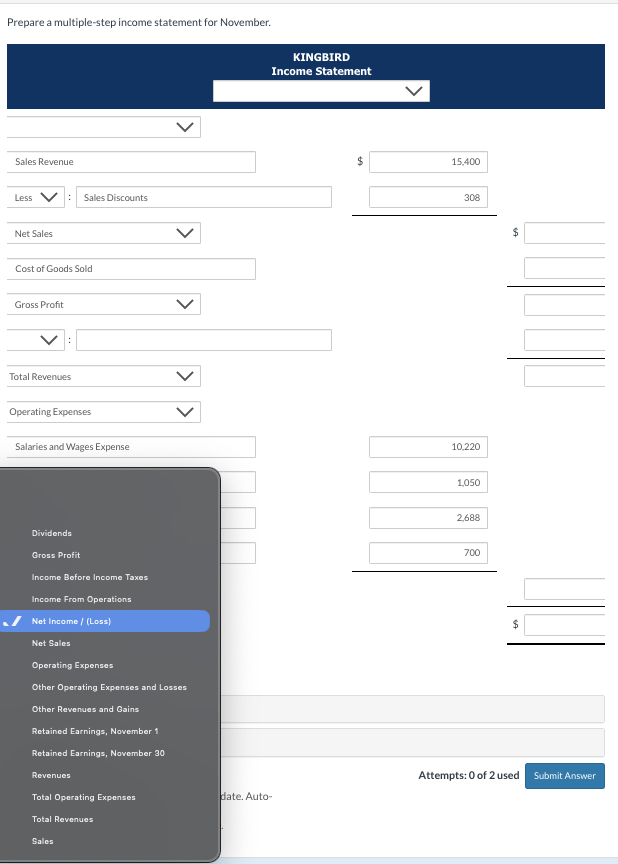

Transcribed Image Text:Prepare a multiple-step income statement for November.

Sales Revenue

Less

Net Sales

Cost of Goods Sold

Gross Profit

: Sales Discounts

:

Total Revenues

Operating Expenses

Salaries and Wages Expense

Dividends

Gross Profit

Income Before Income Taxes

Income From Operations

Net Income / (Loss)

Net Sales

Operating Expenses

Other Operating Expenses and Losses

Other Revenues and Gains

Retained Earnings, November 1

Retained Earnings, November 30

Revenues

Total Operating Expenses

Sales

Total Revenues

KINGBIRD

Income Statement

date. Auto-

$

15,400

308

10,220

1,050

2,688

700

$

$

Attempts: 0 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning