On Oct. 31, 2021, Dark Co's cash balance per records is P7,450, while the balance per bank statement is P8,510. The following information is determined:

On Oct. 31, 2021, Dark Co's cash balance per records is P7,450, while the balance per bank statement is P8,510. The following information is determined:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 18P

Related questions

Question

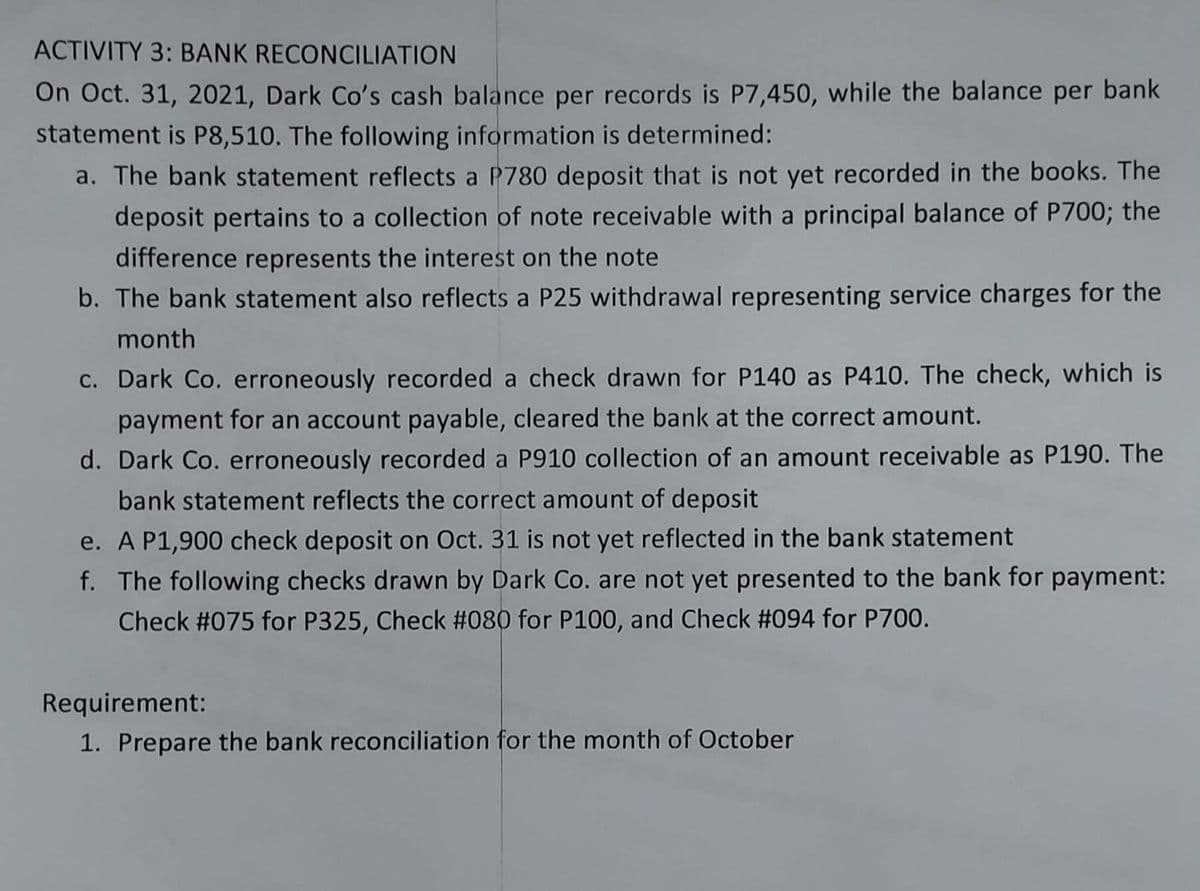

Transcribed Image Text:ACTIVITY 3: BANK RECONCILIATION

On Oct. 31, 2021, Dark Co's cash balance per records is P7,450, while the balance per bank

statement is P8,510. The following information is determined:

a. The bank statement reflects a P780 deposit that is not yet recorded in the books. The

deposit pertains to a collection of note receivable with a principal balance of P700; the

difference represents the interest on the note

b. The bank statement also reflects a P25 withdrawal representing service charges for the

month

c. Dark Co. erroneously recorded a check drawn for P140 as P410. The check, which is

payment for an account payable, cleared the bank at the correct amount.

d. Dark Co. erroneously recorded a P910 collection of an amount receivable as P190. The

bank statement reflects the correct amount of deposit

e. A P1,900 check deposit on Oct. 31 is not yet reflected in the bank statement

f. The following checks drawn by Dark Co. are not yet presented to the bank for payment:

Check #075 for P325, Check #080 for P100, and Check #094 for P700.

Requirement:

1. Prepare the bank reconciliation for the month of October

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning