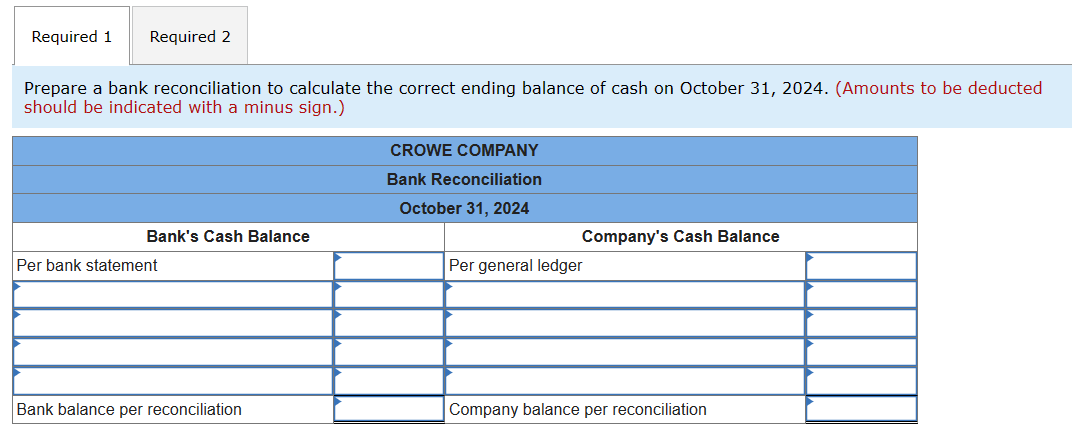

On October 31, 2024, Crowe Company’s general ledger shows a cash account balance of $8,409. The company’s cash receipts for the month total $74,400, of which $71,315 has been deposited in the bank. In addition, the company has written checks for $72,479, of which $71,054 has been processed by the bank. The bank statement reveals an ending balance of $12,019 and includes the following items not yet recorded by Crowe: bank service fees of $190, note receivable collected by the bank of $5,400, and interest earned on the note of $520. After closer inspection, Crowe realizes that the bank incorrectly charged the company’s account $460 for an automatic withdrawal that should have been charged to another customer’s account. The bank agrees to the error. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on October 31, 2024. 2. Record the necessary entries to adjust the balance for cash.

On October 31, 2024, Crowe Company’s general ledger shows a cash account balance of $8,409. The company’s cash receipts for the month total $74,400, of which $71,315 has been deposited in the bank. In addition, the company has written checks for $72,479, of which $71,054 has been processed by the bank.

The bank statement reveals an ending balance of $12,019 and includes the following items not yet recorded by Crowe: bank service fees of $190, note receivable collected by the bank of $5,400, and interest earned on the note of $520. After closer inspection, Crowe realizes that the bank incorrectly charged the company’s account $460 for an automatic withdrawal that should have been charged to another customer’s account. The bank agrees to the error.

Required:

1. Prepare a bank reconciliation to calculate the correct ending balance of cash on October 31, 2024.

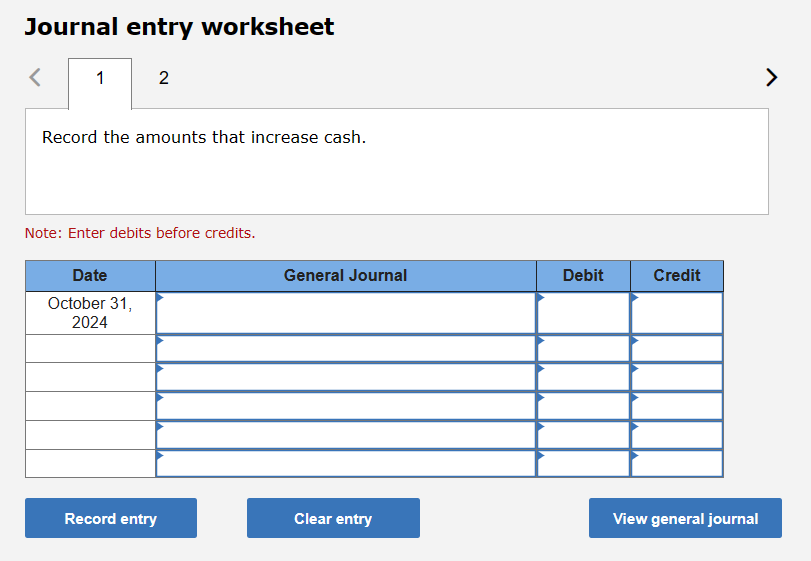

2. Record the necessary entries to adjust the balance for cash.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps