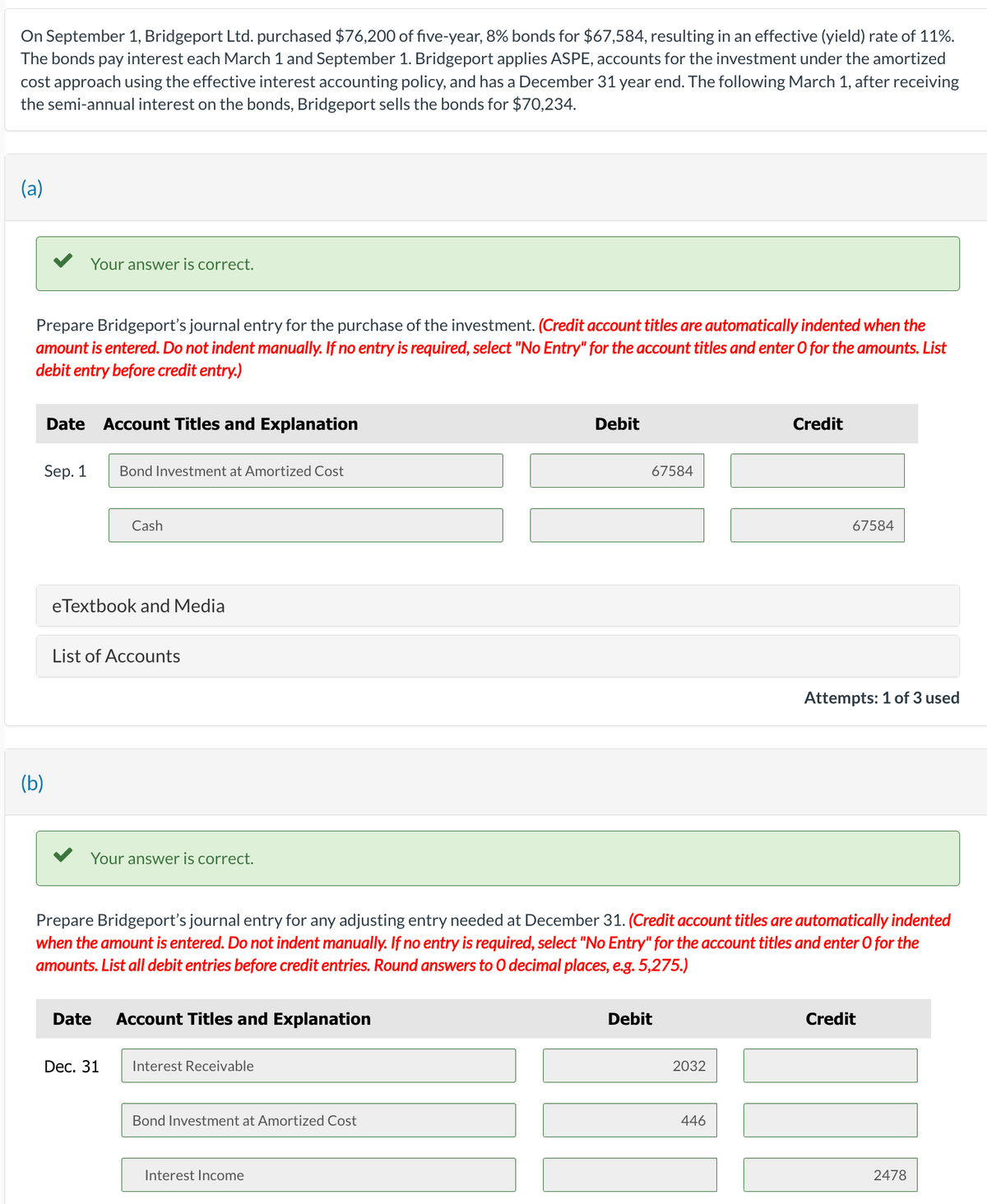

On September 1, Bridgeport Ltd. purchased $76,200 of five-year, 8% bonds for $67,584, resulting in an effective (yield) rate of 11%. The bonds pay interest each March 1 and September 1. Bridgeport applies ASPE, accounts for the investment under the amortized cost approach using the effective interest accounting policy, and has a December 31 year end. The following March 1, after receiving the semi-annual interest on the bonds, Bridgeport sells the bonds for $70,234.

On September 1, Bridgeport Ltd. purchased $76,200 of five-year, 8% bonds for $67,584, resulting in an effective (yield) rate of 11%. The bonds pay interest each March 1 and September 1. Bridgeport applies ASPE, accounts for the investment under the amortized cost approach using the effective interest accounting policy, and has a December 31 year end. The following March 1, after receiving the semi-annual interest on the bonds, Bridgeport sells the bonds for $70,234.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 13M

Related questions

Question

7, please answer part d thanks

Transcribed Image Text:On September 1, Bridgeport Ltd. purchased $76,200 of five-year, 8% bonds for $67,584, resulting in an effective (yield) rate of 11%.

The bonds pay interest each March 1 and September 1. Bridgeport applies ASPE, accounts for the investment under the amortized

cost approach using the effective interest accounting policy, and has a December 31 year end. The following March 1, after receiving

the semi-annual interest on the bonds, Bridgeport sells the bonds for $70,234.

(a)

Prepare Bridgeport's journal entry for the purchase of the investment. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List

debit entry before credit entry.)

Your answer is correct.

Sep. 1

(b)

Date Account Titles and Explanation

Bond Investment at Amortized Cost

eTextbook and Media

Cash

List of Accounts

Your answer is correct.

Date

Dec. 31

Account Titles and Explanation

Interest Receivable

Prepare Bridgeport's journal entry for any adjusting entry needed at December 31. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275.)

Bond Investment at Amortized Cost

Debit

Interest Income

67584

Debit

2032

Credit

446

67584

Attempts: 1 of 3 used

Credit

2478

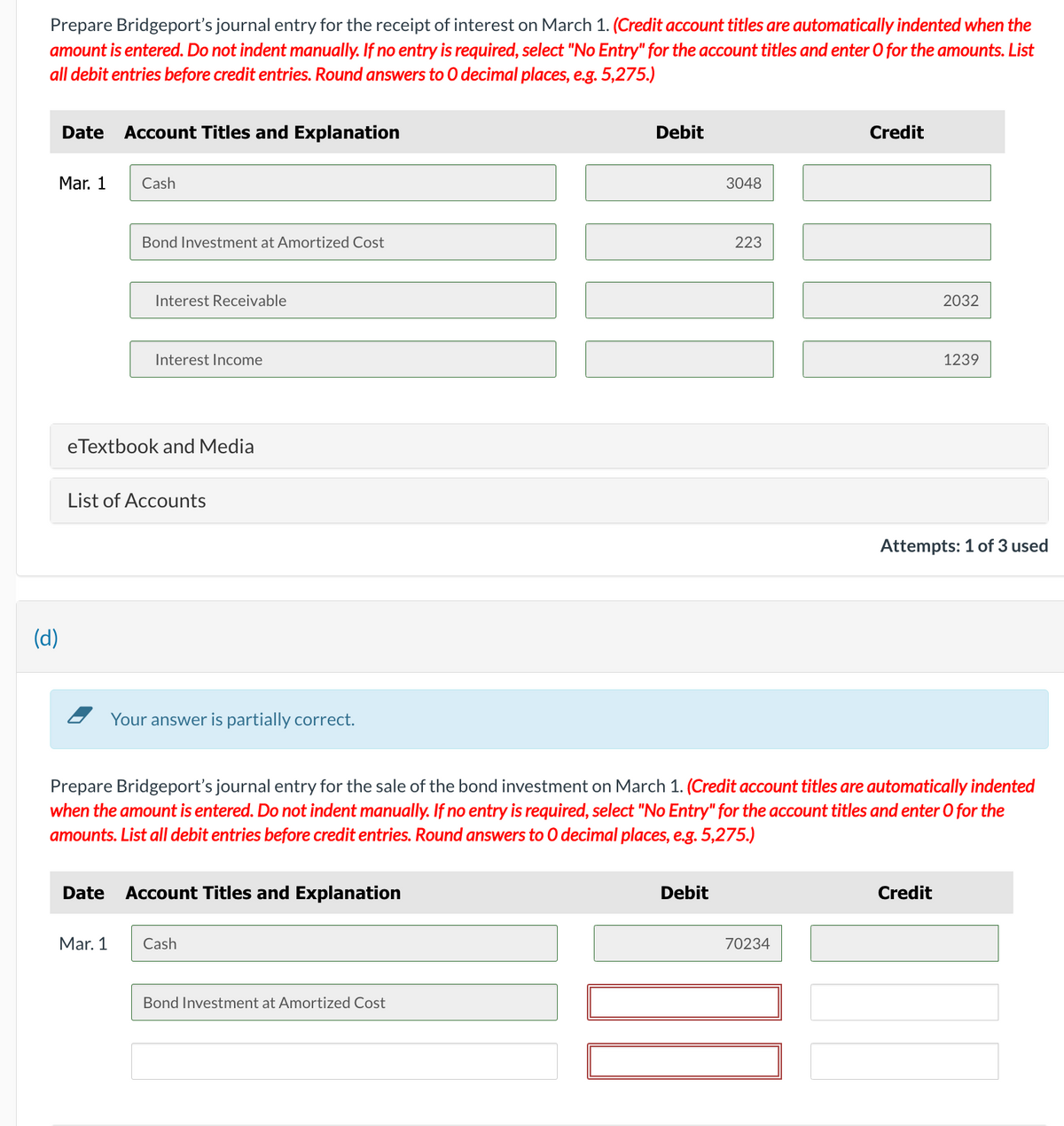

Transcribed Image Text:Prepare Bridgeport's journal entry for the receipt of interest on March 1. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List

all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275.)

(d)

Date Account Titles and Explanation

Mar. 1

Cash

Bond Investment at Amortized Cost

Date

Interest Receivable

eTextbook and Media

Mar. 1

Interest Income

List of Accounts

Your answer is partially correct.

Account Titles and Explanation

Cash

Debit

Bond Investment at Amortized Cost

3048

Prepare Bridgeport's journal entry for the sale of the bond investment on March 1. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275.)

Debit

223

Credit

70234

2032

1239

Attempts: 1 of 3 used

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning