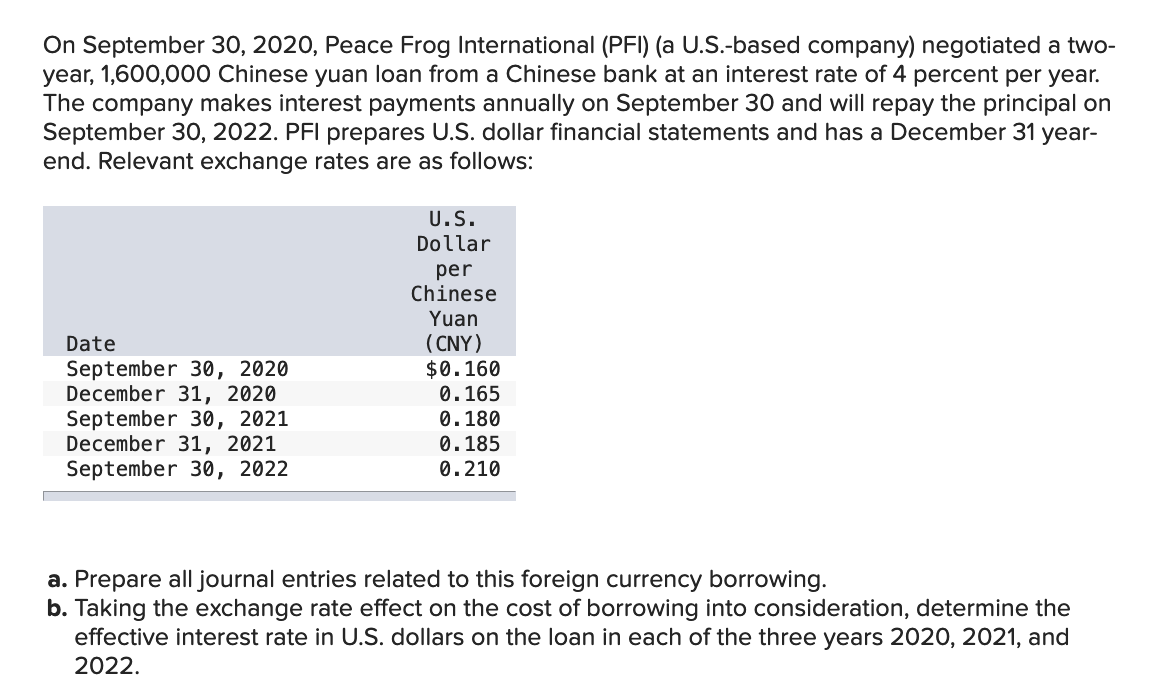

On September 30, 2020, Peace Frog International (PFI) (a U.S.-based company) negotiated a two- year, 1,600,000 Chinese yuan loan from a Chinese bank at an interest rate of 4 percent per year. The company makes interest payments annually on September 30 and will repay the principal on September 3O, 2022. PFI prepares U.S. dollar financial statements and has a December 31 year- end. Relevant exchange rates are as follows: U.S. Dollar per Chinese Yuan ( CNY) $0.160 0.165 Date September 30, 2020 December 31, 2020 September 30, 2021 December 31, 2021 September 30, 2022 0.180 0.185 0.210 a. Prepare all journal entries related to this foreign currency borrowing. b. Taking the exchange rate effect on the cost of borrowing into consideration, determine the effective interest rate in U.S. dollars on the loan in each of the three years 2020, 2021, and

On September 30, 2020, Peace Frog International (PFI) (a U.S.-based company) negotiated a two- year, 1,600,000 Chinese yuan loan from a Chinese bank at an interest rate of 4 percent per year. The company makes interest payments annually on September 30 and will repay the principal on September 3O, 2022. PFI prepares U.S. dollar financial statements and has a December 31 year- end. Relevant exchange rates are as follows: U.S. Dollar per Chinese Yuan ( CNY) $0.160 0.165 Date September 30, 2020 December 31, 2020 September 30, 2021 December 31, 2021 September 30, 2022 0.180 0.185 0.210 a. Prepare all journal entries related to this foreign currency borrowing. b. Taking the exchange rate effect on the cost of borrowing into consideration, determine the effective interest rate in U.S. dollars on the loan in each of the three years 2020, 2021, and

Chapter21: Risk Management

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:On September 30, 2020, Peace Frog International (PFI) (a U.S.-based company) negotiated a two-

year, 1,600,000 Chinese yuan loan from a Chinese bank at an interest rate of 4 percent per year.

The company makes interest payments annually on September 30 and will repay the principal on

September 30, 2022. PFI prepares U.S. dollar financial statements and has a December 31 year-

end. Relevant exchange rates are as follows:

U.S.

Dollar

per

Chinese

Yuan

( CNY)

$0.160

Date

September 30, 2020

December 31, 2020

September 30, 2021

December 31, 2021

September 30, 2022

0.165

0.180

0.185

0.210

a. Prepare all journal entries related to this foreign currency borrowing.

b. Taking the exchange rate effect on the cost of borrowing into consideration, determine the

effective interest rate in U.S. dollars on the loan in each of the three years 2020, 2021, and

2022.

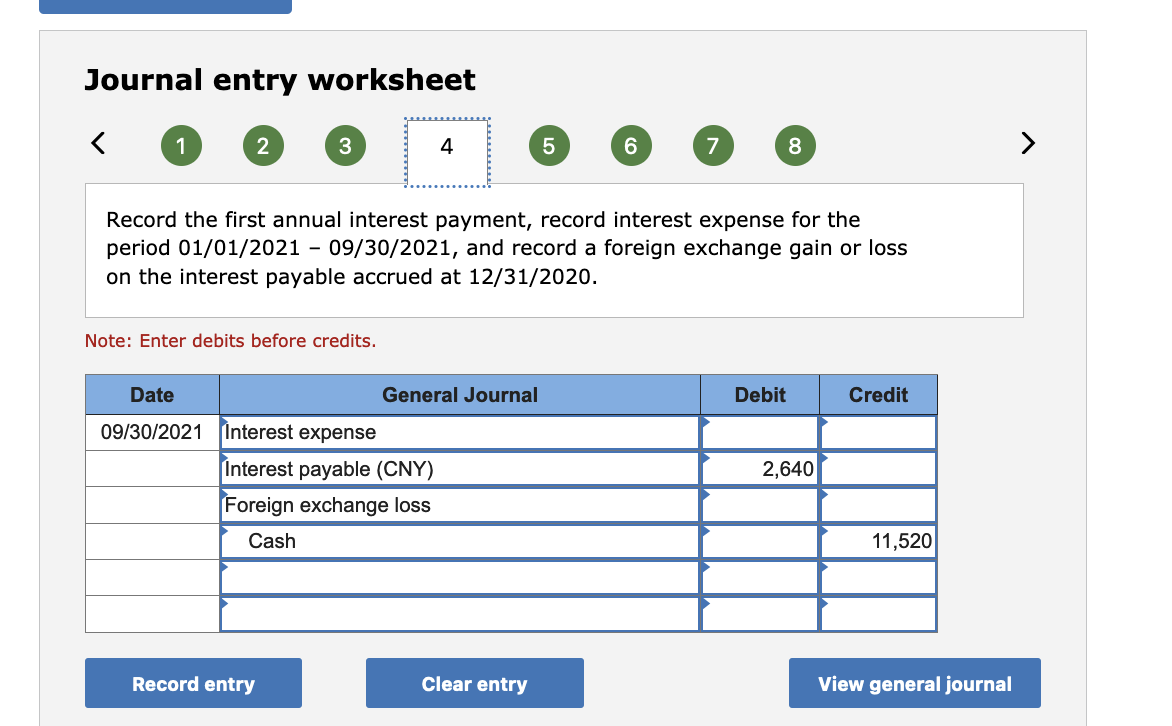

Transcribed Image Text:Journal entry worksheet

1

3

4

7

8

Record the first annual interest payment, record interest expense for the

period 01/01/2021 - 09/30/2021, and record a foreign exchange gain or loss

on the interest payable accrued at 12/31/2020.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

09/30/2021 Interest expense

Interest payable (CNY)

2,640

Foreign exchange loss

Cash

11,520

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT