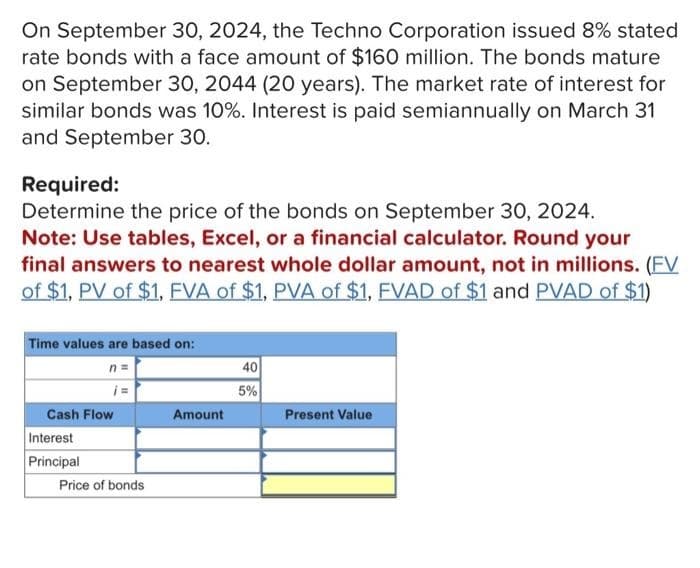

On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $160 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31 and September 30. Required: Determine the price of the bonds on September 30, 2024. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount, not in millions. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Time values are based on: 40 ¡= 5% Cash Flow Amount Present Value Interest Principal Price of bonds

On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $160 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31 and September 30. Required: Determine the price of the bonds on September 30, 2024. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount, not in millions. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Time values are based on: 40 ¡= 5% Cash Flow Amount Present Value Interest Principal Price of bonds

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1RE

Related questions

Question

Tushar

Ad explanation

Transcribed Image Text:On September 30, 2024, the Techno Corporation issued 8% stated

rate bonds with a face amount of $160 million. The bonds mature

on September 30, 2044 (20 years). The market rate of interest for

similar bonds was 10%. Interest is paid semiannually on March 31

and September 30.

Required:

Determine the price of the bonds on September 30, 2024.

Note: Use tables, Excel, or a financial calculator. Round your

final answers to nearest whole dollar amount, not in millions. (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Time values are based on:

40

n =

i=

5%

Cash Flow

Amount

Present Value

Interest

Principal

Price of bonds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT