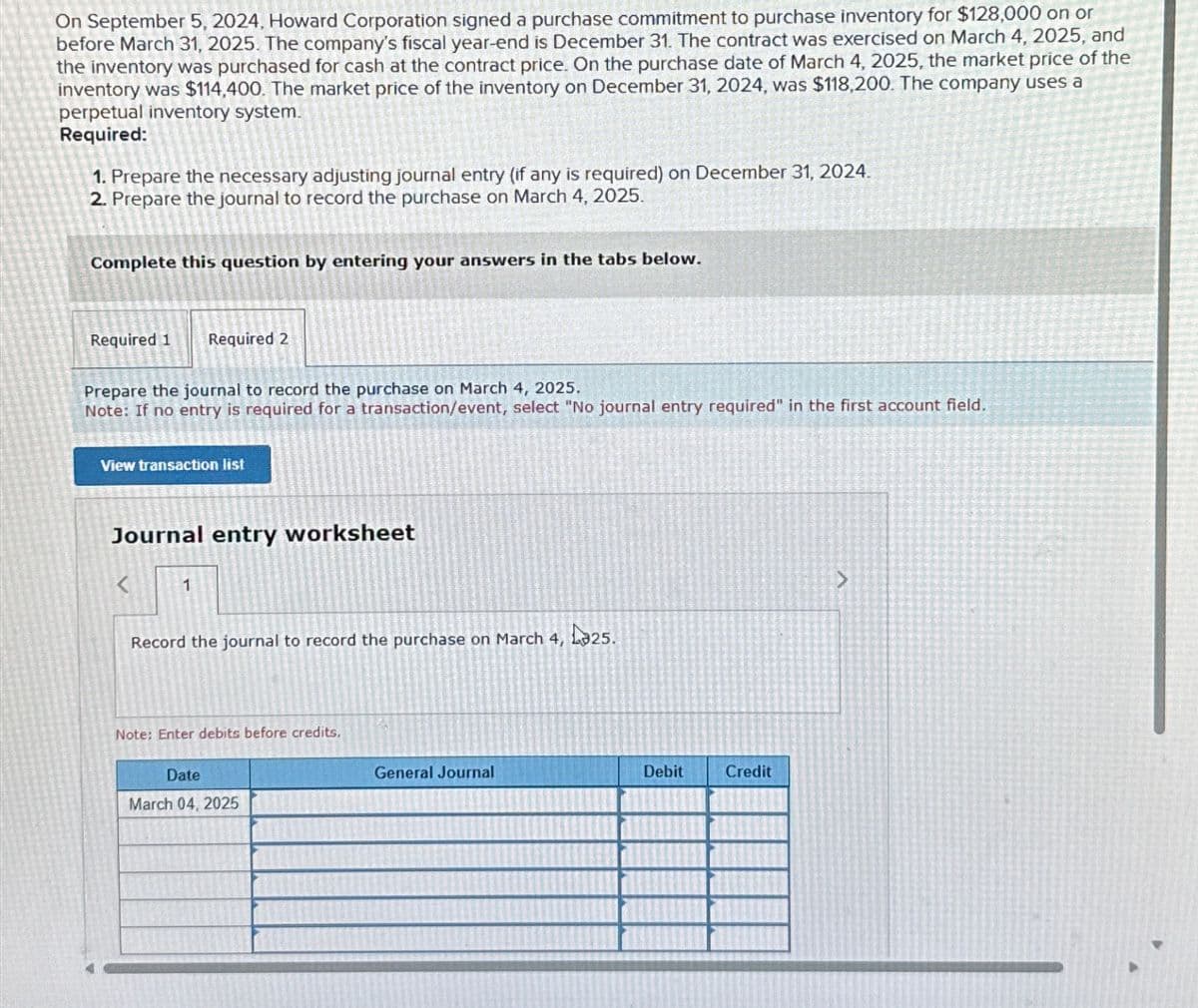

On September 5, 2024, Howard Corporation signed a purchase commitment to purchase inventory for $128,000 on or before March 31, 2025. The company's fiscal year-end is December 31. The contract was exercised on March 4, 2025, and the inventory was purchased for cash at the contract price. On the purchase date of March 4, 2025, the market price of the inventory was $114,400. The market price of the inventory on December 31, 2024, was $118,200. The company uses a perpetual inventory system. Required: 1. Prepare the necessary adjusting journal entry (if any is required) on December 31, 2024. 2. Prepare the journal to record the purchase on March 4, 2025. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal to record the purchase on March 4, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the journal to record the purchase on March 4, Note: Enter debits before credits. Date March 04, 2025 > Lǝ25. General Journal Debit Credit

On September 5, 2024, Howard Corporation signed a purchase commitment to purchase inventory for $128,000 on or before March 31, 2025. The company's fiscal year-end is December 31. The contract was exercised on March 4, 2025, and the inventory was purchased for cash at the contract price. On the purchase date of March 4, 2025, the market price of the inventory was $114,400. The market price of the inventory on December 31, 2024, was $118,200. The company uses a perpetual inventory system. Required: 1. Prepare the necessary adjusting journal entry (if any is required) on December 31, 2024. 2. Prepare the journal to record the purchase on March 4, 2025. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal to record the purchase on March 4, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the journal to record the purchase on March 4, Note: Enter debits before credits. Date March 04, 2025 > Lǝ25. General Journal Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 13RE: Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a...

Related questions

Question

Gadubhi

Transcribed Image Text:On September 5, 2024, Howard Corporation signed a purchase commitment to purchase inventory for $128,000 on or

before March 31, 2025. The company's fiscal year-end is December 31. The contract was exercised on March 4, 2025, and

the inventory was purchased for cash at the contract price. On the purchase date of March 4, 2025, the market price of the

inventory was $114,400. The market price of the inventory on December 31, 2024, was $118,200. The company uses a

perpetual inventory system.

Required:

1. Prepare the necessary adjusting journal entry (if any is required) on December 31, 2024.

2. Prepare the journal to record the purchase on March 4, 2025.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare the journal to record the purchase on March 4, 2025.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

<

1

Record the journal to record the purchase on March 4,

Note: Enter debits before credits.

Date

March 04, 2025

>

Lǝ25.

General Journal

Debit

Credit

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning