On the day his daughter was born, Engineer Ang deposited to a trust company a sufficient amount of money so that her daughter could receive eight annual payments of 50,000 pesos each for her college and masters degree tuition fees, starting with her 18TH birthday. Interest at the rate of 8% per annum was to be paid on all amounts on deposit. There was also a provision that the daughter could elect to withdraw no annual payments and receive a single lump amount on her 25th birthday. The daughter chose this option. a. How much did the daughter receive as the single payment? b. How much did the father deposit?

On the day his daughter was born, Engineer Ang deposited to a trust company a sufficient amount of money so that her daughter could receive eight annual payments of 50,000 pesos each for her college and masters degree tuition fees, starting with her 18TH birthday. Interest at the rate of 8% per annum was to be paid on all amounts on deposit. There was also a provision that the daughter could elect to withdraw no annual payments and receive a single lump amount on her 25th birthday. The daughter chose this option. a. How much did the daughter receive as the single payment? b. How much did the father deposit?

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 25DQ

Related questions

Question

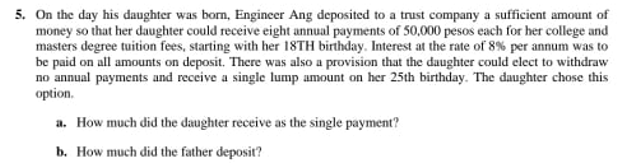

Transcribed Image Text:5. On the day his daughter was born, Engineer Ang deposited to a trust company a sufficient amount of

money so that her daughter could receive eight annual payments of 50,000 pesos each for her college and

masters degree tuition fees, starting with her 18TH birthday. Interest at the rate of 8% per annum was to

be paid on all amounts on deposit. There was also a provision that the daughter could elect to withdraw

no annual payments and receive a single lump amount on her 25th birthday. The daughter chose this

option.

a. How much did the daughter receive as the single payment?

b. How much did the father deposit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you