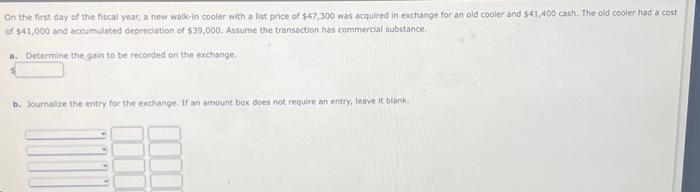

On the first day of the fiscal year, a new walk-in cooler with a list price of $47,300 was acquired in exchange for an old cooler and $41,400 cash. The old cooler had a cost of $41,000 and accumulated depreciation of $39,000. Assume the transaction has commercial substance. a. Determine the gain to be recorded on the exchange. b. Journalize the entry for the exchange. If an amount box does not require an entry, leave it blank.

On the first day of the fiscal year, a new walk-in cooler with a list price of $47,300 was acquired in exchange for an old cooler and $41,400 cash. The old cooler had a cost of $41,000 and accumulated depreciation of $39,000. Assume the transaction has commercial substance. a. Determine the gain to be recorded on the exchange. b. Journalize the entry for the exchange. If an amount box does not require an entry, leave it blank.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6MC: Ashton Company exchanged a nonmonetary asset with a cost of 30,000 and accumulated depreciation of...

Related questions

Question

Please don't provide answer in image format thank you

Transcribed Image Text:On the first day of the fiscal year, a new walk-in cooler with a list price of $47,300 was acquired in exchange for an old cooler and $41,400 cash. The old cooler had a cost

of $41,000 and accumulated depreciation of $39,000. Assume the transaction has commercial substance.

a. Determine the gain to be recorded on the exchange.

b. Journalize the entry for the exchange. If an amount box does not require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning