On the first day of the fiscal year, Alpha Corporation purchased a machine with a cost of $65,000. The machine, which will be installed in Alpha Corporation's operating plant has an estimated salvage value of $5,000 and an estimated life of 5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the units-of-production method. What is the amount of depreciation for the first full year? Question. Os21,667 OSa,000 Os20,000 Os12,000 On the first day of the fiscal vear. Alpha Corporation purchased a machine with a cost of $65.000. The machine, which will be installed in Alpha Corporation's operating plant has an estimated salvage value of $5.000 and an estimated life of 5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the double-declining balance method. What s the amount of depreciation for the first full year? Question. O ss2,000 Os26,000

On the first day of the fiscal year, Alpha Corporation purchased a machine with a cost of $65,000. The machine, which will be installed in Alpha Corporation's operating plant has an estimated salvage value of $5,000 and an estimated life of 5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the units-of-production method. What is the amount of depreciation for the first full year? Question. Os21,667 OSa,000 Os20,000 Os12,000 On the first day of the fiscal vear. Alpha Corporation purchased a machine with a cost of $65.000. The machine, which will be installed in Alpha Corporation's operating plant has an estimated salvage value of $5.000 and an estimated life of 5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the double-declining balance method. What s the amount of depreciation for the first full year? Question. O ss2,000 Os26,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

.

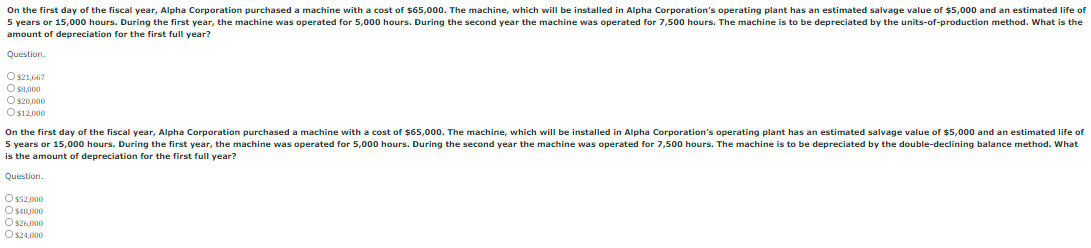

Transcribed Image Text:On the first day of the fiscal year, Alpha Corporation purchased a machine with a cost of 65,000. The machine, which will be installed in Alpha Corporation's operating plant has an estimated salvage value of $5,000 and an estimated life of

5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the units-of-production method. What is the

amount of depreciation for the first full year?

Question.

O s21,667

O S,000

O s20,000

Os12,000

On the first day of the fiscal year, Alpha Corporation purchased a machine with a cost of $65,000. The machine, which wilI be installed in Alpha Corporation's operating plant has an estimated salvage value of $5,000 and an estimated life of

5 years or 15,000 hours. During the first year, the machine was operated for 5,000 hours. During the second year the machine was operated for 7,500 hours. The machine is to be depreciated by the double-declining balance method. What

is the amount of depreciation for the first full year?

Question.

O ss2,000

O SI8,000

O s26,000

O s24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT