Once the age and service requirements are met, an employee must begin participating no later than the earlier of the following: - day of the first plan year beginning after the date on which the requirements were satisfied. • The months after the date on which the requirements were satisfied.

Once the age and service requirements are met, an employee must begin participating no later than the earlier of the following: - day of the first plan year beginning after the date on which the requirements were satisfied. • The months after the date on which the requirements were satisfied.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 14CE

Related questions

Question

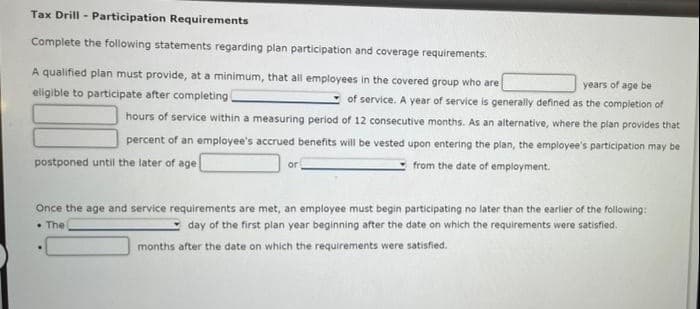

Transcribed Image Text:Tax Drill - Participation Requirements

Complete the following statements regarding plan participation and coverage requirements.

A qualified plan must provide, at a minimum, that all employees in the covered group who are

years of age be

of service. A year of service is generally defined as the completion of

hours of service within a measuring period of 12 consecutive months. As an alternative, where the plan provides that

eligible to participate after completing

percent of an employee's accrued benefits will be vested upon entering the plan, the employee's participation may be

postponed until the later of age

from the date of employment.

or

Once the age and service requirements are met, an employee must begin participating no later than the earlier of the following:

• The

day of the first plan year beginning after the date on which the requirements were satisfied.

months after the date on which the requirements were satisfied.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage