One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Foreign governments often have restrictions on the amount of cash that the subsidiary can repatriate to the parent company. Companies use different techniques to work around the restrictions. One such method is transfer pricing, which involves the subsidiary company obtaining raw materials from O The parent company at a high cost so that there is less profit left to repatriate. A local vendor at a very low cost so that there is more profit to repatriate. O The parent company at a very low cost so that there is more profit left to repatriate. Consider this case: LeBron Development Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project The project requires an investment of AU$800,000 today and is expected to generate cash flows of AU$1,000,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7823 per Australian dollar (AU$) The one-year forward exchange rate is $0.8102 / AU$, and the two-year forward exchange rate is $0.8412 / AU$. . The firm's weighted average cost of capital (WACC) is 10%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? (Note: Round your intermediate and final answers to the nearest cent.) $725,321 $805,912 O$846,208 $926,799

One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Foreign governments often have restrictions on the amount of cash that the subsidiary can repatriate to the parent company. Companies use different techniques to work around the restrictions. One such method is transfer pricing, which involves the subsidiary company obtaining raw materials from O The parent company at a high cost so that there is less profit left to repatriate. A local vendor at a very low cost so that there is more profit to repatriate. O The parent company at a very low cost so that there is more profit left to repatriate. Consider this case: LeBron Development Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project The project requires an investment of AU$800,000 today and is expected to generate cash flows of AU$1,000,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7823 per Australian dollar (AU$) The one-year forward exchange rate is $0.8102 / AU$, and the two-year forward exchange rate is $0.8412 / AU$. . The firm's weighted average cost of capital (WACC) is 10%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? (Note: Round your intermediate and final answers to the nearest cent.) $725,321 $805,912 O$846,208 $926,799

Chapter16: Country Risk Analysis

Section: Chapter Questions

Problem 5ST

Related questions

Question

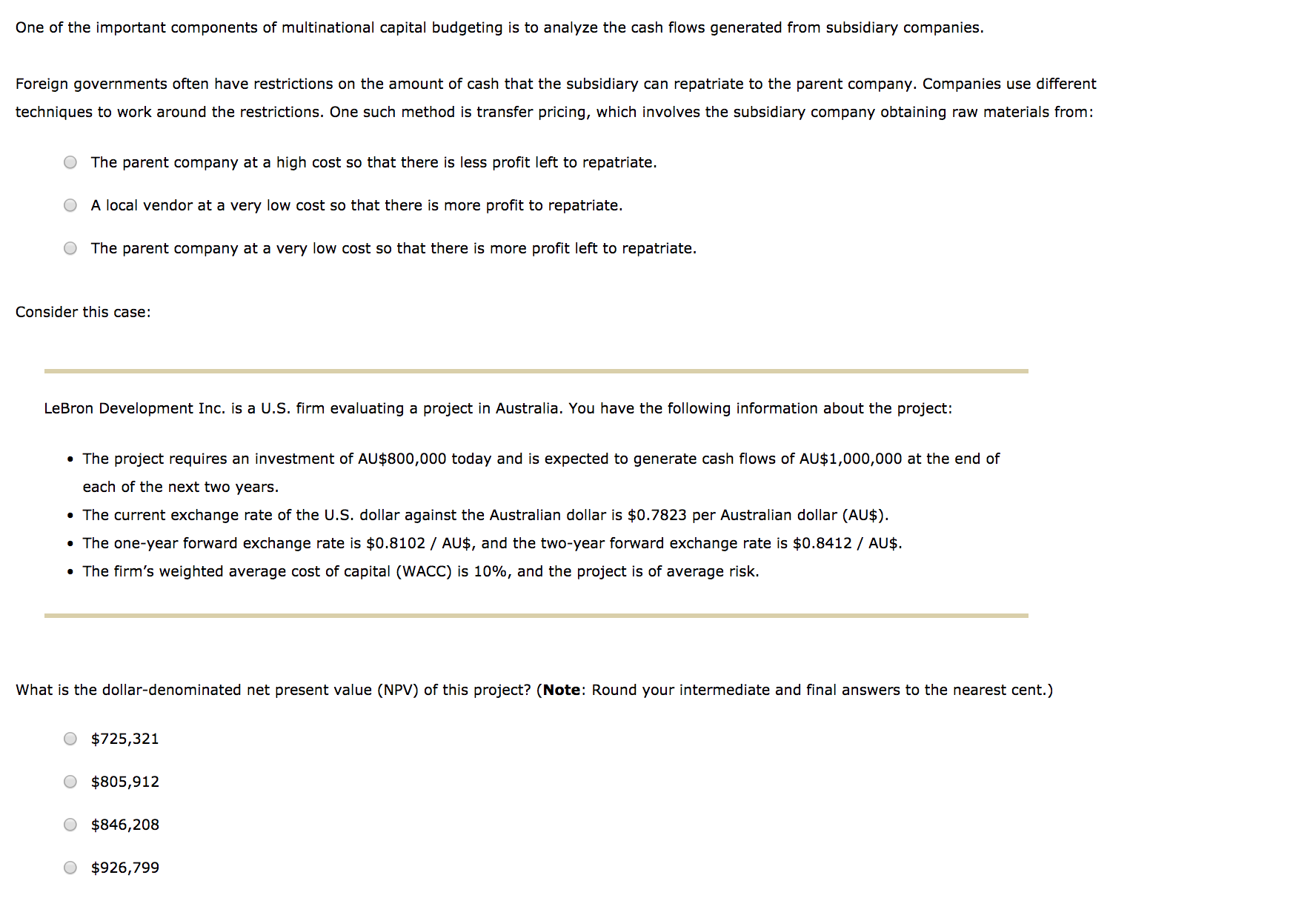

Transcribed Image Text:One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies.

Foreign governments often have restrictions on the amount of cash that the subsidiary can repatriate to the parent company. Companies use different

techniques to work around the restrictions. One such method is transfer pricing, which involves the subsidiary company obtaining raw materials from

O The parent company at a high cost so that there is less profit left to repatriate.

A local vendor at a very low cost so that there is more profit to repatriate.

O The parent company at a very low cost so that there is more profit left to repatriate.

Consider this case:

LeBron Development Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project

The project requires an investment of AU$800,000 today and is expected to generate cash flows of AU$1,000,000 at the end of

each of the next two years.

The current exchange rate of the U.S. dollar against the Australian dollar is $0.7823 per Australian dollar (AU$)

The one-year forward exchange rate is $0.8102 / AU$, and the two-year forward exchange rate is $0.8412 / AU$.

. The firm's weighted average cost of capital (WACC) is 10%, and the project is of average risk.

What is the dollar-denominated net present value (NPV) of this project? (Note: Round your intermediate and final answers to the nearest cent.)

$725,321

$805,912

O$846,208

$926,799

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning