Opie Industries is a manufacturer of plastic bottles. On September 1, 2014, Opie purchased an option contract at a cost of $2,000. The purpose of the option is to hedge against increases in the price of this type of plastic, "PET." The option is to buy 1,000,000 pounds of PET on March 1, 2015 for $.75 per pound. If the market price of PET is below $.75 on March 1, Opie will let the option expire. If the market price is above $.75, then Opie will exercise the option. The option is to be settled net. Opie assumes a 6% annual borrowing rate. Assume this is a cash flow hedge. Prepare the entry that Opie should record on September 1, 2014. Then, assuming that the price of PET is $.72 on December 31, 2014 (Opie's year-end), prepare the entry that Opie should record. Finally, prepare the entries for March 1, 2015, assuming that the price of PET is $.78

Opie Industries is a manufacturer of plastic bottles. On September 1, 2014, Opie purchased an option contract at a cost of $2,000. The purpose of the option is to hedge against increases in the price of this type of plastic, "PET." The option is to buy 1,000,000 pounds of PET on March 1, 2015 for $.75 per pound. If the market price of PET is below $.75 on March 1, Opie will let the option expire. If the market price is above $.75, then Opie will exercise the option. The option is to be settled net. Opie assumes a 6% annual borrowing rate. Assume this is a

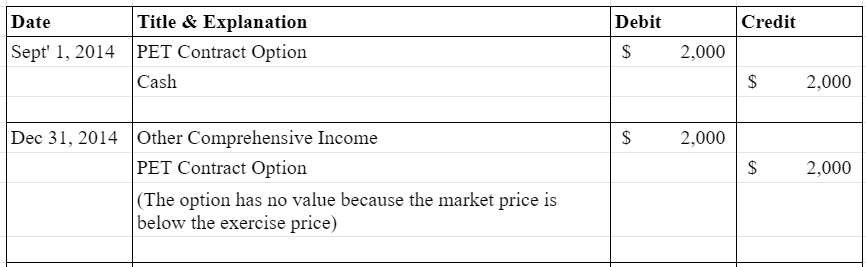

Prepare the entry that Opie should record on September 1, 2014. Then, assuming that the price of PET is $.72 on December 31, 2014 (Opie's year-end), prepare the entry that Opie should record. Finally, prepare the entries for March 1, 2015, assuming that the price of PET is $.78

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images