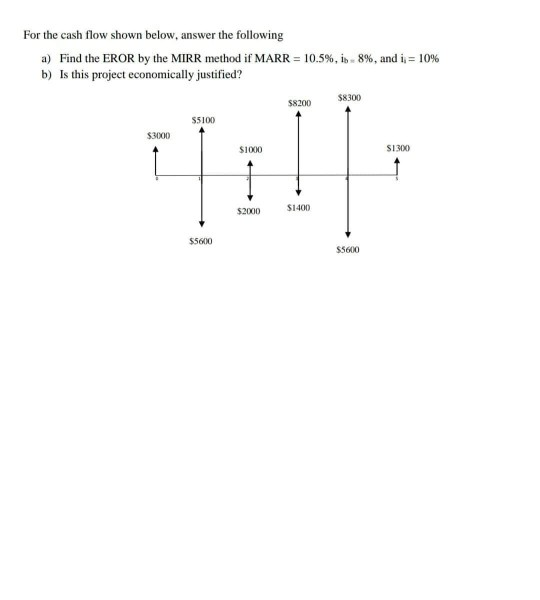

or the cash flow shown below, answer the following a) Find the EROR by the MIRR method if MARR = 10.5%, in - 8%, and i, = 10% b) Is this project economically justified? $8300 $8200 S5100 $3000 S000 S1300 S1400 $2000 $5600

or the cash flow shown below, answer the following a) Find the EROR by the MIRR method if MARR = 10.5%, in - 8%, and i, = 10% b) Is this project economically justified? $8300 $8200 S5100 $3000 S000 S1300 S1400 $2000 $5600

Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section10.4: Internal Rate Of Return (irr)

Problem 2ST

Related questions

Question

Solve both subparts I upvote solution

Transcribed Image Text:or the cash flow shown below, answer the following

a) Find the EROR by the MIRR method if MARR = 10.5%, in - 8%, and i, = 10%

b) Is this project economically justified?

$8300

$8200

S5100

$3000

S000

S1300

S1400

$2000

$5600

Expert Solution

Step 1

The Modified Rate of Return (MIRR) is used to determine the External rate of Return (EROR) where there are multiple interest rates - interest rate for external borrowed funds and interest rate for externally invested cash flows

MARR = 10.5%

ib=interest rate for borrowed funds 8%

ii= investment rate =10%

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Cash Inflow | 3000 | 5100 | 1000 | 8200 | 8300 | 1300 |

| Cash Outflow | -5600 | -2000 | -1400 | -5600 |

Step 2

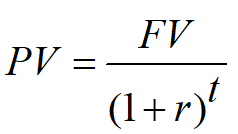

Let us calculate the present value of negative cash flows or cash outflows:

Where,

PV= Present Value of Investment

FV= Future Value of Investment

r = Rate of Interest =ib = 8%

t = Number of years

| Year | 0 | 1 | 2 | 3 | 4 | 5 | Total |

| Cash Inflow | 3000 | 5100 | 1000 | 8200 | 8300 | 1300 | |

| Cash Outflow | -5600 | -2000 | -1400 | -5600 | |||

| Present value @8% | -5185.19 | -2000 | -1400 | -5600 | -14185.2 |

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning