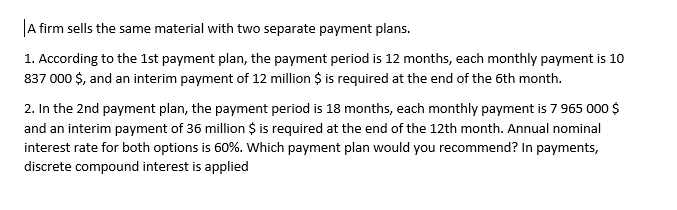

|A firm sells the same material with two separate payment plans. 1. According to the 1st payment plan, the payment period is 12 months, each monthly payment is 10 837 000 $, and an interim payment of 12 million $ is required at the end of the 6th month. 2. In the 2nd payment plan, the payment period is 18 months, each monthly payment is 7 965 000 $ and an interim payment of 36 million $ is required at the end of the 12th month. Annual nominal interest rate for both options is 60%. Which payment plan would you recommend? In payments, discrete compound interest is applied

|A firm sells the same material with two separate payment plans. 1. According to the 1st payment plan, the payment period is 12 months, each monthly payment is 10 837 000 $, and an interim payment of 12 million $ is required at the end of the 6th month. 2. In the 2nd payment plan, the payment period is 18 months, each monthly payment is 7 965 000 $ and an interim payment of 36 million $ is required at the end of the 12th month. Annual nominal interest rate for both options is 60%. Which payment plan would you recommend? In payments, discrete compound interest is applied

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

need answer as soon as possible with calculations

Transcribed Image Text:A firm sells the same material with two separate payment plans.

1. According to the 1st payment plan, the payment period is 12 months, each monthly payment is 10

837 000 $, and an interim payment of 12 million $ is required at the end of the 6th month.

2. In the 2nd payment plan, the payment period is 18 months, each monthly payment is 7 965 000 $

and an interim payment of 36 million $ is required at the end of the 12th month. Annual nominal

interest rate for both options is 60%. Which payment plan would you recommend? In payments,

discrete compound interest is applied

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College