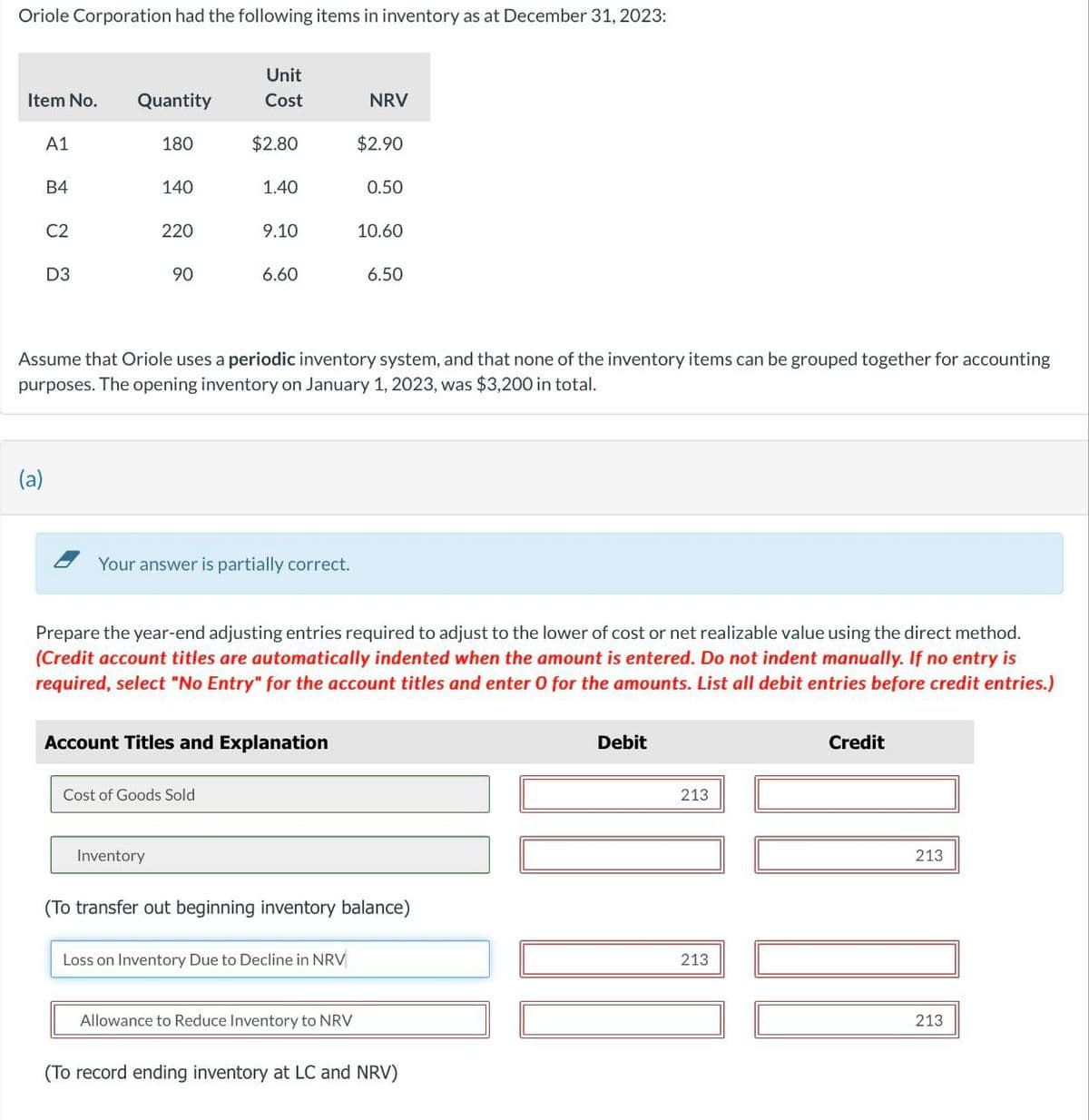

Oriole Corporation had the following items in inventory as at December 31, 2023: Item No. A1 B4 (a) C2 D3 Quantity 180 140 220 90 Inventory Unit Cost $2.80 1.40 Cost of Goods Sold 9.10 6.60 Your answer is partially correct. Account Titles and Explanation Assume that Oriole uses a periodic inventory system, and that none of the inventory items can be grouped together for accounting purposes. The opening inventory on January 1, 2023, was $3,200 in total. NRV $2.90 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Loss on Inventory Due to Decline in NRV 0.50 Allowance to Reduce Inventory to NRV 10.60 6.50 (To transfer out beginning inventory balance) (To record ending inventory at LC and NRV) Debit 213 213 Credit 213 1 06 213

Oriole Corporation had the following items in inventory as at December 31, 2023: Item No. A1 B4 (a) C2 D3 Quantity 180 140 220 90 Inventory Unit Cost $2.80 1.40 Cost of Goods Sold 9.10 6.60 Your answer is partially correct. Account Titles and Explanation Assume that Oriole uses a periodic inventory system, and that none of the inventory items can be grouped together for accounting purposes. The opening inventory on January 1, 2023, was $3,200 in total. NRV $2.90 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Loss on Inventory Due to Decline in NRV 0.50 Allowance to Reduce Inventory to NRV 10.60 6.50 (To transfer out beginning inventory balance) (To record ending inventory at LC and NRV) Debit 213 213 Credit 213 1 06 213

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.14AMCP

Related questions

Question

Loss on Inventory is also wrong please don't provide solutions image based thanx

Transcribed Image Text:Oriole Corporation had the following items in inventory as at December 31, 2023:

Item No.

A1

B4

C2

D3

Quantity

180

140

220

90

Inventory

Unit

Cost

$2.80

1.40

Cost of Goods Sold

9.10

6.60

Your answer is partially correct.

Account Titles and Explanation

Assume that Oriole uses a periodic inventory system, and that none of the inventory items can be grouped together for accounting

purposes. The opening inventory on January 1, 2023, was $3,200 in total.

NRV

$2.90

Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method.

(Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Loss on Inventory Due to Decline in NRV

0.50

Allowance to Reduce Inventory to NRV

10.60

6.50

(To transfer out beginning inventory balance)

(To record ending inventory at LC and NRV)

Debit

213

213

Credit

213

213

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub