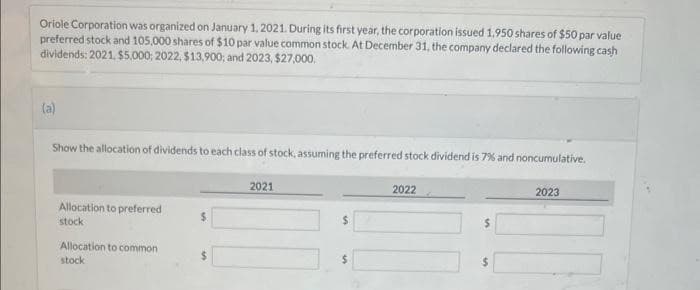

Oriole Corporation was organized on January 1, 2021. During its first year, the corporation issued 1.950 shares of $50 par value preferred stock and 105,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,000; 2022, $13,900; and 2023, $27,000. (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. Allocation to preferred stock Allocation to common stock $ 2021 $ 2022 2023

Q: Chapter 2 Financial Statements L. Bong Lee, owner of Champion Forwarders, follows the calendar year…

A: Adjusting entries are those journal entries which are passed at the end of accounting period for the…

Q: DEF Co. (calendar year business) acquired a Luxury Vehicle for $100,000 (used 80% for business) in…

A: Depreciation deduction refers to the income tax deduction which is made annually and it allows for…

Q: Which of the following is an example of conversion, the misappropriation of fiduciary monies? a .…

A: The correct answer is option - misrepresentation on an insurance application.

Q: Prepare a value analysis schedule for this business combination. Check Number – Goodwill $40,000

A: parent company holds 80% stake in subsidiary purchase consideration is 280,000 dollars

Q: Comprehensive Problem The following were taken from the books of Amihan Company: Long-term Payable…

A: A balance sheet is a statement of the financial condition of companies, corporations, and sole…

Q: Deedee's Hair Products decided to issue 97 shares of $3 par common stock. When recording the…

A: Lets understand the basics. Additional paid in capital is a capital received in excess of par value…

Q: The company’s accounting intern has prepared the end-of-January bank reconciliation from the bank…

A: An entity's bank account is matched up with its financial records using a bank reconciliation…

Q: On January 1, 20X1 Blu Corporation acquired a building for P10M. The entity paid P1M down and signed…

A: Notes payable refer to the company's long-term obligation to repay the sum based on the specific…

Q: What is the entry to record the compensation expense in 2018 and the entry to record upon exercise?

A: In the above question 200000 ordinary shares Face value is p10 Option price is p15 Market price is…

Q: The financial statements are interrelated. a) What item of financial or operating data appears on…

A: Financial statements are those statements which are prepared at the end of accounting period. Income…

Q: Forest Company has five products in its inventory. Information abo follows. Product Quantity Cost $…

A: Inventory is one of important current asset being held by the business. Inventory valuation is also…

Q: Total Assets... Total Liabilities..... Net Income ..... Total Equity ..... ? ? ?

A: Assets: Assets are resources which generates revenue. Liabilities: Liabilities are Financial…

Q: Question#01: 06 The following information pertains to TNT Company for July 2017: 1. Cash balance per…

A: Bank Capital - Bank capital is the balance of a bank's net worth left over after subtracting its…

Q: Gregory Enterprises produces two-wheel rim models: standard and deluxe. The budgeted data for 2021…

A: Two main types of costing methods are being used in business. One is traditional or simple costing…

Q: Prepare closing entries and post to the accounts.

A: Answer c) The process of recording business transactions in the books of accounts for the first time…

Q: Suppose you are tasked to give a financial report at the end of August 2021. Explain why accrual…

A: Every business makes the income statement so that the profit or loss can be determined which…

Q: The right side

A: Equity holder refers to the individuals that provide liquidity to the company and in return, the…

Q: RLW Enterprises estimated that indirect manufacturing costs for the year would be $75 million and…

A: A "predetermined rate" is an indirect cost rate that applies to a specific current or future time,…

Q: Determine the purchase price at the indicated time before maturity of the following bond redeemed at…

A: PARTICULARS VALUES Par Value (Face Value) $3,000 Coupon Rate 6% Time to Maturity 8 years…

Q: If cash is $5450, accounts receivable is $10059,notes payable is $5285, common stock is $1161 how…

A: Retained earnings is the amount which is retained or kept by the entity out of the net profits…

Q: Please tell me what type of the analysis is if the analysis wants to know which customer purchased…

A: Explanation: Diagnostics analytics scrutinizes the reason of what is the reason behind the…

Q: Dillon Products manufactures various machined parts to customer specifications. The company uses a…

A: Journal Entry :— It is an act of recording transaction in books of account when it is occured.…

Q: The balance sheets at the end of each of the first two years of operations indicate the following:…

A: Lets understand the basics. Price earning ratio is a ratio which compare earning per share with the…

Q: For the year just ended, ThruCast Corp. had pretax earnings from operations of $1.25 million. In…

A: Answer:- Tax liability meaning:- The tax liability is the sum of money that a person, company, or…

Q: Consider the following data for two products of Vigano Manufacturing. Activity Budgeted Cost…

A: The traditional method of overhead allocation is based on a predetermined overhead rate. The…

Q: January 1, 2021, Legion Company sold $230,000 of 4% ten-year bonds. Interest is payable semiannually…

A: Bond :— Bond is a Loan but in Form of Securities. Bond is a Instruments Used By Government and…

Q: Compute the amount of Cash and Cash equivalents that should be reported on December 31, 20X1.…

A: Sol: Cash and cash equivalents reported on 31 December 2011 is amounted to p6900000 Detailed…

Q: .LO.4 Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred…

A: Note: As per our guidelines, we will solve the first three subparts According to the IRS, in a…

Q: 7. The following is the Balance Sheet of Weak Ltd. on 31-3-2003 Liabilities Rs. Assets Rs. 2,00,000…

A: Reconstruction: It is a process of reorganizing the affairs of a company by revaluing the assets,…

Q: nts) Which of the following is NOT a difference we discussed between accounts and notes receivable?…

A: Accounts receivable represents the money owed by customers,. Accounts receivable is significantly…

Q: g manufacturing overhead to

A: Manufacturing overhead is an indirect cost . It cannot be specifically traced to a particular unit…

Q: Stevens Company's inventory on March 1 and the costs charged to Work in Process—Department B during…

A: CPR stands for Cost of production report refers to the report or the document which is used in the…

Q: Which of the following statements are true? 1. The fact that one department may be labor intensive…

A: Overhead refers to the expenses that are indirectly associated with the product manufactured and…

Q: Using the compound interest formula, verify the impact of the 2% commission rate identified in this…

A: The question emphasizes the impact of compounding over different horizons. It's a simple time value…

Q: Bonds payable, 6% 6% Preferred stock, P100 par Common stock, P10 par. Income before income taxes was…

A: Bonds payable: 5,000,000 Preferred stock: 1,000,000 Common stock: 2,000,000 Income before income…

Q: how did we get purchases 42300

A: Purchases amount is the amount of the goods which has been purchased during the period by the…

Q: As of January 1, Year 2, Room Designs, Incorporated had a balance of $5,200 in Cash, $2,850 in…

A: Cash Flow Statement By monitoring an organization's cash flow, a cash flow statement is a crucial…

Q: Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the…

A: Introduction: A predetermined overhead rate is a rate that is decided to apply to cost objects for a…

Q: Q5. Why do accountants record accounts in the name of organisation?

A: Accounting records include all documentation and books used in financial statement preparation, as…

Q: You are working for The Wellington Company on temporary assignment while one of the accountants is…

A: Hi, as you have posted the multiple sub parts, but according to the bartleby policy we can only able…

Q: ASSIMILATION ☆ ABM Company POST-CLOSING TRIAL BALANCE Dec. 31, 2016 Accounts Cash in Bank Petty Cash…

A: 1. Accounting Equation - Accounting Equation is calculated using following equation - Assets =…

Q: Flounder Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of…

A: T-accounts are the ledger accounts in which the journal entries are posted. These are prepared to…

Q: Hans weisneer had gross earnings of 430.80 for last week. Hans earns a base salary of 290 on a…

A: The gross earnings for last week of Hans Weisner = 430.80 Base salary of Hans = 290 on a weekly…

Q: Using DBM, when is the t year with a book value of P8,592 if the asset is bought at a price of…

A: Declining Balance Method :— Under this method of depreciation, depreciation is calculated by…

Q: Rita has an NOL generated in 2020 from farming activity. Which is NOT an option for using the NOL in…

A: NOL means: when the actual income of any company is less than the deduction for that assessment year…

Q: Problem 20-3 (PHILCPA Adapted) entity provided the following data: Recoveries Credit sales Writeoffs…

A: Account receivables are individuals or entities who owe money to the firm after receiving products…

Q: The equivalent units of production eTextbook and Media Unit costs $ Determine the unit costs of…

A: Introduction: In a mass production of identical products process costing is used. In process costing…

Q: A.) Credit Unrealized Gain on DI at FVTPL - 37,232 B.) Credit Cash - 952,768 C.) Debit Debt…

A: Sol: please fallow the answer as below The unrealized gain on the bonds would be: Unrealized gain =…

Q: e rule—and even when completed many fail to meet expected revenues. Executives often blame project…

A: Financial risk refers to the concept of determining the chances of how much money an entity can lose…

Q: ces Pablo Company calculates the cost for an equivalent unit of production using process costing.…

A: Solution Explanation- 1- Fifo cost Direct material Conversion Cost added during period…

Step by step

Solved in 2 steps with 2 images

- Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Comprehensive Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, 100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: Part a. A shareholder has raised the following questions: 1. What is the legal capital of the corporation? 2. At what average price per share has the preferred stock been issued? 3. How many shares of common stock have been issued (the common stock has been issued at an average price of 23 per share)? Part b. The company engaged in the following transactions in 2019: Required: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Contributed Capital section of Youngs December 31, 2016, balance sheet.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000